Hillary Clinton vs. Donald Trump: Who are you voting against?

With Donald Trump winning the Republican nomination and Hillary Clinton poised to be crowned the Democratic nominee next week, the campaign rhetoric and platforms the White House hopefuls are presenting now paint a clearer picture of how each candidate's positions would affect the financial markets. Here are some sectors to watch when the new president takes office, according to S&P Capital IQ.

With Donald Trump winning the Republican nomination and Hillary Clinton poised to be crowned the Democratic nominee next week, the campaign rhetoric and platforms the White House hopefuls are presenting now paint a clearer picture of how each candidate's positions would affect the financial markets. Here are some sectors to watch when the new president takes office, according to S&P Capital IQ.

In many cases, financial advisers feel more strongly about keeping a candidate out of the White House than voting one in.

Hillary Clinton and Donald Trump will face a lot of skepticism from financial advisers as they square off Monday in the first presidential debate.

(Related read: Advisers react to Hillary Clinton speech that takes aim at ‘super-rich’ and Wall Street)

Reflecting the polarization and bitterness permeating the campaign, many advisers indicated in an InvestmentNews survey earlier this month that they likely will be holding their noses as they go to the polls in November.

Nearly a quarter of survey participants — 23% — said their votes won’t be cast in favor of a candidate whose policies they embrace as much as to try to prevent another candidate they dislike from entering the Oval Office.

In fact, “voting in opposition to the other candidates” was cited by 23% of those taking the survey, and ranked as the second most important factor in deciding for whom advisers would vote. The No. 1 reason was “economic issues,” which was cited by 25% of survey respondents.

The survey of 1,055 readers, which was conducted Sept. 9-13, showed Mr. Trump holding a commanding lead over Ms. Clinton, at 46% to 34%. Libertarian candidate Gary Johnson was favored by 8% of those surveyed, while Green Party nominee Jill Stein garnered 0.5%. Another 8% said they were undecided.

Source: InvestmentNews Research

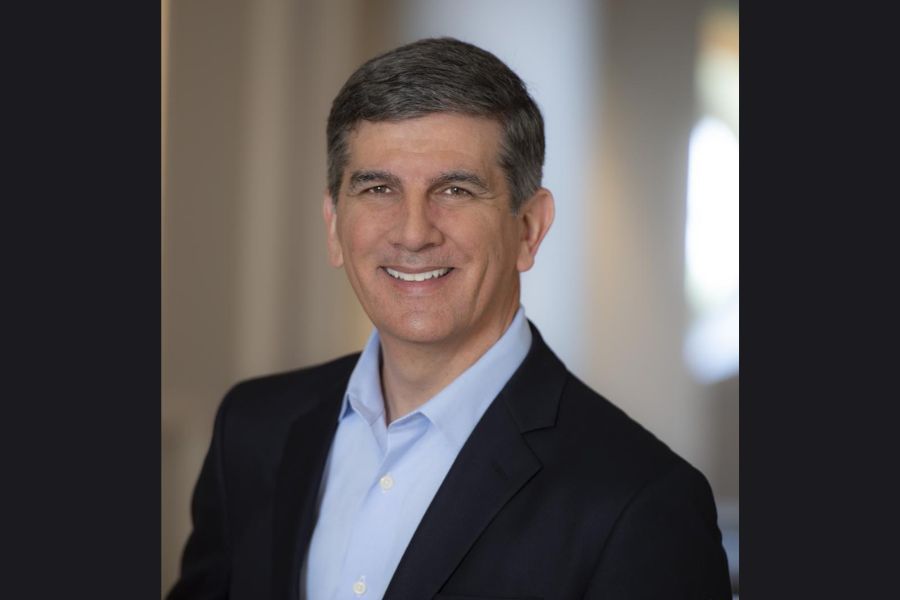

“It’s probably more anti-Hillary than it is pro-Donald,” Michael Freeman, trustee and chief investment officer of Freeman Family Trust, said of his support for Mr. Trump.

