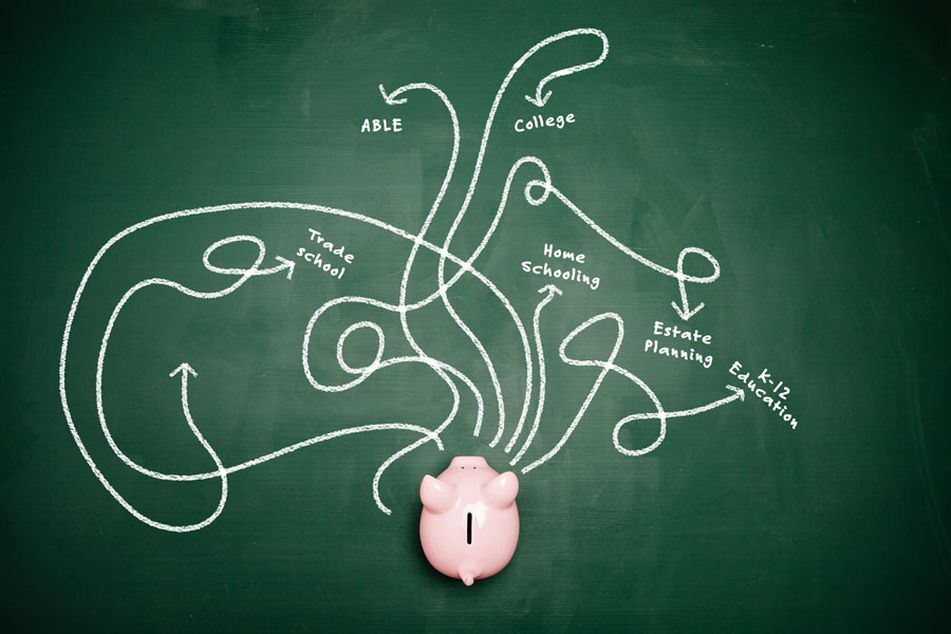

529 savings plans are not just for college anymore

Thanks to changes in the tax law, 529 plans are being used as estate planning tools and to pay for more education-related expenses than ever before.

The nation’s most widely used investment vehicle for paying for college is also becoming popular as an estate planning tool and for financing other non-college-related costs thanks to recent tax changes and some creative financial thinking.

As a result of the 2017 tax reform law, an individual contributing to a 529 college savings plan can frontload five years’ worth of contributions — or $75,000 total — into one year without incurring federal gift taxes.

For instance, if two grandparents want to help finance college for a grandchild, they can put $150,000 into his or her 529 plan. Doing so also helps them reduce the potential bite of estate taxes.

“It’s a pretty unique device in order to do some gifting,” said Jeremy Gottlieb, chief executive of Gottlieb Wealth Management.

Recently, he had a client with a large estate who moved a big chunk of money immediately into his grandchildren’s 529 plans.

“He and his wife were able to accelerate the gifting, which I thought was powerful,” Mr. Gottlieb said.

There’s also the psychological boost for clients who want to make education part of their legacy for their family.

“There’s a real blessing to giving money while you’re alive and helping a son, daughter or grandchild realize a dream,” said Frank Fantozzi, president of Planned Financial Services.

Assets in 529 plans, which are sponsored by individual states and grow tax free as long as the assets are used for college expenses, have grown to $328 billion since they were created by Congress in 1996. These funds have been saved in 13.1 million accounts, with another $25 billion invested in 1 million 529 prepaid tuition plans as of June, according to Strategic Insight.

That’s up from $34.8 billion in savings plans and $10.8 billion in prepaid tuition plans in 2003, according to the Investment Company Institute.

More options

Being used as an estate planning tool is only one way that 529 college savings plans have evolved in recent years.

The 2017 tax law also allows the withdrawal of up to $10,000 annually to pay for K-12 education at public, private or parochial schools. In addition, funds in 529 plans — up to the annual contribution limit of $15,000 — can be rolled over into an Achieving a Better Life Experience Account, which promotes savings for expenses related to disabilities.

Money from a 529 plan for one sibling can be rolled into an ABLE account for another sibling. About $259 million has been saved so far in these accounts, which were created five years ago. That benefit will sunset in 2026, unless the U.S. Congress extends it.

Beyond the tax-law changes, there are techniques for using a 529 account that are now catching on with planners. For instance, they can fund computers and other technology purchased for a student.

They can also be utilized by adult account holders to pay for their own education or retraining, a move that’s occurring in about 2% of 529 plans, according to Paul Curley, director of college savings research at Strategic Insight. These types of uses for the adult will likely grow as technological advances change the workplace.

