Lead adviser talent and compensation in the three largest U.S. cities

A look at adviser pay by professional designation in New York, Los Angeles and Chicago. See the top performing designations too.

We designed our National Adviser Compensation Database to give individual advisers the power to benchmark their compensation in the most specialized ways possible, in order to meet the needs of an industry that has no shortage of specialists. The above chart answers the question, “What should a CFA-holding lead adviser (owner or non-owner) expect to earn in Chicago?” — and our database can answer many more questions just like it.

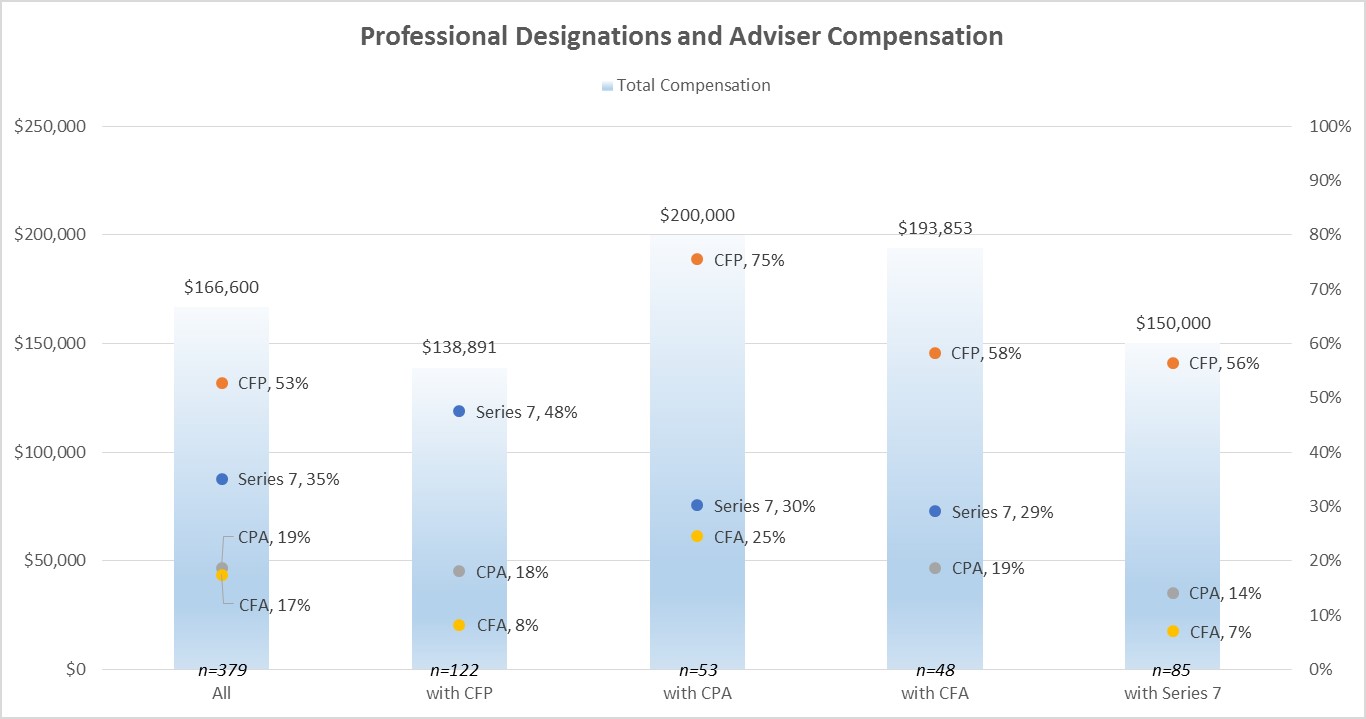

Below, we break things down further and look at the designations lead advisers commonly hold. In last year’s study, advisers holding a CPA were the most likely to hold other designations, while also generating the most revenue and receiving the highest amount of profit distributions.

So it came as no surprise that they were the top-performing designation in terms of salary. Each designation suits advisers in different niches of financial planning, wealth management and investment advisory. Using our benchmarking tool, advisers can plug in their story and receive customized results.

Want to know where your pay stands? Head over to the database.

Learn more about reprints and licensing for this article.