Sponsored Content from BNY Mellon's Pershing

3 Secrets to Sustaining Growth, Revealed by Top-Performing Advisory Firms

Despite 2020’s multi-faceted disruption, many advisory firms managed to deliver strong revenue growth and profitability. However, a select group of firms significantly outperformed peers in these areas and others – by driving three key strategies.

When we think back to spring 2020, when our lives and business practices were jolted by a slew of new challenges, it’s truly remarkable just how far we’ve all come. For many of us, collaborating with team members and serving clients via electronic means have become routine. Across the advisory industry, business processes have been reshaped radically, talent strategies have been revamped and technologies have been pushed to their limits and beyond. As the year ended, the question on everyone’s mind was: Have advisory firms thrived or merely survived?

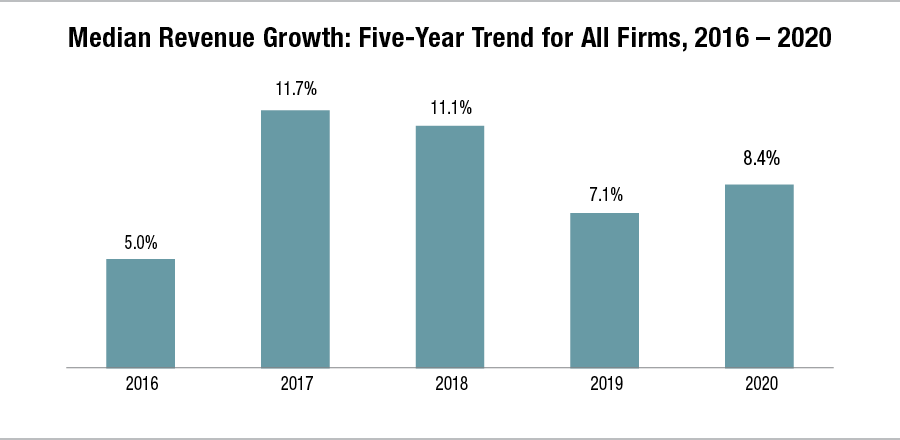

Although there’s no definitive answer to this question, the newly released 2021 update to the InvestmentNews Pricing and Profitability Study may offer the clearest view of how advisory firms performed in 2020 across a number of critical metrics. The “perfect storm” of milestones ( the 30th anniversary of the study, the start of a new decade, and a pandemic year) made for an interesting set of key findings. one in particular was both surprising and reassuring: advisory firms, on average, were able to drive growth in a range of areas despite the historic headwinds. The median revenue growth rate for all firms was 8.4% in 2020. This was up from 7% in 2019, and may possibly signal a return to the double-digit revenue growth rates the study reported for 2017 and 2018.

Additionally, gross and operating profit margins were 65.7% and 23.6%, respectively, maintaining a five- year trend. Productivity, as measured by revenue per staff member, reached $284,250 in 2020, the highest level ever recorded in this study. Silver linings and an opportunity to learn from the best – top-performing firms have blazed a path to help inspire other advisory firms.

This year, for the first time, the study presents a close-up of the 25% of surveyed firms that delivered the highest composite score of profitability and growth in 2020. This new “Top-Performing Firms” data cut reveals important clues about their management approaches and business strategies.

