Wealthy seek to pass on family values through philanthropy

Advisers can use their role to facilitate building generational bonds

Conversations advisers are having with wealthy clients about philanthropy these days have a lot less to do with how much they can afford to donate and much more about ways to include the whole family in giving.

Wealthy clients want to bring their children and grandchildren into philanthropic conversations and decisions about where and how to disperse funds as a way of sharing values and continuing the family’s giving legacy.

“Wealthy families are increasingly wondering whether leaving a bunch of money to kids without them being prepared for it is the way to go,” said Charlie Jordan, a partner and wealth adviser with Brightworth.

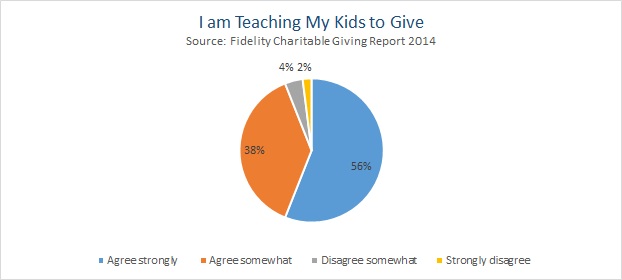

About 94% of donors to Fidelity Charitable strongly or somewhat agree on the need to teach children how to give charitably, according to a survey of 1,100 donors released today. About 78% said the causes their donor-advised fund support reflect input from family members.

Families with larger accounts were especially interested in getting their family more involved with grant making, the survey found.

“People care deeply about involving their families in philanthropic giving and are interested in preparing the next generation to carry on the family’s charitable values,” said Amy Danforth, president of Fidelity Charitable.

In fact, families are discussing philanthropic plans frequently.

About 17% of donors to Fidelity Charitable said they discuss charitable planning with their families more than five times a year, 28% discuss it two to five times a year and 21% discuss it once a year, according to the survey.

Advisers can help by encouraging family meetings, or even facilitating them, Mr. Jordan said. When facilitating, the adviser kicks off the conversation and then helps it stay on track, he said. They also can help structure the plan around the family’s requests, such as whether a patriarch or matriarch will make all the final decisions or if votes will be cast.

Kim Laughton, president of Schwab Charitable, said they see donor advised funds being used by families to teach the values of philanthropy, as well as investment management.

“They use it as a no-risk way to teach about investing in different classes and pools,” she said.

For advisers, bringing the family in on philanthropic matters can help win-over clients for life — and maybe even beyond.

“One of the best ways to improve the relationship with the client is to improve the relationship with their whole family,” Mr. Jordan said. “The best way to reach that next generation is to make them part of the family dynamic and establish that you are their adviser.”

Learn more about reprints and licensing for this article.