Financial planning founders started a movement — and created a profession

They developed the art and science of financial planning and set high standards for its practitioners

They developed the art and science of financial planning and set high standards for its practitioners

They developed the art and science of financial planning and set high standards for its practitioners

By now, most financial planners have probably heard the story of how 13 individuals in different areas of the financial services industry — mutual funds, stock brokerage and life insurance among them — gathered in an airport hotel in December 1969 and planted the seeds of what has become the financial planning profession.

From those humble beginnings a movement started, and this week InvestmentNews recognizes the 50th anniversary of financial planning. It is a profession with a rich and colorful history, marked with success, disagreements and legal struggles that continue to this day.

As you read the stories here, one theme stands out: the determination of thousands of dedicated people who have devoted their working lives to ensure their fellow citizens have the help they need to accomplish their financial goals.

— Robert Hordt

When Patti Houlihan became a certified financial planner in 1983, she commemorated the occasion by putting a personal license plate on her car: IMACFP.

Often when she would get out of her car, someone would ask her what the license plate meant.

“Nobody knew what a CFP was,” said Ms. Houlihan, owner of Houlihan Financial Resource Group. “Now it would be unusual to find someone who doesn’t know what a CFP is.”

In December, financial planning will mark the 50th anniversary of its creation during a meeting of 13 financial professionals in a hotel room near Chicago’s O’Hare International Airport. Those founders, who were mostly from the mutual fund and insurance sectors, set out to develop a new way of providing financial guidance.

Instead of focusing on the sale of financial products, it would concentrate on helping clients manage their finances. It wouldn’t be just about portfolios. It would be holistic.

Financial planning wasn’t even a thing 50 years ago

“The art of financial planning is asking the right questions and digging deeper to get to the heart of the matter,” said Sheryl Garrett, founder of the Garrett Planning Network. “It’s the art of learning to connect with people. We are changing lives in a way very few other professions can.”

Financial planning has grown far beyond sitting around a kitchen table and talking to clients about life insurance, Ms. Houlihan said. It now encompasses investments, taxes, retirement, estate planning, real estate, workplace benefits and many other areas.

Life goals

“We’ve grown to bring all these disciplines into one unit to help clients,” said Ms. Houlihan, a former chairwoman of the Certified Financial Planner Board of Standards Inc. “That’s what financial planning is all about — it’s life goals.”

“It’s come a hell of a long way,” said Dan Moisand, principal at Moisand Fitzgerald Tamayo. “Financial planning has never been more popular. It’s never been more needed.”

Marv Tuttle has seen most of its evolution. He was chief executive of the Financial Planning Association from 2004-12.

It transformed “from a dream to a reality,” Mr. Tuttle said. “It’s a global movement with a lot of passion. There is an energy in transferring it from the first to the second generation. Maybe we’re even into the third generation of financial planning.”

The underpinnings of financial planning came from a meeting in Chicago of 13 financial industry leaders. Out of that meeting emerged what eventually became the International Association of Financial Planning and the College for Financial Planning, which would give the nascent profession a body of knowledge.

The first College of Financial Planning class created the Institute for Certified Financial Planners. For years, the ICFP and IAFP co-existed with some tension. They both promoted financial planning, but the ICFP focused on promoting the CFP credential while the IAFP was a big-tent organization that welcomed many credentials and concentrated on the financial planning process, according to “A Concise History of the Financial Planning Profession” by Dave Yeske (Journal of Financial Planning, Sept. 2016). The two groups merged to form the Financial Planning Association in 2000.

“The secret sauce was the boldness of the pioneers to create these institutions,” said Brent Neiser, senior director of the National Endowment for Financial Education.

Debates at retreats, conferences and on college campuses gave rise to fundamental tenets of planning, such as acting in a client’s best interests, adhering to a strict ethical standard and developing innovative financial strategies, according to Mr. Neiser.

“Iron sharpens iron, to borrow a biblical phrase,” Mr. Neiser said. “The best ideas won out in the competition. It was people trying to be better and looking to other centers of thought.”

A history of financial planning

Grassroots profession

There is a certain entrepreneurial aura around financial planning because it has developed organically. The competency, ethics and education requirements have been self-imposed. New ways of practicing rise from the grassroots.

“It is exciting to be in this profession because we’re helping to co-create it,” Ms. Garrett said.

One of the challenges over the first 50 years of financial planning was figuring out a way to get compensated for it. At first, planning was seen as a “loss leader” to get prospective clients in the door for product transactions.

In the 1980s and 1990s, there was a movement toward charging fees for financial planning based on assets, according to Mr. Tuttle.

“That was the transition that really got financial planning to be in a more successful place,” he said.

There is disagreement today about whether assessing AUM fees is the right way to charge for financial planning.

Ms. Garrett advocates separating charges for financial planning from those for asset management. In her network, advisers bill clients for their time in preparing financial plans or charge a fixed fee.

