BlackRock CEO Larry Fink challenges money managers, politicians on retirement issues

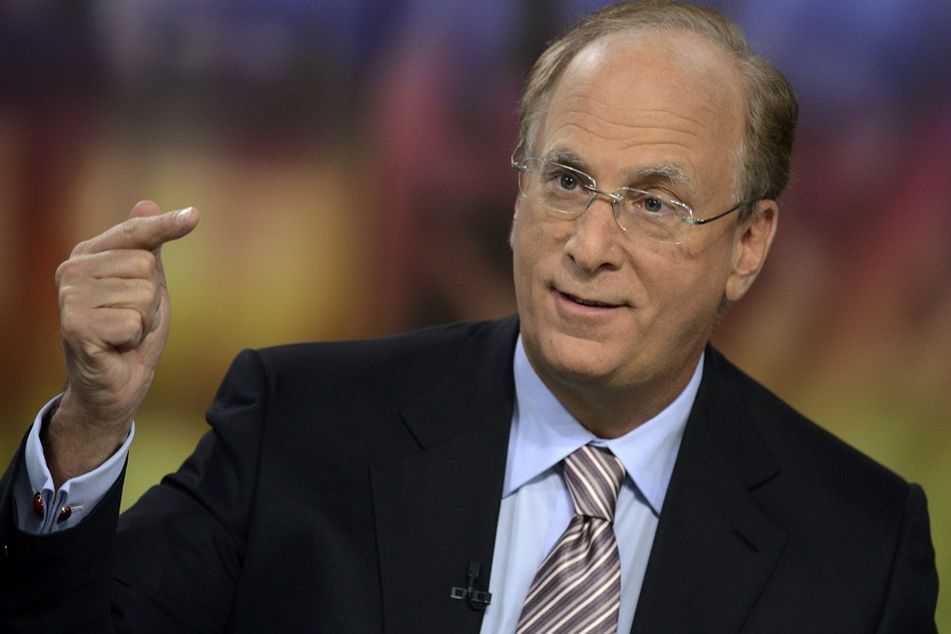

Laurence D. Fink

Laurence D. Fink

Inadequacy of savings is a "far bigger crisis than health care ever was."

BlackRock Inc. chief executive Laurence D. Fink on Tuesday challenged his industry to do a better job of preparing investors for retirement, adding that presidential candidates should debate ways to address the inadequacy of savings during the upcoming election season.

“This industry has done a good job of staying out of the news, and that’s the problem,” said Mr. Fink, whose firm is the world’s largest asset manager, with $4.8 trillion under management as of March 31. “I don’t think they want a voice.

“You see that from proxy voting and everything else,” he said. “Most of them want to stay out of the news and earn their fees.”

Mr. Fink said that the inadequacy of savings in the U.S. private sector is going to amount to “a drag on our economy” and that it should be debated alongside other key issues in the next presidential election.

“This is going to be a far bigger crisis than health care ever was,” he said. “It’s not part of the narrative.”

Mr. Fink said that the asset management industry and the private sector need to do a better job at education and increasing the savings of their clients and employees. He spoke at Pensions & Investments‘ The Global Future of Retirement Conference in New York.

Learn more about reprints and licensing for this article.