Stan Lee: Estate planning takeaways from the Marvel legend’s elder-abuse saga

Late-life planning will grow more important for advisers as clients increasingly live into their 90s and 100s.

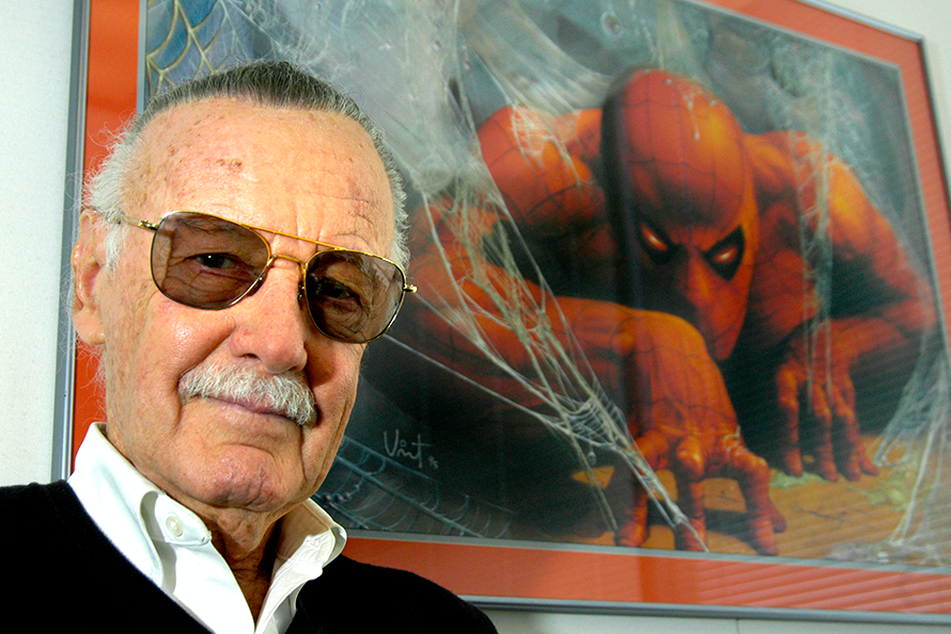

Stan Lee, the creative juggernaut behind many of Marvel Comics’ iconic superheroes, died Monday at Cedars-Sinai Medical Center in Los Angeles. He was 95. The following is a recent InvestmentNews story about the controversy surrounding Mr. Lee’s estate.

Financial advisers can draw some key estate-planning lessons from the controversy surrounding Stan Lee, the 95-year-old Marvel Comics legend whose vast fortune is allegedly under attack from financial predators.

Mr. Lee, who co-created such iconic characters as Spider-Man, the X-Men, Black Panther, the Hulk and the Fantastic Four, has an estate reportedly valued at more than $50 million. Hearing, vision and memory impairments mean he’s unable to “resist undue influence,” according to reports.

Business associates, caregivers and family members are supposedly trying to manipulate Mr. Lee to gain control of his assets, something experts believe will happen more often as increasing numbers of people live into their 90s and 100s but may not have the faculties to manage their financial affairs.

“The Stan Lees will happen more and more,” said Charlie Douglas, an estate planner based in Atlanta, Ga.

Estate planning often focuses on the distribution of wealth upon one’s death but not on the vital issues of aging and later-life planning, said Martin Shenkman, the founder of an eponymous law firm.

Consolidation

With these estate-planning goals in mind, one “very powerful” thing advisers can facilitate for older clients is consolidation of their financial accounts, Mr. Shenkman said. Shifting assets to one or two accounts affords a simpler balance sheet that’s easier to oversee, he explained.

“So many clients I’ve seen have accounts in six, eight, 10, 12, 15 different institutions. Who can keep track of that?” Mr. Shenkman said.

Revocable trusts

Clients who put their assets in a type of trust called a “revocable trust” have better protection against the sort of elder financial abuse allegedly being perpetrated by Mr. Lee’s confidantes, said Beth Shapiro Kaufman, president of the law firm Caplin & Drysdale.

A type of revocable trust, a “standby revocable disability trust,” allows a successor trustee to take over management of the trust assets in the case of incompetence or incapacity, Mr. Douglas said. That usually requires two doctors licensed in the state (California, in Mr. Lee’s case) to write a letter expressing that the owner isn’t able to manage his/her financial affairs, Mr. Douglas said.

(More: How criminals steal $37 billion a year from America’s elderly)

Mr. Shenkman encourages clients to use revocable trusts, which can include any assets aside from retirement accounts, when they are 60 and older.

If an asset owner becomes incapacitated and a successor trustee takes over, it’s easier to get a bank or financial institution to respect the wishes of the successor trustee’s position with a revocable trust than it is with a designated financial power of attorney, Mr. Shenkman said. Furthermore, wills protect individuals only after they’re dead, not while they’re alive, he added.

“Most people use revocable trusts to avoid probate [court],” Mr. Shenkman said. “That may be a benefit, but the focus is on managing assets as you age.”

Picking trustees

Many of Stan Lee’s problems, and indeed those of elder-financial-abuse victims generally, revolve around the people in his inner circle.

For example, Mr. Lee’s 67-year-old daughter, J.C., is a financially irresponsible individual who spends anywhere from $20,000 to $40,000 a month on credit cards and has demanded alterations to a trust set up for her, according to an exposé in The Hollywood Reporter.

Mr. Lee, along with an attorney, recently filed a declaration saying three men also with “bad intentions” were trying to “gain control over [his] assets, property and money.” A Los Angeles court issued a temporary restraining order on June 13 against one of those men, Keya Morgan, a memorabilia collector who allegedly became a caregiver after Mr. Lee’s wife died last year.

Which all goes to say, clients need to pick their trustees carefully.

(More: Financial abuse against the elderly most often committed by those closest to them)

“I can’t prevent incapacity. But I can make sure someone is competent to make the right decision,” said Hyman Darling, chair of the estate planning and elder law department at law firm Bacon Wilson.

Advisers should ask questions such as: Why are you picking this person? Will they be influenced by someone else?

“If it’s because he’s the oldest or because he lives closest, those are the wrong reasons,” Mr. Darling said.

Mr. Shenkman recommends using a professional, independent trustee or a group of co-trustees to serve as a protective measure. Clients can also appoint a “trust protector,” someone who has the right to change trustees if there’s impropriety or can demand an accounting from the trustee.

“[Mr. Lee] may be somewhat of an ideal candidate for an independent corporate trustee,” Mr. Douglas said. “He doesn’t set up well for family and friends because he had his one daughter, and they have a difficult relationship.”

Learn more about reprints and licensing for this article.