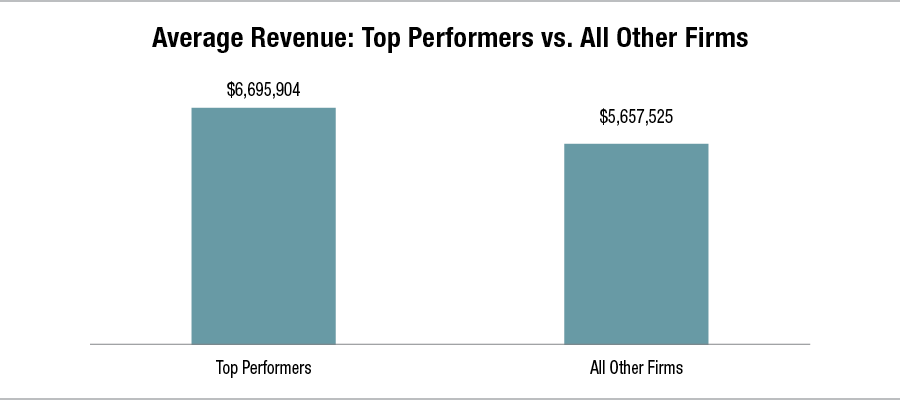

In 2020, these top-performing firms earned revenue of $6,695,904, compared to average revenue of $5,657,525 at all other firms. This difference, roughly 20% higher, deserves a close look, even though a range of factors – particularly firm size – contribute to this results.

Here are 3 things that top-performing firms appear to be doing very well, which contributes to their excellent results:

1. Managing Overhead Expenses Vigorously

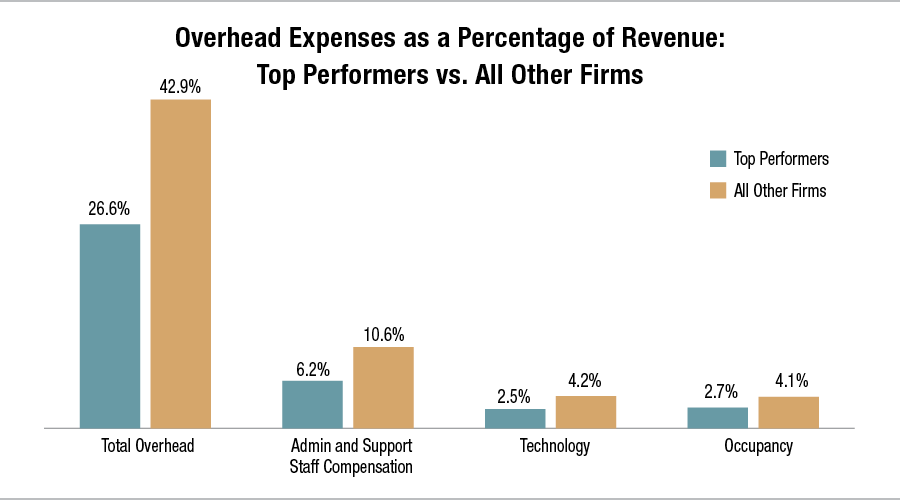

One stark difference we see among these top performers is how they manage their expenses. Their total overhead represented less than 27% of revenue, compared to nearly 43% for all other firms in the study. The chart below drills into three key drivers of this result, but at a glance we can see that the top performers were doing business with relatively:

- Fewer administrative and support employees

- Lower technology costs

- Lower occupancy (office) costs

We heard from our advisory firm clients that they were mindful of those same three expense categories, some even taking the opportunity to leverage money saved by operating in a remote-working world to reinvest in richer virtual technology and event experiences for their clients, while the foresight that hybrid and 100% remote working arrangements will remain a part of corporate culture.

2. Carefully Calibrating Their Pricing Strategy

The study found that top performers in 2020 had larger client relationships than their peers, earning a median of $10,000 in revenue per client compared to $9,123 for all other firms. They also enjoyed a pricing edge. The median revenue-to-assets-managed ratio for the top performing firms was 70 basis points, as compared to 66 basis points for all other firms. Although this might not seem significant on the surface, it could add hundreds of thousands in annual incremental revenue when applied to all of a firm’s assets under management.

A related finding in the survey was that only 11% of all participating firms reported changing their pricing in the past two years. Of these firms, 53% increased their fees and 47% lowered them. This may indicate that the top performers have managed to sustain or increase their fees and, theoretically, earn those higher fees by delivering superior service or value adds.

These findings suggest that advisory firms are exploring alternative fee structures: retainer, hourly – in order to go upstream and downstream, and find appropriate billing models for their client groups. Advisory firm leaders should consider building a pricing strategy based on the client experience, and consider how the pricing philosophy aligns with the pricing strategy (think: aligning services with fees to ensure profitability and incentivizing clients to engage with more services).

