Can ETFs plug the river of outflows at Columbia Funds?

Fund firm plans to offer 17 active exchange-traded funds; weighed down by sagging interest in mutual funds

Columbia Management Investment Advisers is one of the fund firms that has suffered the most from investors’ shift from mutual funds to exchange-traded funds. Now it’s betting active ETFs could help turn around the outflow woes.

Columbia, the asset management subsidiary of Ameriprise Financial Inc, unveiled the plans for its first actively managed ETFs in a Monday morning filing with the Securities and Exchange Commission. Columbia proposed 17 active ETFs in total. Ten will be fixed-income focused, including five target-date municipal bond ETFs, while the other seven will be actively managed equity ETFs, including international, emerging markets, and small- and mid-cap focused products.

The ETFs will be similar to existing Columbia mutual funds and be run by the same portfolio managers, said spokesman Charlie Keller. “We’re looking for that group of investors that like ETFs,” he said. “This gives us the opportunity to reach them in the vehicle they want.”

The group of investors that like ETFs is certainly on the rise. The predominately passive investment vehicles, which allow investors to trade a basket of stocks or bonds intraday on an exchange, have seen assets grow to more than $1 trillion, up from around $20 billion in 2003.

It remains to be seen whether actively managed ETFs, which make up less than 1% of all exchange-traded fund assets today, will attract the same interest though.

The argument can even be made that one of the main reasons for the rise of ETFs has been a waning in investors’ confidence in actively managed strategies. Those doubts are well-founded, too. Barely a third of actively managed U.S. large-cap mutual fund managers have outperformed the S&P 500 over the five-years ending June 30, according to Morningstar Inc. The past three years have been even worse, as less than 17% of actively managed funds outperformed.

Since 2007, nearly $220 billion has been invested in passive U.S. large-cap ETFs. During that same time period, more than $500 billion has been pulled from actively managed U.S. large-cap mutual funds, according to technology firm ConvergEx Group.

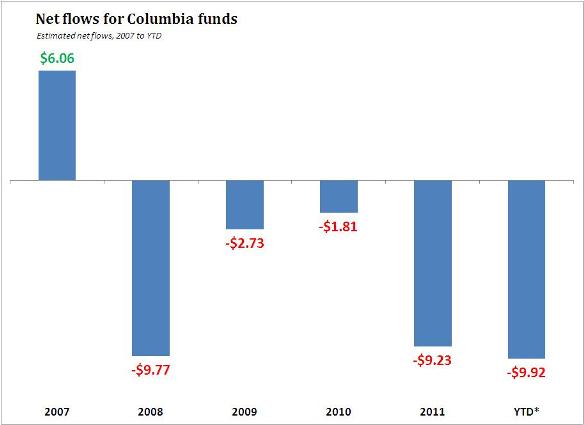

Columbia has been one the firms hit hardest from the shift. It’s registered outflows for more than four years, and total assets have decreased to $158 billion, a 20% drop from its 2007 peak of $196 billion, according to Morningstar Inc.

Columbia isn’t the only asset management firm betting on active ETFs. Household names like Fidelity Investments, T. Rowe Price and Franklin Templeton are each in various stages of applying for exemptive relief from the SEC to launch actively managed ETFs. Columbia skipped the registration process with the regulator thanks to its 2011 acquisition of Grail Advisors LLC, which already had permission to launch active ETFs.

One ray of hope for would-be active ETF managers like Columbia has been the acceptance of Pacific Investment Management Co. LLC’s ETF version of the Total Return Fund, the largest mutual fund in the world. The Pimco Total Return ETF has grown to almost $2.5 billion since its March 1 debut, thanks in large part to the star power of its manager, Bill Gross.

Columbia doesn’t have any managers with the star power of Mr. Gross, but the simple fact that the Total Return ETF has attracted billions proves the appeal of ETFs isn’t just about active versus passiv management. The daily liquidity, transparency, and lower relative expenses of ETFs are playing a role too.

Columbia is also smartly targeting less efficient areas of the market where managers can add value over an index. For example, more than 40% of actively managed emerging markets funds and actively managed small-cap funds beat their index over the past three-years, far outpacing the 17% of large-cap funds that did so, according to Morningstar Inc.

Nevertheless, anytime a strategy is trying to beat a benchmark the vehicle is always going to be secondary. First, Columbia needs to prove its managers can beat their benchmarks with the investment constraints of using an ETF, which notably means no derivatives. That’s going to take time. Some advisers won’t even look at an actively managed fund until it has at least a three-year track record.

So even though Columbia looks poised to join Pimco as one of the pioneers in the actively managed ETF space, it could still be years before it finds out if the experiment works. But that doesn’t bother Mr. Keller.

“We’re trying to stay ahead of the trends in the industry,” he said. “We believe these are the right products for right now.”

Learn more about reprints and licensing for this article.