Liquid alts suffer big asset drop; MainStay Marketfield takes biggest hit

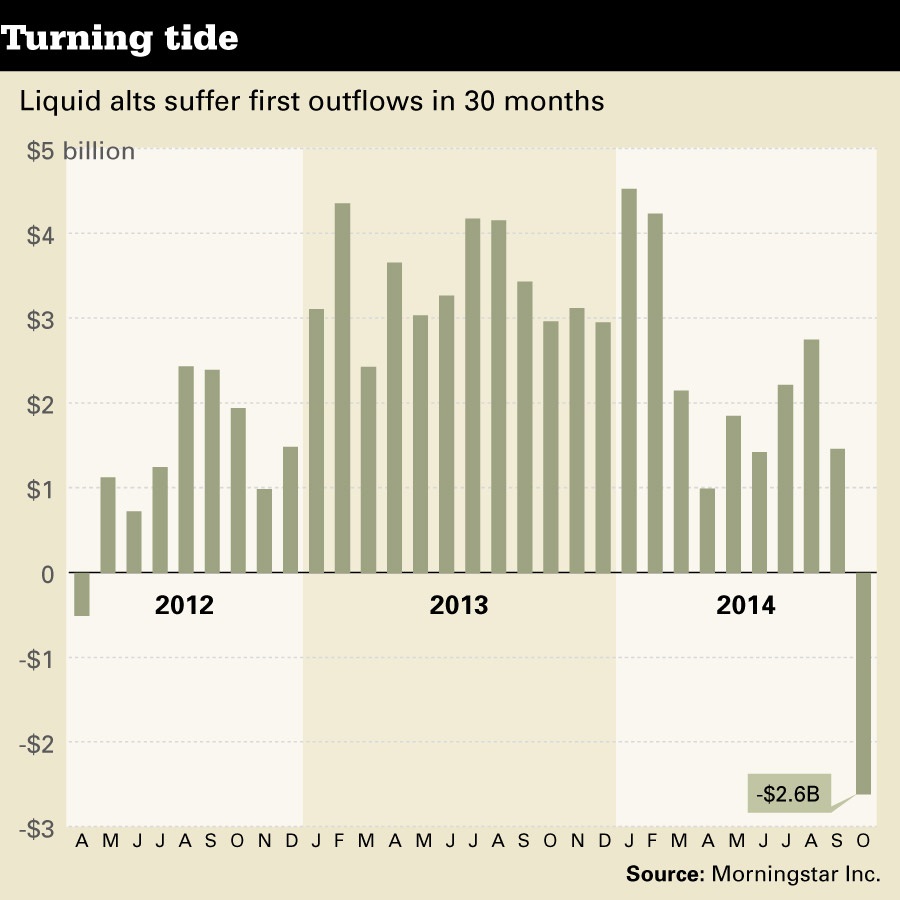

After strong growth, the category suffers its first outflows in two years in the month of October. Redemptions were dominated by a continued sell-off of the MainStay Marketfield Fund, the largest in the alternative category.

Even in pleasant times for stock and bond investors, lower-returning investments pitched as protection against the risk of a downturn have been winning money hand over fist.

Well, they were.

October offered fund companies a reminder that a quality that they market as advantageous — the inherent liquidity of the mutual fund — means investors can take their money out just as easily as they put it in.

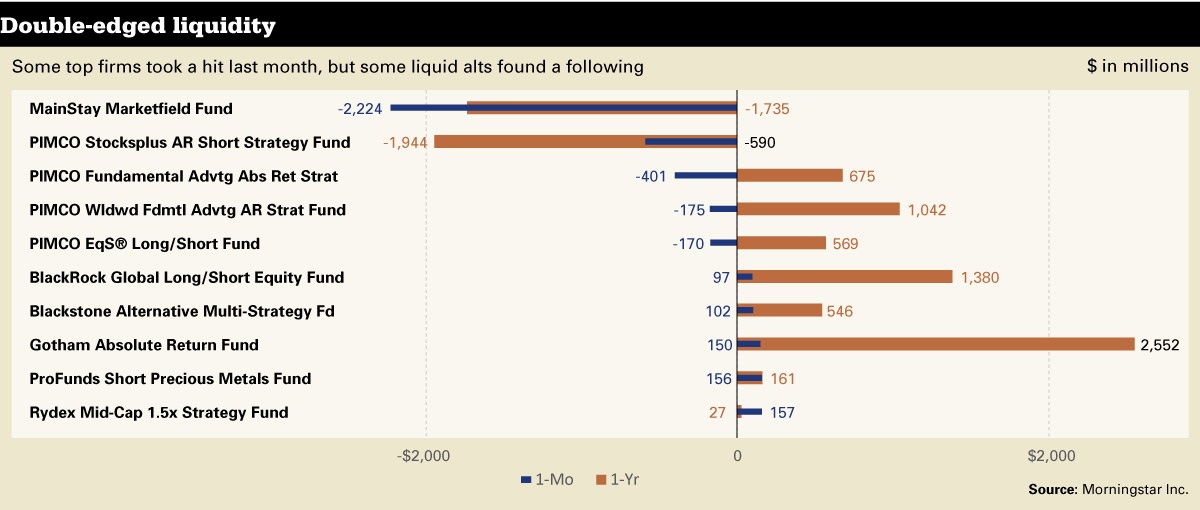

The redemptions are dominated by a continued sell-off of the MainStay Marketfield Fund (MFADX), the largest in the alternative category, which posted its seventh month of outflows, according to Morningstar Inc.

(More: Liquid alts get warning from SEC’s Norm Champ)

Marketfield has posted a -10.7% return this year as of Wednesday, underperforming 97% of its competitors and the S&P 500’s 12.2% advance, Morningstar said.

The fund is distributed by a unit of the New York Life Insurance Co. New York Life spokeswoman Allison Scott did not respond to a request for comment.

Investor dollars into alternatives have tapered off.

Liquid alternative mutual funds had $2.6 bill of outflows in October, the first month of net outflows since April ’12 pic.twitter.com/72sgmfx3S2

— Jason Kephart (@JasonKephart) November 13, 2014

Nearly half of alternatives funds lost assets during the month. Four Pimco funds were on that list, losing a total of $1.3 billion in assets during the month, The funds included three absolute return strategies and a long-short fund.

As flows reversed, the number of funds posting outflows rose by 12 percentage points, according to an InvestmentNews analysis of Morningstar data.

(Related: Huge Marketfield fund suffering outflows as performance wanes)

Not all alts are made equal.

While long/short equities, market-neutral and bear market funds lost assets, multialternatives and managed futures are winning assets this year.

Learn more about reprints and licensing for this article.