That theme was prevalent among those who intend to vote for the real estate mogul and reality television star.

“In my opinion, he’s the lesser of two evils,” said Michael Masiello, owner of Masiello Retirement Solutions. “We will survive Donald Trump. We won’t survive the socialist.”

(Related read: Advisers react to Hillary Clinton speech that takes aim at ‘super-rich’ and Wall Street)

Ed Dunlap, a retired financial adviser, also has limited enthusiasm for Mr. Trump.

“Yes, I guess,” Mr. Dunlap said when asked whether he intends to vote for Mr. Trump. “You could put me in the ‘anybody but Clinton’” camp.

The fact that advisers appear ready to go to the polls to stop the candidate they don’t like from getting to the White House is a trend familiar to polling and election experts.

A Pew Research Center survey released Sept. 21 showed that about one-third of Mr. Trump’s and one-third of Ms. Clinton’s supporters “frame their vote at least partially in opposition to the other candidate.”

“Overwhelmingly, the story line for this election is the negativity toward each candidate,” said James McCann, a professor of political science at Purdue University. “It’s disconcerting from the larger view of democracy.”

MOSTLY REPUBLICANS

The results of the poll should not be surprising, given that most of the advisers who participated — 49% — said they are registered Republicans. About a quarter — 24% — are registered Democrats, while 18% identified as independent.

Showing wavering backing within his own party, Mr. Trump drew support from 71% of respondents who said they are registered Republicans, while Ms. Clinton was backed by 80% of those who are registered Democrats.

|

||

|---|---|---|

| All | 34.3% | 46.5% |

| Republican | 10.7% | 71.2% |

| Democrat | 80% | 7% |

| Independent | 39% | 40% |

| Other | 24% | 32% |

| Not registered | 32% | 30% |

|

||

|---|---|---|

| All | 52.4% | 30.9% |

| Republican | 36% | 45% |

| Democrat | 86% | 6% |

| Independent | 54% | 29% |

| Other | 46% | 25% |

| Not registered | 55% | 22% |

Mr. Masiello was not thrilled that Mr. Trump prevailed in the GOP primary.

(Related read: On verge of GOP nomination, advisers say Trump is still largely unknown)

“He made it through,” Mr. Masiello said. “And whether I like it or not, that’s the best one side can offer.”

But Knut Rostad, president of the Institute for the Fiduciary Standard and a registered Republican, said he cannot bring himself to vote for Mr. Trump — or for Ms. Clinton — and will instead support Mr. Johnson.

Mr. Trump “speaks like an insolent, arrogant 12-year-old, and it baffles me that some Republicans haven’t moved away from him,” Mr. Rostad said. “They bought the line that there’s nothing more than a two-party system here.”

Many registered-Republican advisers intend to vote for Mr. Trump, but they’re not confident he’ll defeat Ms. Clinton. Only 45% of Republicans in the InvestmentNews poll think Mr. Trump will win the presidency. This compares with 31% of overall respondents who believe he will win. Democratic advisers, however, have great confidence in their nominee’s chances. Eighty-six percent of registered-Democrat advisers think Ms. Clinton will become president, compared with 52% of all respondents.

Advisers may be foretelling the outcome of the election with their assessment that Ms. Clinton will win.

“Academic research shows that the ‘who will win’ question has been more predictive of the actual winner than ‘who are you voting for,’” Christine Matthews, president of Bellwether Research and Consulting, wrote in an email.

But one of the major challenges Ms. Clinton faces as a Democrat running to replace President Barack Obama — a two-term Democratic incumbent — is the perception that she’s a continuation of the current administration.

Advisers who think Mr. Obama has increased regulations too much and implemented other policies that hinder economic growth don’t want to see Ms. Clinton move into the White House.

“It’s time for a change,” Mr. Freeman said.

