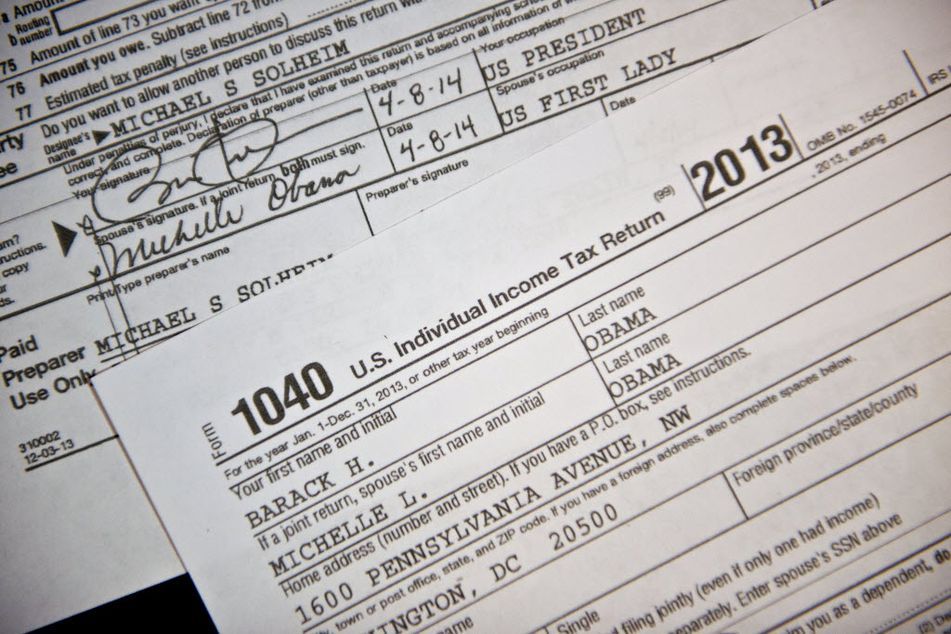

Line-by-line: Opportunities lie in your clients’ income tax return

Though the individual income tax return is a window into the past, what it reveals can shape savings and investment strategies into the future. Advisers can mine the 1040 for information and savings ideas for clients.

Advisers have plenty of good reasons to take a good look at investors’ Form 1040.

Tax season is now in its height as the April 15 deadline for taxpayers to submit their individual income tax returns approaches.

Though the individual income tax return is a window into the past, what it reveals can shape savings and investment strategies into the future. Further, though advisers do not always have a direct role in tax preparation, they can mine the 1040 for additional information and savings ideas and provide an additional service for clients.

“Taxes are something we can exert some control over, whereas it’s very difficult to control investment returns,” Dean Mioli, director of investment planning for the SEI Advisor Network, said.

SEI recently kicked off its Tax Planning Academy, a series of webinars for advisers who are interested in learning tax planning techniques, and review of the 1040 was covered in a Feb. 23 session. The next one, scheduled for June 29, will cover portfolio analysis from a tax perspective.

“It’s more realistic to say to a client that you can save $8,000 than to say that you can get a return of 10% or 12%,” John Anderson, managing director and head of practice management services for SEI Advisor Network, observed.

Here are a few opportunities that lie within the 1040:

LINE ITEMS TO REVIEW

Take a peek at this Form 1040, and turn your attention to lines 8a, 9a, 9b and 13. Respectively, those fields cover taxable interest, ordinary dividends and qualified dividends, and finally capital gains or losses.

High levels of interest in line 8a should drive advisers to question whether they can reduce that number in the future by reassessing their client’s investment mix.

“Would you have been better off with tax-free municipal bond interest?” Mr. Mioli asked.

Another conversation to have along those lines is asset location — what’s the tax status of the account where those investments are held — and whether certain asset classes are tax inefficient. Tax efficient asset classes, like municipal bonds and equity funds with low turnover may be better suited for a standard brokerage account or a non-qualified account, Mr. Mioli added. Tax inefficient assets, like emerging market debt, may be better held in a tax deferred account, like an IRA, or a tax-free bucket, like a Roth IRA.

