Romney goes all in, vows to cut out investment taxes on middle class

If elected, Mitt Romney says he will cut out all investment taxes on the middle class. Great news for advisers, right? Right?

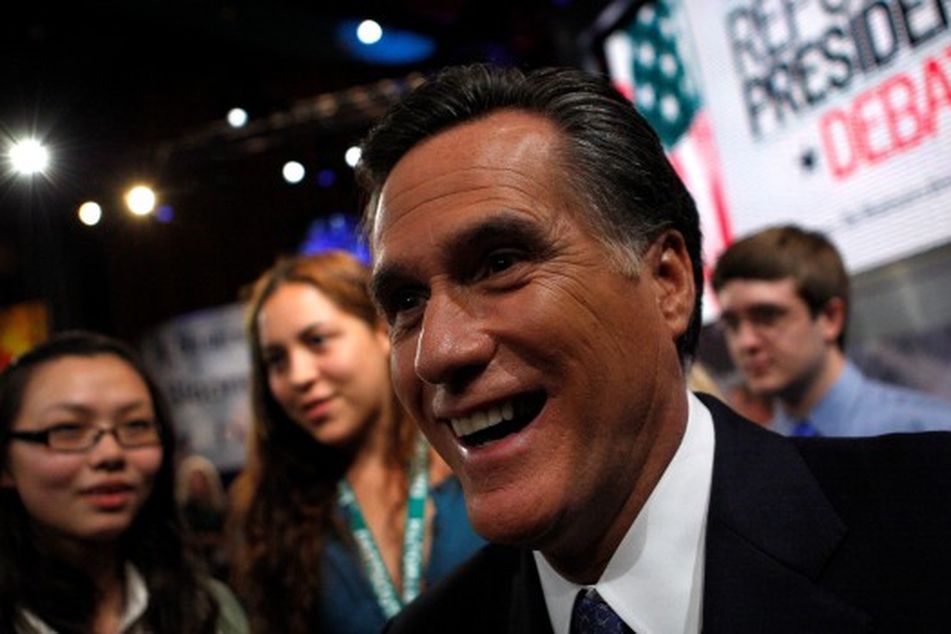

Republican presidential nominee Mitt Romney sharpened an already intense focus on the middle class in Tuesday’s debate by upping the ante to attract this key voting bloc.

In his faceoff with President Barack Obama, Mr. Romney reiterated his vow to lower taxes for those in the middle-income category in part by freeing them from investment levies.

“Your rate comes down, and the burden also comes down on you for one more reason, and that is every middle-income taxpayer no longer will pay any tax on interest, dividends, or capital gains; no tax on your savings,” Mr. Romney said.

This is a key part of Mr. Romney’s effort to boost a group that he said has been “buried” during Mr. Obama’s tenure. Mr. Romney loves to riff on the “buried” description, which he’s using incessantly after it was uttered recently by Vice President Joe Biden.

Getting rid of investment taxes “makes life a lot easier,” Mr. Romney said. “If you’re getting interest from a bank, if you’re getting a statement from a mutual fund, or any other kind of investments you have, you don’t have to worry about filing taxes on that because there will be no taxes for anybody making $200,000 a year and less on your interest, dividends and capital gains.”

That’s all well and good for the middle class but Mr. Romney’s proposal — like all policy options — has consequences. Actually, we should probably do some parsing of the term “middle class.” People who make $200,000 annually in just about any part of the country – except, maybe, Washington, New York and Los Angeles – are pretty much rich or on the way to becoming rich.

Showering the new investment-tax benefit on the middle class may not be a boon for investment advisers. First, if the middle-class is going to avoid investment taxes, surely they need to go up for the wealthy. Otherwise, Mr. Romney will have trouble reducing the burgeoning federal deficit.

Higher capital gains taxes on the wealthy will strike at the heart of advisers’ most important clientele – high-net-worth investors.

Secondly, giving the middle-class freedom from investment taxes won’t necessarily drive them into the arms of advisers. A recent poll conducted by the Consumer Federation of America and Primerica shows that the middle class usually wing it when it comes to investment decisions.

In addition, it’s not clear that advisers are reaching out to the middle class. Often their account minimums drive away that market segment.

Neal Solomon, managing director of WealthPro LLC, asserts that advisers are working with the middle class but need to step up their game.

“[F]inancial planners should feel proud that we serve this critical segment of America’s population. We need to keep trying to do even more,” Mr. Solomon wrote in a comment to a recent InvestmentNews online article. “No matter how well we are doing, we should always keep striving to do even better, even more.”

Perhaps advisers will get their chance to reach out to the middle class, if Mr. Romney is elected.

Learn more about reprints and licensing for this article.