“If we think financial planning is so important, why don’t we let the public know what it really costs?” she said.

Compensation models

The way that financial planners are compensated can be an important way for them to distinguish themselves from other kinds of financial advisers, according to Duane Thompson, president of Potomac Strategies and a former FPA official.

“Strides have been made but there is still a lot of confusion among consumers over the difference between investment management and financial planning,” Mr. Thompson said. “Part of that problem resides with the financial planning profession and how they charge for services, which is identical to asset managers.”

Charging fees based on assets played a pivotal role in the relatively recent history of financial planning.

The FPA filed a lawsuit against the Securities and Exchange Commission in 2005 when the agency issued its so-called Merrill Lynch rule, which allowed brokers to work with clients in fee-based accounts while continuing to operate under a suitability standard rather than the fiduciary duty that governs investment advisers.

Opening salvo

In 2007, the U.S. Court of Appeals for the District of Columbia Circuit vacated the rule. Following the decision, brokers who used fee-based accounts also had to register as investment advisers.

“That was one of the opening salvos in a battle over appropriate conduct standards for investment advice that continues today,” Mr. Thompson said. “It’s still a landmark case, really the only administrative challenge that the financial planning trade groups have filed.”

The FPA was concerned at the time that it might lose members because of the case. Instead, the organization grew stronger after the win, Mr. Moisand said.

“It was a big point of pride for the profession at the time,” he said. “This small group could stand up to much bigger, more powerful forces.”

Financial planners are, once again, in the middle of the debate over raising advice standards as the CFP Board and the SEC go in different directions.

Next June, the CFP Board will begin enforcing a new requirement that mark holders — including brokers — act as fiduciaries for their clients at all times, not just when they are putting together financial plans.

Stonger CFP rule

Proponents say the new CFP rule is stronger than the SEC’s Regulation Best Interest, which is designed to raise the broker standard while at the same time maintaining separate rules for brokers and advisers. That rule also will be implemented next June.

The CFP standard makes mark holders more like other professionals, Mr. Thompson said.

“Lawyers and doctors can’t change hats,” he said. “They’re fiduciaries all the time.”

“We’re wrestling with the same issues today that we were 30 years ago,” said Knut Rostad, president of the Institute for the Fiduciary Standard. “That indicates the movement is vibrant and alive.”

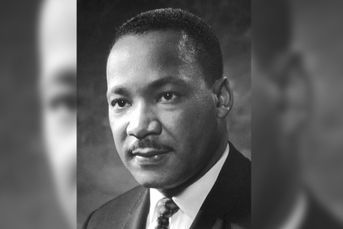

20 people who helped shape the financial planning industry

A look back at the past 50 years in financial planning wouldn’t be complete without mentioning the professionals who have helped make the industry what it is today.

But before we do, let us first acknowledge that it would be impossible to include everyone in this group who deserved recognition. In choosing these 20 individuals, we have tried to highlight those we thought were influential in molding the industry either through their ideas or actions. Some, like Lewis Kearns, were true pioneers. Mr. Kearns was a leading presence at the December 1969 meeting that laid the groundwork for the financial planning profession. Others, like William Bengen, who came up with the 4% rule for retirees, are known for prominent theories.

Still others, like Ric Edelman and Joe Duran, have been chosen for creating successful business models that are pushing the business of financial planning to new heights.

We’re sure that some critics will quibble over worthy individuals left off our list, but we are also confident that few will question whether those included deserve the honor.

The creator of the landmark 4% rule, William Bengen’s impact on the financial advice industry is felt every day by thousands of financial advisers worried their clients will outlive their money.

In 1994, he released groundbreaking research that demonstrated that 4% is a sustainable withdrawal rate in retirement. Since then, the 4% rule has become a bedrock principle of financial planning.

Regardless, advisers and planners routinely debate its merits, particularly as yields on bond-index funds have dropped over time.

With a background in aerospace engineering and experience running a family business, Mr. Bengen became a financial planner in the late 1980s. His clients were soon asking how much they could safely withdraw from retirement savings without running out of money.

He then had his moment of insight.

Mr. Bengen modeled a portfolio with a 50% allocation to stocks and 50% to bonds. He determined that a client who started with withdrawals any time between 1926 and 1976 could have lived off the portfolio for at least 30 years if he or she made 4% annual withdrawals that were adjusted for inflation.

A decade later, Mr. Bengen added small-cap stocks to his model, boosting the withdrawal rate to 4.5%.

— Bruce Kelly

After more than a decade into his financial planning career, Roy Diliberto realized that the clients he knew the best and had known the longest were getting extra financial advice.

He was helping these clients realize what was truly important in their lives, and, in many cases, helped them realize why they made certain decisions that were harmful to their financial health.

