Edmond Walters, founder and CEO of eMoney Advisor, steps down

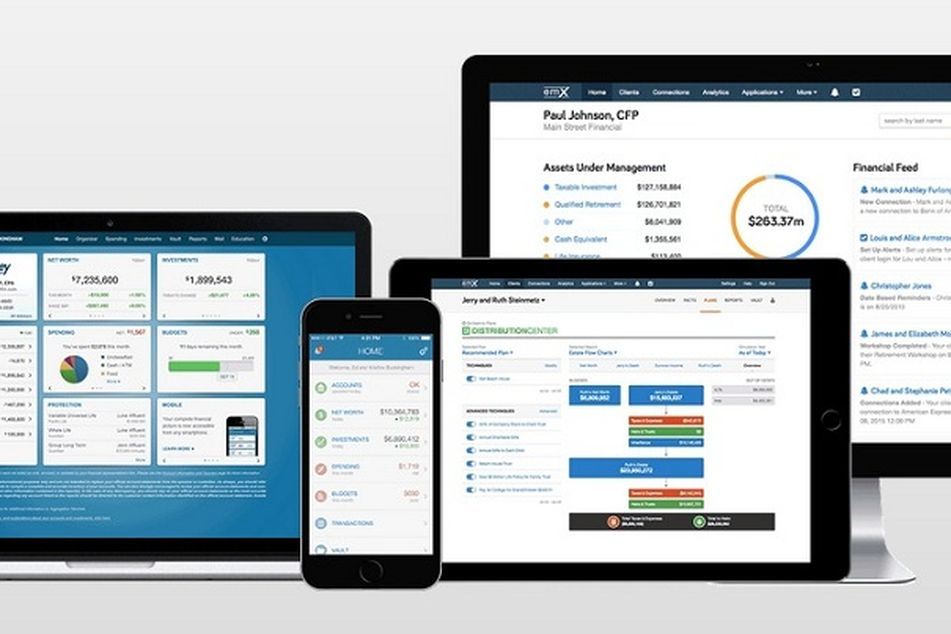

Edmond Walters, founder and CEO of the financial planning software firm, has resigned effective immediately, months after the firm was acquired by Fidelity, which said the firm's operations will continue without interruption.

Edmond Walters, the founder and chief executive of financial planning software provider eMoney Advisor, has resigned, effective immediately.

Michael Durbin, the president of Fidelity Wealth Technologies, will serve as interim CEO until a replacement is found.

Mr. Walters and Mr. Durbin were not available for comment as of press time.

eMoney, which Fidelity acquired in February for a rumored $250 million, will continue to act as an independent company, according to the custodian.

In February, Fidelity created a wealth technology division intended to promote innovation in the clearing and custodial business.

Acquiring eMoney certainly puts Fidelity in a favorable position, since the firm can take advantage of a tool that likely will end up in every adviser’s tool kit, Matthew Fronczke, engagement manager and financial adviser technology analyst at kasina, wrote in an email.

“Not only do they benefit from the use of this tool with their own advisers, but also advisers across the independent broker-dealer and registered investment adviser landscape that access the planning software,” Mr. Fronczke said.

“Fidelity has a long history of participating in both organic technology development as well as technology [venture capital] funding, so even with the departing of [Mr.] Edmond, eMoney is left in good hands,” he said.

The company has sought to shake up the industry on numerous occasions. During the annual Technology Tools for Today conference in Dallas this year, Mr. Walters went on stage and announced that eMoney would collaborate with 28 companies for integrations, including its competitors.

Joe Duran, the chief executive of United Capital, said he suspects that Mr. Walters, who had been with the company for 15 years, had a vision that did not align with that of Fidelity’s senior management.

“Edmond is a brilliant guy, an incredible visionary, and someone with very specific views about the future,” Mr. Duran said. “And obviously it was very different than Fidelity’s goals, which bought the technology with a vision of its own.”

Bob Veres, the publisher of Inside Information, said he also speculates that Mr. Walters’ willingness to work with competitors might not have been what Fidelity had in mind.

“It’s just a speculation that Fidelity decided to be less open about promoting the competition,” Mr. Veres said.

Edmond Walters left eMoney today. It’s VERY unlike him to walk away from a challenge; there must have been a problem with the Fidelity Mgt.

— Bob Veres (@BobVeres) September 3, 2015

Prior to taking his current position at Fidelity, Mr. Durbin had spent six years as president of the custodian’s RIA custody unit, and before that held various leadership roles over the course of 18 years at Morgan Stanley. He said in a statement that Fidelity is committed to eMoney’s mission to revolutionize the way that advisers serve their clients.

“That will mean ensuring the eMoney team continues to foster an independent spirit, fierce entrepreneurialism and unrelenting focus on clients,” Mr. Durbin said in the statement. “The team is incredibly strong and driven to transform the wealth management industry. That spirit will continue.”

Mr. Duran said he knows from experience that it will be a tough adjustment for Mr. Walters — Having built a platform he later sold to a General Electric Co. unit, he left before his contract was up because of misaligned goals.

“I’m sure that for him it was an incredibly tough decision,” Mr. Duran said. “For me, it was agonizing to leave, but it was probably what was best for everyone.”

Learn more about reprints and licensing for this article.