“My locating assets in the proper tax bucket, I generate an additional 50 to 75 basis points of after-tax alpha,” Mr. Mioli said. “It’s a free return from being tax smart.”

LINES ON DIVIDENDS

Meanwhile, dividends noted on lines 9a and 9b should drive a discussion of where those dividends are coming from and their tax implications.

Stephen J. Bigge, partner with Keebler & Associates, provides the following example: A client reports $10,000 in dividends for 2014, $2,000 of which are qualified — and thus subject to taxation at the long-term capital gains rate — and $8,000 of which are non-qualified. Taxable interest received by a mutual fund and subsequently paid out falls under non-qualified dividends.

Mr. Bigge warned against focusing solely on the tax treatment of those two types of dividends as a means to drive investment strategy. Look at the bigger picture, instead. “Would you rather have $8,000 in short-term capital gains at an unfavorable rate, but you’re still ahead after taxes?” he asked.

“You have to look at the after-tax effect,” Mr. Bigge added. “Many clients complain that their adviser is generating all this short-term capital gains. You’re still getting a great return, and you’re still out ahead after taxes.”

REPORTING CAPITAL GAINS

Line 13 applies to capital gains and may be accompanied by Schedule D, where clients need to report gains and losses for short and long term.

If a client has loss carryforwards — a blessing, considering how strong the stock market has been over the last few years — be sure to use them efficiently, Mr. Bigge warned. Consider that short-term capital gains are taxed at the same level as ordinary income, which is at a height of 39.6%, compared with the long-term capital gains rate of 20%. And don’t forget that the net investment income tax applies to both, with an additional levy of 3.8%.

“A long-term loss against a short-term gain is very efficient, and a short-term loss against a long-term gain is very inefficient,” Mr. Bigge said. “Long-term losses against long-term gains and short term losses against short term gains are neutral.”

If capital losses exceed capital gains, the amount of excess loss taxpayers can claim on line 13 to lower their income is the lesser of $3,000 (or $1,500 for married-filing-separately) or the total net loss on line 16 of Schedule D, according to the IRS.

Mr. Mioli noted that advisers should look at line 13 of Form 1040 and ask whether there were any opportunities to reduce gains throughout the year. “We never know when’s the best time to tax-loss harvest, so you have to have systems in place so that when the opportunity presents itself, you can pounce on it,” he said.

CHARITABLE DONATIONS

If you’ve been doing your homework, you probably nagged your clients about their charitable gifts that are typically made at the end of the year. And if you’re really ahead of the game, you helped soften the blow of capital gains by donating appreciated stock. Itemized deductions, such as the income tax deduction from charitable giving, is reported on line 40 of the 1040 and on Schedule A.

Nonetheless, Mr. Mioli said that clients often give thousands of dollars in cash to charity.

“I say there’s a smarter way to do it,” he said. “Instead of giving cash, give an appreciated asset.”

TALK ABOUT IRAS

As you work through a client’s 1040, be sure to tell them that now is a good time to fund that last-minute IRA contribution. Remember that the limit is $5,500 per year for IRA contributions or $6,500 for taxpayers who are over 50.

Matt Sommer, director of retirement strategy at Janus Capital, noted that many people have misconceptions about funding IRAs, believing that they either can’t because they have a workplace retirement plan or because they earn too much money.

Single filers with a workplace retirement plan and who have a modified adjusted gross income over $70,000 get no deduction for IRA contributions. Married-filing-jointly taxpayers who have a retirement plan at work are phased out of the deduction with a modified adjusted gross income, or MAGI, of $116,000.

This is a scenario where clients ought to invest even if they don’t get the deduction.

“It’s remarkable that many people in the marketplace believe that because an individual has a plan at work or because of their income that they can’t fund an IRA,” Mr. Sommer said. “While they may not be able to take advantage of the upfront deduction, they can benefit from the IRA and take advantage of the tax deferred growth it offers.”

Learn more about reprints and licensing for this article.