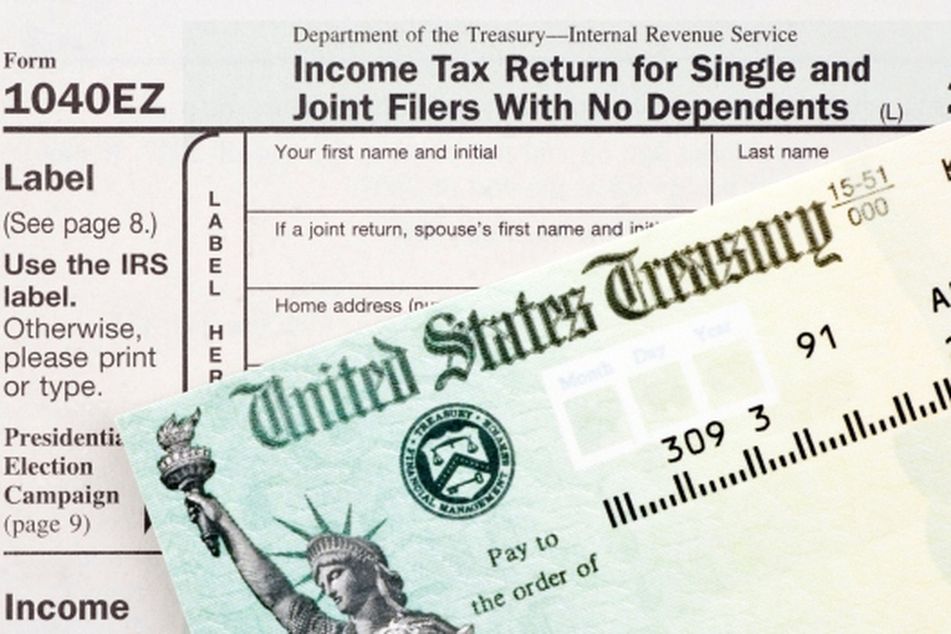

Fun is done: Frugality rules as tax refunds to be squirreled away

Survey shows a shift in what filers plan to do with checks from the IRS; 'more reserved and cautious'

Americans apparently are continuing a thrifty streak that first surfaced during the 2008 economic downturn.

The latest sign of the new frugality: Nearly two-thirds of Americans who expect to get an income tax refund this year plan to save at least some of it, according to a recent telephone survey of about 1,000 conducted by TD Ameritrade Holding Corp. TICKER:(AMTD).

Historically, many taxpayers have treated a refund from the Internal Revenue Service as found money — spending it on nonessentials such as vacations. The new attitude, however, is in line with the post-2008 mentality, said TD Ameritrade spokeswoman Christina Goethe.

“We have seen this time and time again since 2008 — that people’s behaviors are a little more reserved and cautious because of the economy,” she said.

This is the first year that TD Ameritrade has included tax refund questions in its annual New Year’s resolutions survey, and it might not be a very good indicator for typical behavior over the years, she said.

“In a few years, we might see a shift back,” she said. “It is hard to use these results as a benchmark, because everything in the last few years has been unusual.”

According to those surveyed, just over half of the respondents expect to get a refund on either their state or federal tax returns this year. About 63% said they will save or invest at least part of the money. Only 14% went old-school, saying they plan to splurge on luxuries such as a new mobile phone or travel. About half said they will use some of the money to pay down debt or pay for necessities such as food or utility bills.

Learn more about reprints and licensing for this article.