Fidelity late but not too late with new ETFs

Mutual fund giant Fidelity Investments is set to launch a series of exchange-traded funds, the firm's first in 10 years. Is it too little, too late? Advisers say no, but they're not overly excited, either.

Fidelity Investments is making its first big leap into the exchange-traded fund arena Thursday with the launch of 10 sector ETFs, but the question remains: Is it too little, too late?

“ETFs still have a long way to go before they catch up to mutual funds, and there’s still room for entrants,” said Mike Rawson, an analyst at Morningstar Inc. “I think we should wait a few years to see what else Fidelity is able to do.”

(Featured Data: 3Q’s Best- and Worst-Performing Equity ETFs)

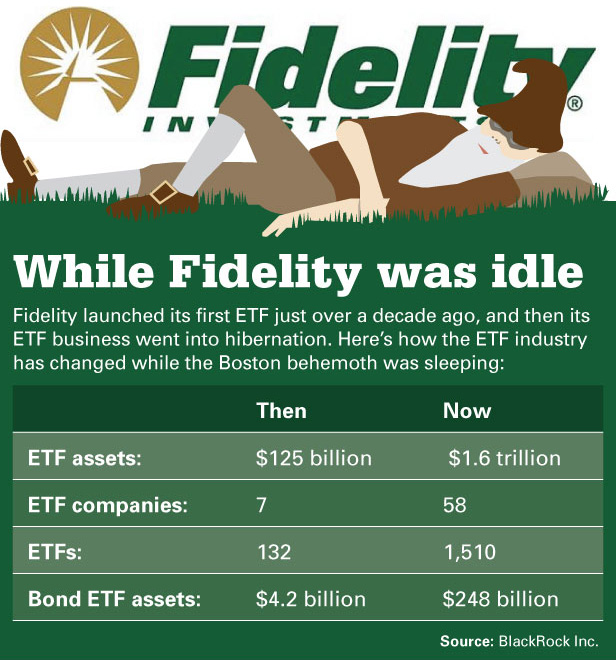

Ten years ago, Fidelity launched its first and only ETF: the $262 million Fidelity Nasdaq Composite Tracking ETF (ONEQ). It hasn’t launched another since and has largely missed out on the ETF boom.

Total assets in the ETF market have increased to $1.6 trillion this year, from $125 billion in 2003, making Fidelity’s share of the market a mere sliver, according to data from BlackRock Inc., the largest ETF manager and a subadviser to Fidelity’s sector ETFs.

“They haven’t had a clear ETF strategy, and they haven’t pursued it [as] aggressively as they should have,” Mr. Rawson said. “Even though [ETFs] are small in relation to the mutual fund market, their flows are large.”

TOUGH COMPETITION

Fidelity faces heavy competition. There now are more than 1,500 ETFs, up from less than 150 10 years ago. And the number of companies launching them has grown to 58, from less than 10 in 2003, according to BlackRock.

Waiting, however, may have been Fidelity’s best strategy, said Jim Lowell, editor of the Fidelity Investor newsletter.

The company held off until now to ensure that ETFs didn’t become commoditized too quickly and potentially unprofitable as a business, he said.

The delay also has allowed the company to enter at a time when it can be competitive on costs.

Fidelity’s 10 sector ETFs will charge 12 basis points in management fees, according to a filing with the Securities and Exchange Commission.

That compares with the 14 basis points that The Vanguard Group Inc. charges on its sector ETFs, which were the cheapest available.

“This isn’t a knock on the door. This is a punch in the face over at Vanguard,” Mr. Lowell said.

“Fidelity can afford to commoditize sector ETFs further and faster … There’s a huge business opportunity here,” he said.

State Street Global Advisors, which manages the largest suite of sector ETFs, charges 18 basis points.

“A price war is inevitable,” Mr. Lowell said.

Fidelity “can get in there and undercut on price where they simply couldn’t in the last decade. This is a market share moment,” Mr. Lowell said.

The company said it isn’t thinking about its rivals, however.

“This is not about any competitor. This is about our customer,” said Tony Rochte, president of Fidelity SelectCo LLC at Fidelity Investments.

“We’ve pioneered sector investing through mutual funds, but some investors want to be able to trade intraday,” he said. “It was clear to us that to be a continued leader in this space we needed an ETF offering.”

For its part, Vanguard is “not nervous” about having the added competition from Fidelity, said spokesman David Hoffman.

The 10 comparable Vanguard sector ETFs make up 5% of the $300 billion in the company’s total U.S. ETF business, he said.

“We’re never engaged in a price war,” Mr. Hoffman said.

“We’re a low-cost leader across the board,” he said. “I think investors can expect to see that in the future.”

Kevin Quigg, the global head of ETF sales strategy for State Street, said that investors should focus their attention on total cost of ownership of the sector ETFs.

The company’s sector SPDR ETFs were the second line of ETF products it brought to market, he said.

“We have through time lowered our expense ratios from a scale perspective as we have the ability to pass it on to our shareholders,” Mr. Quigg said. “They are bringing products in the same space, and at the end of the day, investors decide.”

Fidelity has every reason for wanting to dive into the ETF market.

Since 2008, Fidelity’s active U.S. equity funds have suffered $87 billion in net outflows, according to data from Morningstar.

By contrast, the company’s passively managed index funds have had positive net inflows of $15 billion since 2008.

The new Fidelity funds merit attention, said financial adviser Andrew Wang, senior vice president of Runnymede Capital Management.

“I’m certainly going to take a look at them,” he said. “Expenses are definitely something that we want to be cognizant of.”

OTHER ADVISERS WARY

Other advisers don’t see low cost as a reason to get too excited about the new Fidelity lineup.

“It’s not something that made me jump out of my seat,” said Matt Reiner, chief investment officer at Capital Investment Advisors. “I don’t know how exciting they’ll be to strategists.”

Mr. Reiner’s firm manages $1.3 billion in assets through a combination of ETFs and other investments, mainly using State Street’s SPDR funds in the ETF arena.

David Blain, president of BlueSky Wealth Advisors, agrees that prices alone might not be enough to give Fidelity leverage in the market.

“For us, ETFs form the core of the portfolio, and it’s just not something that gets switched out very often,” he said. “To me, it’s a marketing gimmick.”

Although there are critics, Mr. Rawson said that Fidelity’s strong brand name, established brokerage platform and numerous managers are key factors working in the firm’s favor with the launch of the new ETFs.

The company isn’t taking the new venture lightly and is investing heavily to make up for lost ground, he said.

“I think they view this as a very serious strategy,” Mr. Rawson said.

“They have very competitive index products,” he said. “It would only make sense for them to have ETFs to go along with that.”

Mr. Lowell, who is also the chief investment officer at Adviser Investments, said that he will be looking into the products at his firm, which has close to $3 billion in assets under management.

“We’d be foolish not to,” he said.

Jason Kephart contributed to this story

Learn more about reprints and licensing for this article.