3. Boosting Productivity by Cultivating Larger Clients

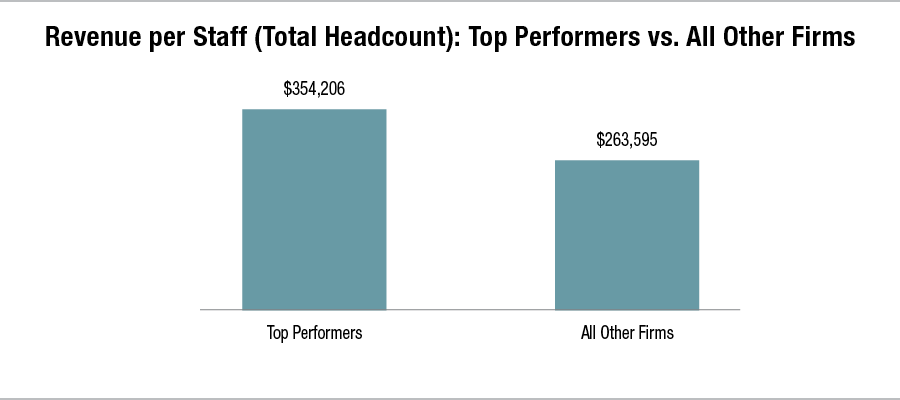

Above, we noted that the top-performing firms in this study have built client relationships that are larger than those of peer firms. This enhanced to their ability to achieve much higher productivity levels in 2020: The top performers reported median revenue per staff member of $354,206, while all other firms reported $263,595. [This difference translates into any number of advantages for the high-performing firms, from improving capacity to serve clients to uncover additional efficiencies through technology and process improvements.

Some of our clients have shared that the virtual world spurred on by the pandemic has helped nurture and expand relationships with clients, who may have family members in disparate states (or even countries). Through virtual means, multiple clients (and potential new clients in the younger generation of extended families) can now be brought together for meetings, events and key milestone moments with the click of a button.

All Eyes on the Future

These first-time-ever insights into top-performing firms are just a small part of the rich data sets and perspectives shared in the latest InvestmentNews Pricing and Profitability Study. But, they can help leaders at every firm to set their eyes on the future, to consider just how well their teams adapted to extreme circumstances – and how such creativity and resilience can drive innovation and future success.

I know your share my belief that the best years for advisory firms are still ahead of us, and we have the tools, talent and resolve to seize every opportunity the future presents us.

About the author

Christina Townsend is a Managing Director and Co-Head of Relationship Management Wealth Solutions at BNY Mellon | Pershing. She, and her team, work collaboratively across the enterprise to develop, implement and support the strategy and solutions available to wealth managers, registered investment advisors, multi-family offices and trust companies. She has a team of dedicated relationship management experts working with prospects and clients to optimize their businesses. Christina is a member of the Wealth Solutions Executive Committee.

Prior to her current role, she led the Managed Investments product and transition teams and served on the Managed Investments Executive Committee. She was responsible for the product strategy, roadmap and implementing client’s managed account solutions.

Christina joined Pershing in 2000. She started her career in the corporate intern program and then spent a number of years supporting business process improvement efforts for the firm. She managed a team that was responsible for delivering large-scale technology and new client conversion projects.

She is the North America Co-Chair of BNY Mellon’s Women’s Initiative Network and is a member of the BNY Mellon WIN Executive Council.

Christina earned a Bachelor of Science degree in Economics from Bates College. She completed the Securities Industry Institute® program, sponsored by Securities Industry and Financial Markets Association (SIFMA), at the Wharton School of the University of Pennsylvania.

Connect with Christina Townsend on LinkedIn

Learn more about reprints and licensing for this article.

This content is made possible by BNY Mellon's Pershing; it is not written by and does not necessarily reflect the views of InvestmentNews' editorial staff.