(Related read: Why financial advisers hate Elizabeth Warren)

Shon Anderson, chief wealth strategist at Anderson Financial Strategies, opposes Ms. Clinton because of the “overreaching government role that she has been part of her whole career — and she continues to propagate.”

Thane Walton, retirement planning consultant at United Planners, said he is “not super excited” about voting for Mr. Trump. But the idea of putting someone in the Oval Office who has not had a career in public service appeals to him.

“I am a fan of business and business leaders,” Mr. Walton said. “I like change and getting a nonpolitician in there.”

POTENTIAL DISASTER

But for some advisers, electing Mr. Trump would not only be a change of pace — it could be a disaster. They cite concerns that he lacks the temperament to be president.

“He’s a loose cannon,” said Alan Ungar, a consultant at Abacus Wealth Partners. “He shoots from the hip. He scares me, frankly.”

Mr. Ungar sees Ms. Clinton’s years of experience in government — as first lady, a senator and secretary of state — as an asset, not a drawback.

“What I want is somebody who will guide us safely through our next phase of history and someone I can respect,” Mr. Ungar said. “She does her homework. I feel comfortable that any decision she makes will be well thought out.”

He also said Ms. Clinton has demonstrated an ability to reach across the aisle — a trait that will serve her well in the likely event that as president she would face a Republican House led by Speaker Paul Ryan, R-Wisc.

(Related read: Don’t dismiss Donald Trump’s appeal, says longtime political writer Mark Halperin)

“She will be able to work with Paul Ryan,” Mr. Ungar said.

Suzanne Rague, president of Portfolios Northwest, also is reassured by Ms. Clinton’s steadiness compared with the protean Mr. Trump.

“There would be more certainty and predictability under Hillary Clinton, and that would be better for the economy long term versus having a loose cannon who is very mercurial and shifting in the policies he would be backing,” Ms. Rague said.

The stakes are even higher for another supporter of Ms. Clinton.

Benjamin Lupu, owner of Kensington A.M.I. Investment Management, said the world economy depends on Ms. Clinton defeating Mr. Trump.

“The entire global market would panic if the GOP candidate, whose name I don’t even like to say, is elected,” Mr. Lupu said. “There will be a level of alarm and fright throughout the world that we have not seen in our lifetime.”

There also is a great sense of urgency on the other side of the political fence.

“If we don’t change our tax code and our economic system, this country is going to cease to exist, like the Roman Empire,” Mr. Masiello said. “What [Mr. Trump] is saying is what most Americans feel. We’re pissed off, candidly — or, at least I am. And I don’t think I’m that far out of touch with middle America.”

(Related read: Republican tax plan would reduce brackets, slash investment taxes)

Advisers who intend to vote for Mr. Trump give him the benefit of the doubt when it comes to economic and tax policies, even if they don’t believe he has fully articulated his stances.

“[Mr.] Trump definitely doesn’t have an extremely tight grasp on all the issues, but his approach is friendlier toward business, the economy and markets,” Mr. Anderson said. “The details will eventually get sorted out.”

But based in part on President Bill Clinton’s administration, Jeff Yamada, wealth counselor at MCS Family Wealth Advisors, doesn’t see Ms. Clinton as anti-business.

“The Clintons are pretty friendly toward business overall, so I don’t see a huge threat there,” Mr. Yamada said.

Ms. Clinton will get Ms. Rague’s vote because she is confident Ms. Clinton will get the regulation of business right.

For instance, she would like to see the Labor Department rule to raise investment advice standards for retirement accounts extended to all retail advice.

“That’s more likely to occur under Hillary Clinton,” Ms. Rague said.

But a race that has been all about personality will probably be decided on the issue of temperament. Even Mr. Trump’s supporters say he has to ease up on nasty off-the-cuff attacks on political opponents and others.

“I’m hoping someone has talked to this man and told him to tone it down,” Mr. Freeman said. “This is grade-school kind of stuff.”

Learn more about reprints and licensing for this article.