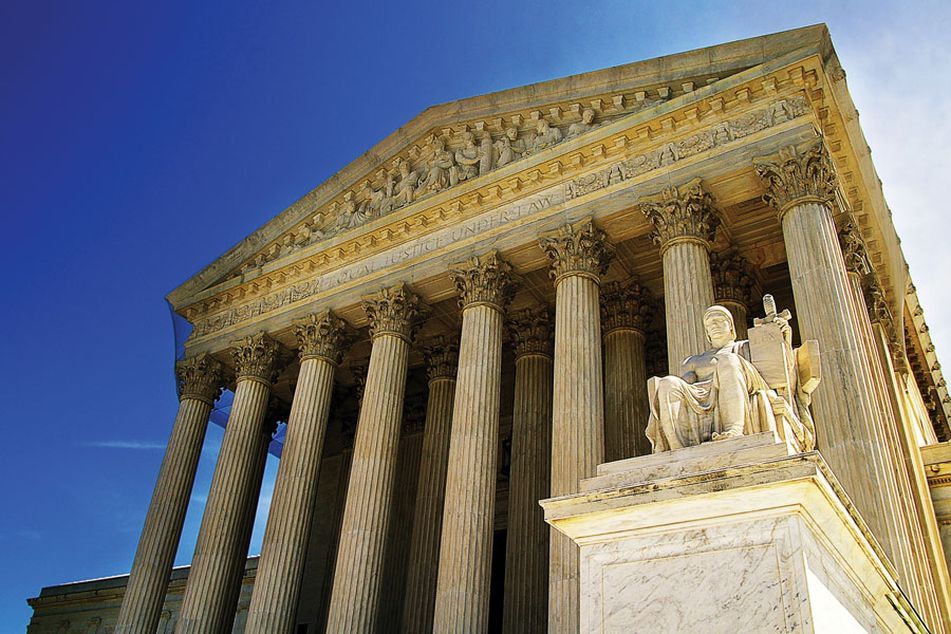

Supreme Court to hear 401(k) stock-drop case

The high court could have a significant impact on how such retirement plan suits involving company stock play out.

The Supreme Court accepted a 401(k) lawsuit Monday that could reframe how employers think about company stock in their retirement plans.

Plaintiffs in the case, Retirement Plans Committee of IBM v. Larry W. Jander, allege that plan fiduciaries acted imprudently by continuing to offer IBM stock as an investment option to retirement plan participants despite knowledge of “undisclosed troubles” relating to the company’s microelectronics business.

In October 2014, IBM announced the sale of its microelectronics business to GlobalFoundries Inc., revealing it would pay $1.5 billion to GlobalFoundries to take the division off its hands and supply IBM with semiconductors. IBM’s stock price declined by more than $12 per share in the wake of that announcement, costing investors in the IBM Company Stock Fund of retirement savings, according to court documents.

(More: Lessons for advisers from 401(k) lawsuits)

The U.S. Court of Appeals for the Second Circuit overturned the district court’s dismissal of the lawsuit. IBM subsequently petitioned the Supreme Court to hear the case, which was granted Monday.

If the Supreme Court were to affirm the Second Circuit’s decision, it would have a “significant impact,” said Marcia Wagner, principal at The Wagner Law Group. A plaintiff in a stock-drop case would have a much better chance of surviving a motion to dismiss, which increases the likelihood of a case being settled to avoid a costly legal defense, she said.

Use of company stock in retirement plans has declined substantially over the past decades. Only 13.5% of 401(k) plan assets were invested in company stock at the end of 2017, a decline of roughly 10 percentage points from 10 years earlier.

The Supreme Court decision to hear the IBM case follows a few years after a significant Supreme Court decision in a different stock-drop case, Fifth Third Bancorp v. Dudenhoeffer. The high court in that case, a unanimous decision handed down in 2014, delivered mixed results for plaintiffs and defendants in stock-drop cases.

(More: How to keep your 401(k) clients out of court)

On one hand, the court overturned a common employer defense that presumed company stock to be a prudent retirement-plan investment. However, it also imposed more stringent standards for bringing a stock-drop case, such as a requirement to offer a plausible alternative action that a defendant could have taken with respect to its stock fund, and an affirmation that a defendant can’t be imprudent for failing to buy or sell stock in violation of insider-trading laws.

Almost all cases since Dudenhoeffer have been dismissed at the motion to dismiss stage, Ms. Wagner said.

Learn more about reprints and licensing for this article.