Financial adviser moves set to pick up in 2015

An analysis of InvestmentNews' Adviser on the Moves database points to an active year starting from the first quarter

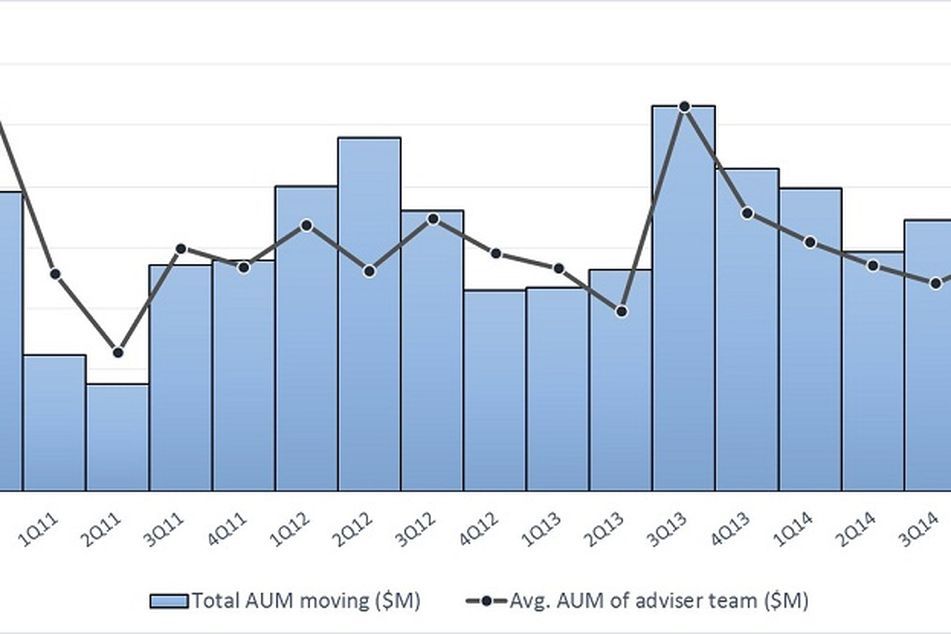

If the past is any indicator, adviser moves are likely to pick up steam in the first quarter, according to an analysis of InvestmentNews’ Advisers on the Move database, which tracks teams of advisers and brokers changing firms.

We expect our initial tally of recent fourth quarter-end activity to expand by approximately 10% as prior adviser move announcements and reporting trickles in, boosting fourth quarter activity to approximately $18 billion of adviser AUM. That revised sum would place activity flat versus the prior quarter.

But if the cyclical nature of adviser moves in the past is any guide — and economic and other fundamentals hold steady — adviser move activity is set to pick up in earnest in 2015, and we are forecasting a pickup in assets moving by an average of approximately 15% in 2015. Summers have been particularly active, and the third quarter of 2015 could see record activity in our database.

https://s32566.pcdn.co/wp-content/uploads/assets/graphics src=”/wp-content/uploads2015/02/CI9792819.JPG”

Wirehouse exits picked up steam in 2014, but in relative terms did not reach the pace of the exodus our database showed in 2012.

Bank of America Merrill Lynch and UBS Wealth Management were the biggest losers in 2014, according to deals tracked, with a combined total of almost $35 billion leaving those firms.

In terms of total AUM moving firms, wirehouses suffered $56 billion in adviser team losses in 2014, or 67% of the activity tracked in our database. Of that total, more than half of those wirehouse teams (60%) stayed within the wirehouse channel. In years past — notably 2012 — wirehouse departures were landing at a greater clip at regionals, independent broker-dealers or RIAs.

The year-over-year uptick in 2014 wirehouse departures was aided by a recent exodus from Bank of America Merrill Lynch, with $6.2 billion in adviser AUM leaving Merrill Lynch in the fourth quarter alone.

Learn more about reprints and licensing for this article.