When a Goldman Sachs job is a liability

Republican Cruz kicks off 2016 campaign for the U.S. presidency, skipping mention of Heidi Cruz's Wall Street career

Ted Cruz, kicking off his 2016 campaign for the U.S. presidency, extolled his wife’s entrepreneurial spirit by telling of her grade-school bakery business. He didn’t mention the 10-year career at Goldman Sachs Group Inc. she just put on hold.

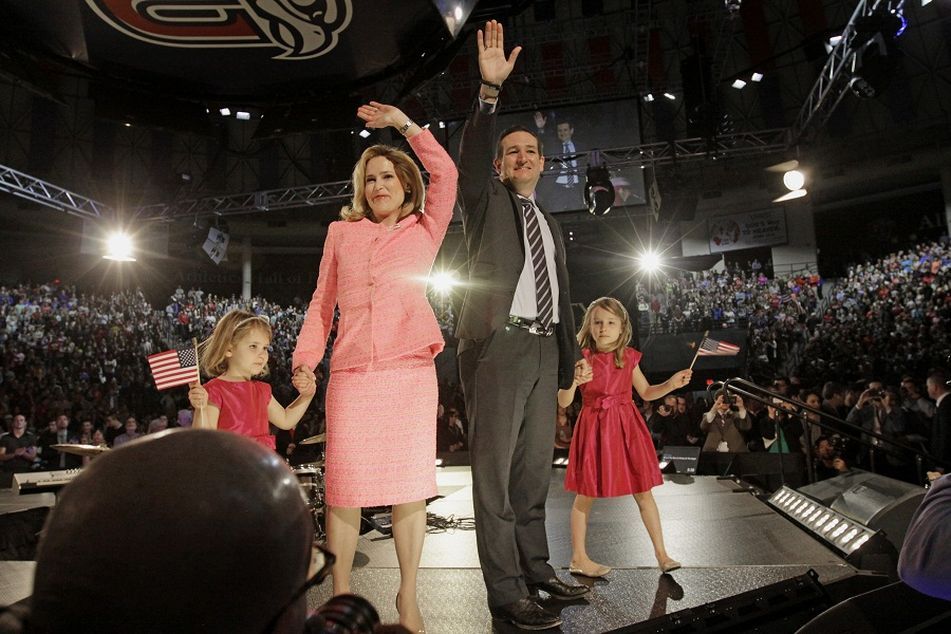

Mr. Cruz, a Republican senator from Texas, became the first major-party candidate to formally enter the race on Monday. He was joined on stage by his wife, Heidi, and their two daughters, Caroline and Catherine, after he told a crowd of supporters about Heidi’s Bakery, her childhood venture in California.

Cruz aides said he plans to emphasize the role powerful women played in shaping his life as he runs for president. That may be complicated by his wife’s profession as an adviser to wealthy families at a firm that finished last among the 100 most-visible U.S. companies in Harris Poll’s most recent annual ranking of corporate reputations.

“She and her brother compete baking bread. They bake thousands of loaves of bread and go to the local apple orchard where they sell the bread to people coming to pick apples,” said Mr. Cruz, 44. “She goes on to a career in business, excelling and rising to the highest pinnacles, and then Heidi becomes my wife and my very best friend in the world.”

Heidi Cruz, 42, has taken unpaid leave from her job at Goldman Sachs in Houston to help with her husband’s run, according to a person briefed on the matter, who asked not to be identified speaking about her employment. The leave will last the duration of the campaign, the person said.

‘FAT CATS’

Wall Street has remained a sensitive topic for politicians since the 2008 financial crisis, even as they have continued to court campaign contributions from the industry. Democrats attacked Republican presidential nominee Mitt Romney’s private-equity background in 2012. Kentucky Senator Rand Paul, like Mr. Cruz a Tea Party favorite, said last year that Republicans can’t be “the party of fat cats, rich people and Wall Street.”

Goldman Sachs became a symbol of the populist anger toward Wall Street as it was one of the first firms sued by regulators over sales of mortgage-related securities and its executives were called before Congress to explain their bets on the housing market.

Heidi Cruz, a Harvard Business School graduate who worked in President George W. Bush’s administration, joined New York-based Goldman Sachs in 2005 and was promoted to managing director, the firm’s second-highest rank, in 2012. She serves as regional head of the Houston office in the private wealth-management unit, which serves individuals and families who have on average more than $40 million with the firm.

BUSH AIDES

Heidi and Ted Cruz met in Austin, Texas, in 2000, when both were policy aides on the Bush campaign, according to a New York Times profile in 2013. Her employment at Goldman Sachs became a political topic when Senator Richard Durbin, an Illinois Democrat, tried to push Ted Cruz into admitting he was on his wife’s Goldman Sachs health insurance plan after criticizing President Barack Obama’s health-care policies, the Times reported.

While Ted Cruz avoided mentioning his wife’s employer Monday, he did speak of the time she spent living in Kenya and Nigeria as the daughter of missionaries. Mr. Cruz kicked off his campaign at Liberty University, a religious school in Lynchburg, Va., founded by the late evangelist Jerry Falwell.

Mr. Cruz grabbed national headlines in 2013 when he spoke for 21 hours on the Senate floor in favor of defunding the Affordable Care Act and helped to trigger a partial government shutdown. That led business leaders including Goldman Sachs Chief Executive Officer Lloyd C. Blankfein to travel to Washington to warn lawmakers they were risking the economic recovery if they didn’t raise the federal debt ceiling.

Learn more about reprints and licensing for this article.