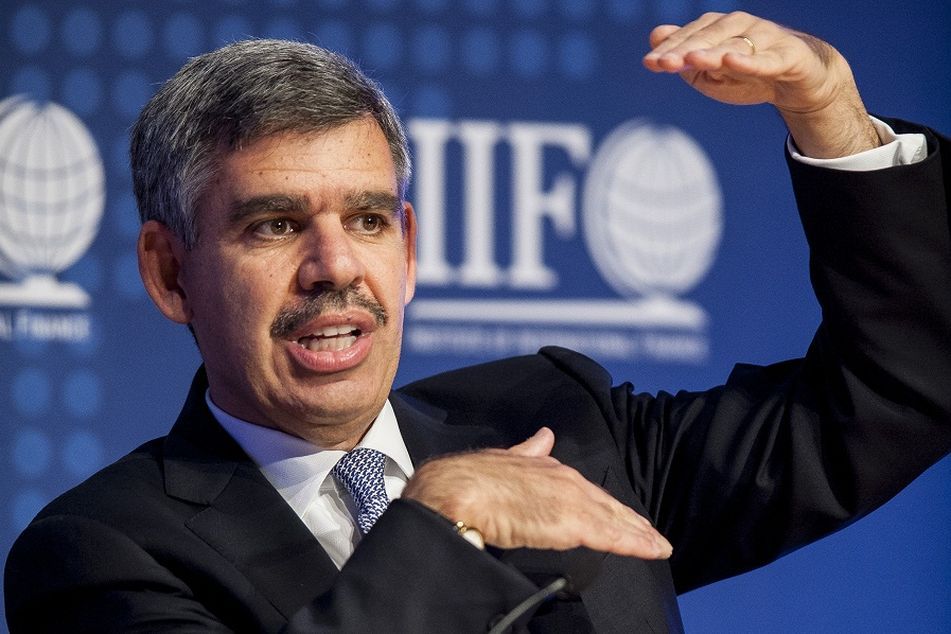

Take 5: Allianz’s El-Erian says Hillary Clinton has best economic plan

Five candid responses on the Fed, the economy, and how to invest $1 million

A candid chat with Mohamed El-Erian, chief economic adviser at Allianz SE, puts negative interest rates in perspective, grades President Barack Obama’s performance on the economy, and hashes out whether Hillary Clinton or Donald Trump will be better for America.

InvestmentNews: What are the chances that the U.S. Federal Reserve will resort to negative interest rates within the next 12 months?

Mr. El-Erian: Low, very low. While the economy is not great and continues to operate below potential, it’s doing okay. Add to that, Fed officials who are aware of the theoretical damage that negative rates inflict on a modern market-based economy. They see the signals out of Japan pointing to potential collateral damage. Bottom line, you would need a major market accident or a significant economic calamity abroad for the Fed to adopt negative rates.

InvestmentNews: What’s your evaluation of the Fed’s monetary policy since the financial crisis?

Mr. El-Erian: It is an easy call for the 2008-2010 period. The Fed gets an ‘A+’ for the way it normalized markets heavily disrupted by the global financial crisis, thus averting a multi-year global depression. From 2010 to today, its more complex. An ‘A-/B+’ for its ability to repeatedly repress financial volatility and boost asset prices – not as an end in itself but as a means to promoting higher economic activity. A ‘B-‘ grade in meeting its objective to generate growth as it was inevitably hindered by imperfect tools. And an ‘incomplete’ when it comes to the final assessment of the balance between durable benefits and unintended negative consequences.

InvestmentNews: How would you grade President Obama’s efforts to help U.S. economy?

Mr. El-Erian: Impressive in identifying the key issues, designing the possible policy responses and proposing them to Congress. Implementation, however, has been significantly hindered by political polarization on Capitol Hill. As a result, the U.S. is yet to pivot away from excessive prolonged reliance on Fed policy and toward the comprehensive policy package that unleashes the country’s tremendous growth potential.

InvestmentNews: From your perspective, which presidential candidate, and why, will be most beneficial for the U.S. economy and financial markets?

Mr. El-Erian: What financial markets need most is a set of comprehensive policies out of DC that generates high inclusive growth. It is also what Main Street desperately needs. To date, Secretary Clinton has put forward a well-documented set of policy proposals that, if passed by Congress, would help reinvigorate the country’s growth engines. Mr. Trump is still in the process of detailing his economic approaches, particularly as his perspective evolves from one heavily influenced by his corporate expertise to the broader ones that incorporate more macro-economic dimensions, sovereign-debt realities and international economic relations.

InvestmentNews: If one were to inherit $1 million today how should they invest it?

Mr. El-Erian: This is a tricky question, especially as much depends on where the person is starting from. So a few general principles on what to do, and also what not to do.

The best overall investment is not via the financial markets but, instead, in human capital – that is in strengthening the education, expertise, experience and mindsets needed to navigate a fluid and unusually uncertain future.

Turning to financial markets, I would not rush in to invest the funds at current valuations in public markets. Instead, I would patiently look for entry opportunities to deploy the cash in what I expect will be markets that trade in wider bands. I would also look for opportunities away from public markets.

Finally, I would not invest any of the money in the negative yielding securities that now constitute some 30% of total government bonds issued around the world.

Learn more about reprints and licensing for this article.