Displaying 2691 results

Bill would give one-time extra Social Security payment to all recipients

Sen. Elizabeth Warren, D-Mass., introduced legislation paying $581 to each person receiving retirement benefits to offset no cost of living adjustment in 2016.

Chinese stocks go from a sell to a buy just like that

Breakfast with Benjamin: Emerging-markets fund manager who darted out of Chinese stocks at the best possible time is now moving back in.

Social Security strategies grandfathered for existing claimants

File and suspend available for six more months.

Budget deal would nix popular Social Security claiming strategies

Loss of file and suspend and some spousal benefits could catch near-retirees off guard.

Game almost over for Social Security claiming strategies

Congressional budget deal provision could affect current and future retirees.

New Ways & Means chairman gives Speaker Ryan a tax-reform partner

One of Rep. Kevin Brady's ongoing pursuits has been eliminating the estate tax.

Hedging against triple whammy of Medicare price hikes

The price tag for Medicare is expected to swell dramatically Jan. 1 as the result of several factors.

Attorney learns the wrong way to deduct IRA losses

Semi-retired patent attorney cannot deduct losses in an IRA.

Sounding the secular stagnation alarm bells

Breakfast with Benjamin: Larry Summers is sounding the alarm for secular stagnation.

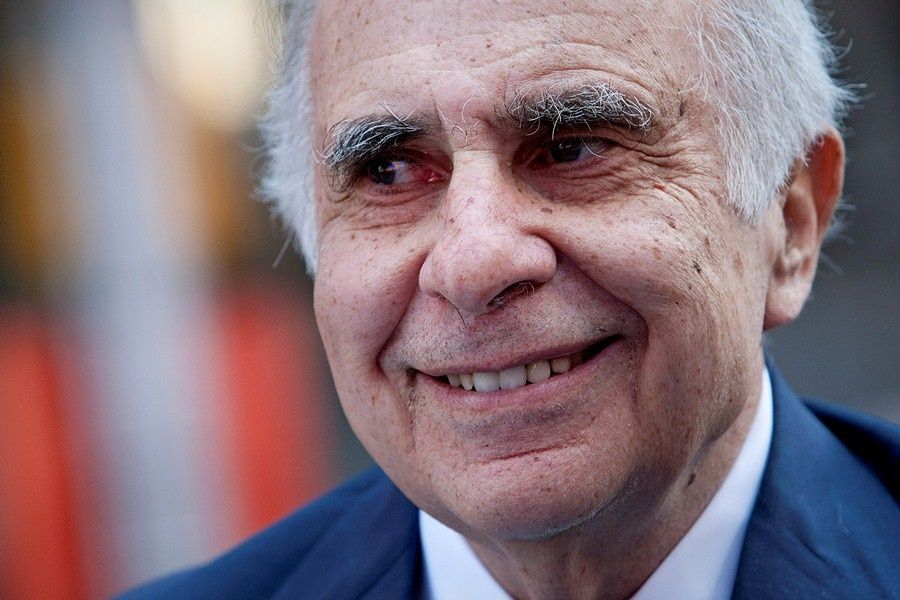

Carl Icahn campaigns against corporate inversions and for himself

Breakfast with Benjamin: Carl Icahn's smooth move to try and halt corporate inversions in the name of tax patriotism is, naturally, also pretty good for his own portfolio.

Support grows to repeal Obamacare ‘Cadillac tax’

Bipartisans in Congress — as well as business and labor groups — are coalescing to try to stop a tax on high-premium health care plans.

Don’t abandon Social Security strategy to avoid Medicare hike

Short-sighted remedy is like 'prescribing a lobotomy for a headache'.

The Social Security survivor benefit do-over

Widows and widowers can repay benefits and collect higher amounts later.

How Social Security claiming strategies affect Medicare premiums

One strategy may protect you from higher premiums in 2016; the other won't.

Consumers lack detailed knowledge of Social Security

New survey finds advisers can play crucial role in maximizing clients' benefits.

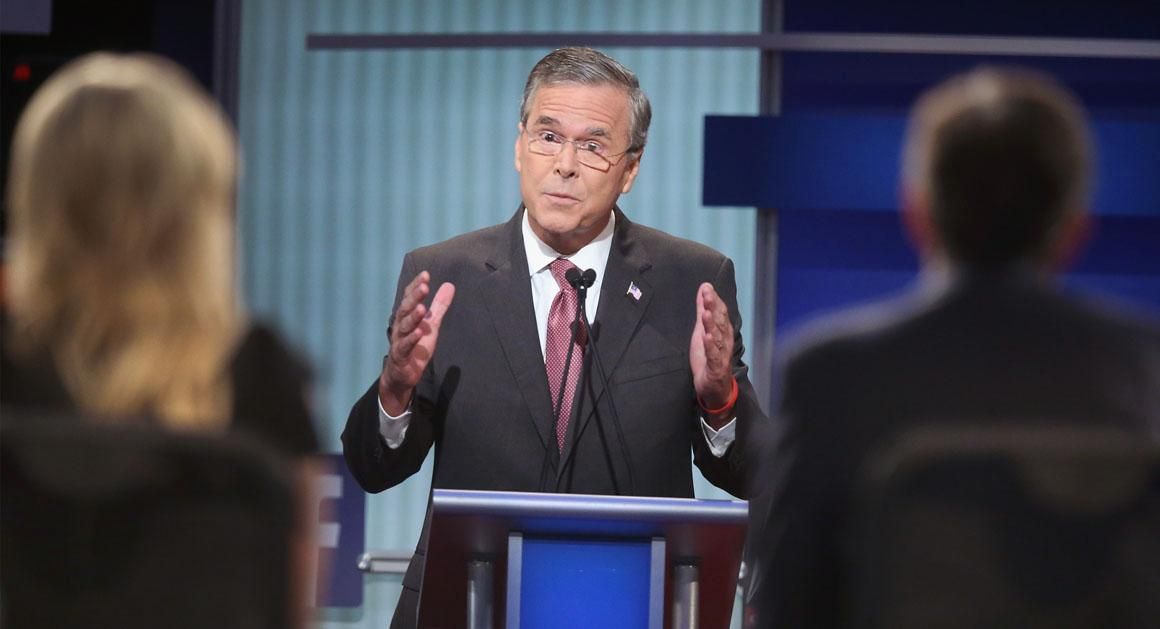

Jeb Bush tax plan would set investment taxes at 20%, eliminate deductions

The presidential candidate also would eliminate so-called “carried interest” that allows private equity and hedge fund partners to pay capital gains taxes rather than ordinary income taxes on their share of fund profits.

Presidential candidates can’t ignore Social Security

Exhaustion of disability trust fund in 2016 should force discussion of long-term financing issues.

Hillary Clinton’s capital gains tax plan pushes rates up for highest earners

Compared with today's two-tier system — a 43.4% top rate for assets held less than a year and 23.8% beyond that — the proposal by the Democratic presidential front-runner would create a six-rate structure for capital gains for high-income households.

No Social Security cost-of-living adjustment in 2016

Social Security recipients will not receive a benefits boost next year mostly because low gasoline prices have kept inflation too low to spark an automatic cost-of-living adjustment, the government announced.

Hillary Clinton’s plan to prevent stock market crashes

Breakfast with Benjamin The Democratic candidate proposes new fees for taking investment risks, because taking investment risks aren't risky enough already, or something like that.