“That’s a trend that’s happening and we would expect that to continue,” Mr. Curley said.

home-schooling

Some members of Congress want to expand 529 uses even further. A major retirement bill is being held up in the Senate by a lawmaker who wants to allow 529 funds to cover the costs of home-schooling.

The prevailing mindset is that 529s must be targeted toward undergraduate education.

“The uses are pretty flexible,” said Sallie Mullins Thompson, a financial planner who runs a solo practice. “People don’t realize that these funds can be used for more than a four-year college.”

Advisers can deploy 529 plans in even more creative ways for clients.

“It’s good to have that flexibility,” said Brian Mercado, an adviser at JSF Financial. “People have situations that evolve. It’s good that [529] plans are evolving, too.”

Retaining control

An added advantage of turning to a 529 to help manage an estate is that the person making the contribution to the plan retains control over the funds.

“You can sock away a lot of money from your estate in a short period of time, but not lose the rights to those dollars,” said Jarrod Winkcompleck, chief executive of Gap Financial Services.

It’s the most unique aspect of using 529s for estate planning, said Sam Huszczo, founder of SGH Wealth Management.

“While the client’s living, they still own the money,” Mr. Huszczo said.

Clients also have the latitude to change the beneficiary of the 529 plan at any time.

For instance, if a child decides college is not for her, the 529 owner can instead make the recipient a sibling, niece, nephew or grandchild.

“It’s like creating a tax-free scholarship fund for future generations,” Mr. Mercado said.

For many parents, exploding educational costs are not just something to prepare for when kids get to college. They’re a reality from kindergarten through high school, especially if their children attend private schools throughout their education.

Whether it makes sense to withdraw funds from a 529 plan to pay for K-12 expenses can depend on the state.

Indiana, for instance, offers a 20% tax credit for contributions up to $5,000 annually to its 529 plan that can be used to offset the Indiana income tax. Therefore, it pays for people using the Indiana 529 to put K-12 tuition money into the account, even if they’re going to quickly withdraw it to pay for the upcoming semester because it will qualify them for the tax break.

“Just by adding a middleman to an expense you’re already paying, you can save on taxes,” said Russ Ford, owner of Wayfinder Financial.

The tax math also is favorable in Missouri, where contributions to the state’s 529 plans are deductible for state taxes up to $8,000 for an individual, or $16,000 for a couple. Missouri also is a place where using the 529 plan as a pass-through for K-12 expenses generates tax benefits, said Christopher Beste, an adviser at RFG Advisory.

Small savings

“It’s not going to wow you on your taxes. But any savings is worth it. You’re just playing by the rules,” Mr. Beste said.

But dipping into a 529 plan to pay for K-12 education in Oregon is less inviting.

An investor would need to add back to their taxable income any amount of K-12 distribution that received a state deduction and any earnings on the distribution would have to be claimed on state income taxes, according to Ryan Mohr, principal and founder of Clarity Capital Management.

“That could complicate things for situations where funds are used to pay for K-12 expenses,” Mr. Mohr said. “It has to be part of the conversation if [clients] are going to take out funds to pay for tuition for private school.”

Several states have not recognized paying K-12 costs as a qualified 529 distribution. California, for instance, imposes a 2.5% penalty tax on withdrawals.

Given that 529s are sponsored by states, the rules can differ for each, giving advisers and their clients more to ponder.

“It’s a huge challenge,” Mr. Winkcompleck said. “I don’t think there are any two [states] that are similar, so you always have to double-check.”

Recently, the Financial Industry Regulatory Authority Inc. counseled investors to study each state’s plan before deciding which one to purchase.

Need for research

“Start with your home state when looking for a 529 savings plan,” the regulator said in an August alert. “Pay special attention to state tax breaks and fees that are waived or lowered for in-state residents. Do some research to see if there are other state benefits available to you.”

It may take state-by-state analysis to determine whether utilizing the K-12 feature is worth it, but the added flexibility is generally welcomed.

“Some parents find some comfort in knowing they can use the 529 in the short term,” Mr. Curley said.

Even though 529 plans are evolving into estate planning tools and expanding to cover K-12 costs, it’s their original purpose as a savings plan for college that will continue to be their bread and butter, according to Brian Jones, an adviser at NextGen Financial Advice.

“The average middle-class [investor] isn’t going to use the new features of the 529 that much,” Mr. Jones said. “For a lot of people, they’re really setting [money] aside for college.”

Learn more about reprints and licensing for this article.