Salary model exploited by rivals

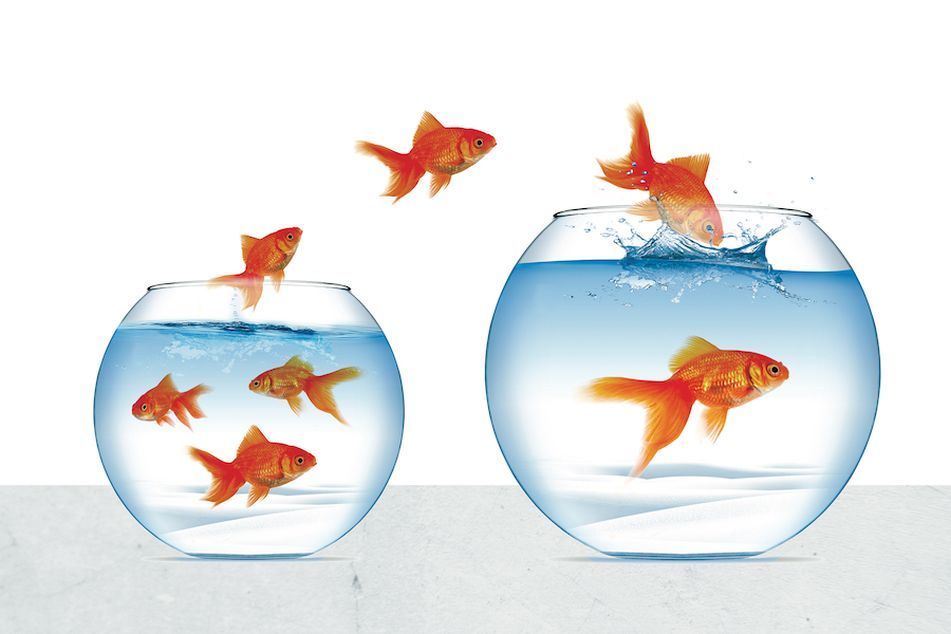

235 individual advisers or teams with $61.5 billion in assets left a wirehouse in 2018 to work at another type of firm, InvestmentNews data show.

The Big Four wirehouses control trillions of dollars of client assets and are not about to disappear anytime soon. But they have been losing individual and groups of advisers to competitors.

According to InvestmentNews data, 235 individual advisers or teams with $61.5 billion in assets left a wirehouse in 2018 to work at another type of firm: a stand-alone registered investment adviser, a hybrid firm, an independent broker-dealer or a regional brokerage.

The potential threat of wirehouses evolving their pay system to a salary-plus-bonus model is one more talking point those competitors use to convince advisers to jump ship.

Advisers face changes

Merrill Lynch’s move to add salaried advisers to branch offices is “really putting it in the face of the FAs,” said Jerome F. Lombard Jr., president of the private client group at regional broker Janey Montgomery Scott, which has had some success recruiting Merrill Lynch advisers.

“The death by a thousand paper cuts continues,” said John Pierce, head of recruiting at Stifel Financial, a regional firm which also has successfully recruited wirehouse advisers recently.

“Recruits are telling us they feel there is an intentional disintermediation of their roles by putting clients into other channels of the bank. This makes advisers less important to their mass-affluent clients. New advisers working on an alternative pay scale only adds to that.”

Recruiters said that potential changes in pay structures are not the only thing on advisers’ list of gripes with wirehouses.

“It’s on the veteran advisers’ radar, but the top two apprehensions right now are the bureaucracy and a gotcha issue with compliance,” said Mark Albers, an industry recruiter who focuses on the wirehouses.

“A lot of senior guys are worried that the firm will make something up based on an honest mistake about expenses and get fired. And cross-selling credit cards and bank accounts … is also an issue.”

Learn more about reprints and licensing for this article.