Republican introduces bill to curb SEC use of in-house judges

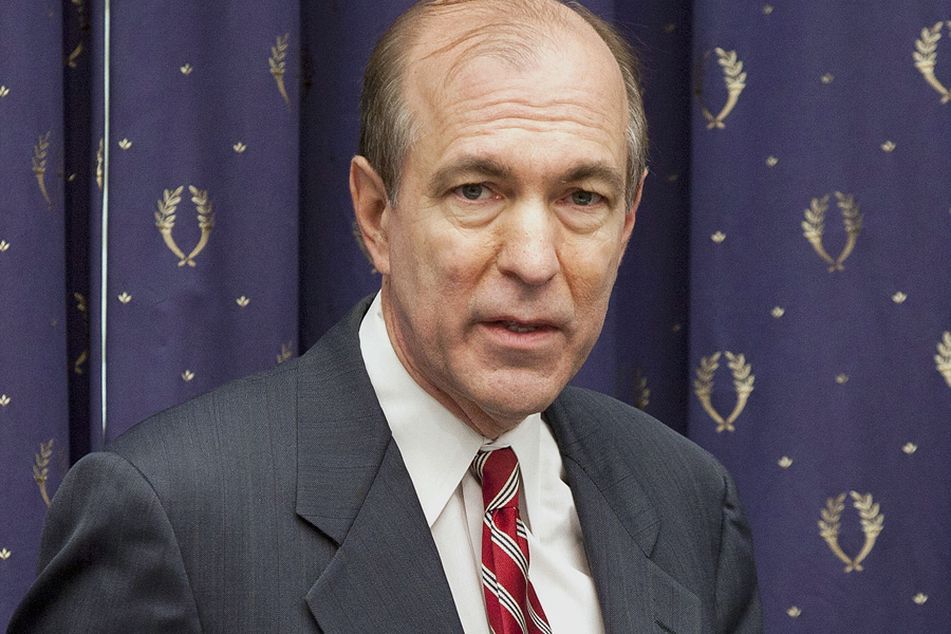

Rep. Scott Garrett, R-N.J.

Rep. Scott Garrett, R-N.J.

Legislation would give advisers the option to have cases tried in federal court instead of in forums presided over by the agency's administrative law judges.

A Republican lawmaker wants to curb the ability of the Securities and Exchange Commission to try enforcement claims before in-house judges, a process that has generated much controversy, including protests from investment advisers.

Rep. Scott Garrett, R-N.J., introduced legislation Thursday that would give defendants in SEC cases the option to have the matter tried in a federal court instead of in forums presided over by an SEC administrative law judge.

“Strong enforcement of the securities laws is an essential part of the SEC’s mission to protect investors and maintain a fair and efficient marketplace, but in recent years the agency has transformed into a veritable judge, jury and executioner with its blatant overuse of their in-house courts,” Mr. Garrett, chairman of the House Financial Services Subcommittee on Capital Markets and Government Sponsored Enterprises, said in a statement.

Mr. Garrett added: “Every American has the constitutional right to defend themselves before a fair and impartial court, and the Due Process Restoration Act will go a long way towards protecting the rights of the innocent while maintaining the ability of the SEC to punish wrongdoers.”

The SEC’s increasing use of administrative forums has spurred several lawsuits, including some from investment advisers.

Opponents say the administrative process does not allow defendants the same latitude to make their cases as they have in a jury trial. Supporters argue the system is faster and less costly than a court proceeding, provides protections and uses judges with expertise in securities laws.

In addition to allowing defendants to move their cases to federal court, Mr. Garrett’s bill would raise evidence standards for cases that remain in the administrative forum.

In reaction to criticism of the ALJ system, the SEC recently passed a rule that would provide defendants greater discovery opportunities and make other reforms to the process.

Learn more about reprints and licensing for this article.