Working with some other advisers also interested in more than investment returns for clients, Mr. Diliberto developed a system and process for formal financial life planning that he began using with clients in 2000, the same year he served as the Financial Planning Association’s first president.

He soon became a frequent speaker and pioneer of behavioral finance for advisers.

Mr. Diliberto’s process involves hours during the first two client meetings discussing client histories, values and goals, far beyond the typical discussions of investment objectives and risk tolerance.

“I wanted a way to get to understand [clients] much faster so I could help them earlier on,” Mr. Diliberto told InvestmentNews in 2013. “We get into depth about what’s important to them.”

— Bruce Kelly

Alexandra Armstrong started working in the financial services industry in the 1970s, becoming the first woman in the country and the first person in Washington, D.C. to become a certified financial planner.

In 1983, she co-founded Armstrong Fleming & Moore, a D.C.-based advisory firm where she still holds the title of chairman emeritus even as she closes in on her 80th birthday on Sept. 26.

But one should not make the mistake of assuming Ms. Armstrong is fading into retirement.

“Oh, no,” she said. “I’m still here if they need me.”

Ms. Armstrong, who recently finished writing her latest book on women and retirement, “Your Next Chapter,” is generally recognized as a pillar of this country’s financial planning industry.

Among her many accomplishments, she led the precursor to the Financial Planning Association, the International Association for Financial Planning, retiring as chairwoman in 1987. She was the first woman to hold that position.

In 2004, she became the first woman to receive the P. Kemp Fain Jr. Award, one of the highest awards bestowed by the FPA.

And in 2016, Ms. Armstrong became the first recipient of an InvestmentNews lifetime achievement award that has been named in her honor.

— Jeff Benjamin

Ric Edelman started out on the fringes of the financial advice industry in the 1980s, covering it as a reporter. More than three decades later, he is squarely at its center and sits at the head of a giant RIA with $180 billion in client assets at the end of 2018.

He has been a populist and teacher throughout, hosting his own radio and television shows, popping up on “The Oprah Winfrey Show” to chat and preach about financial advice, and writing books with more than a million copies in print.

He is one of the few, if not only, financial advisers to achieve the dream of many aspiring superstar advisers: that of being a financial planner with a true national brand.

“I talk to the people who find money boring or intimidating and who feel they’re not customers but hostages of Wall Street,” he told InvestmentNews in 2013.

He is also a keenly savvy businessman. In 2018, private-equity shop Hellman & Friedman said it was buying Financial Engines for $3 billion and combining it with Edelman Financial Services. Mr. Edelman is a shareholder of the combined firms and has a seat on its board.

— Bruce Kelly

Harold and Deena Evensky are perhaps the premier power couple in the field of financial planning.

Mr. Evensky essentially wrote the book on financial planning, “Wealth Management: The Financial Advisor’s Guide to Investing and Managing Client Assets.” Published in 1997, it brought the now ubiquitous term “wealth management” into the lexicon.

Ms. Evensky is widely credited for having paved the way for formal education in the financial planning field.

The duo, who married in 1991, founded Evensky & Katz Wealth Management in 1985, becoming early adopters of the fee-only financial planning model. They merged with Foldes Financial Management in 2014, and the combined firm now manages $1.8 billion.

Ms. Evensky is perhaps best-known in the industry by the name Deena Katz. Recently, she changed her last name to Evensky, after 28 ½ years of marriage, because she’s “proud to be Evensky’s wife” and is “not really in practice anymore.”

The couple served as educators at Texas Tech University for years, teaching the next generation of financial planners. They retired from teaching at the university in 2018. Ms. Evensky is a professor emeritus there, and both fill in from time to time when needed.

— Greg Iacurci

P. Kemp Fain Jr. was a true pioneer of financial planning.

Mr. Fain was the Certified Financial Planning program’s very first enrollee. He founded and held leadership roles at the International Association for Financial Planning’s first local chapter and the Institute of Certified Financial Planners, and helped start the International Board of Standards for Certified Financial Planners.

Mr. Fain began his career in financial services as a stockbroker but was searching for an educational program that focused on serving clients. When he met Loren Dunton, whom some call the “father of financial planning,” Mr. Fain was sold on the idea of a professional designation for planners.

At a 1988 national meeting of financial planners, Mr. Fain delivered a speech titled “One Profession, One Designation,” in which he laid out a plan for transforming the CFP designation from an educational credential into a professional designation.

Mr. Fain died of cancer at the age of 54 before his vision could be fully realized. The Financial Planning Association honors his memory with an annual award in his name for outstanding contributions to the financial planning profession. The FPA calls the P. Kemp Fain Jr. Award the “pinnacle of recognition in the financial planning profession.”

Before Sheryl Garrett put her stake in the ground on the issue about two decades ago, the notion of providing financial advice on an hourly basis was virtually unheard of.

Today, through the growth of the Garrett Planning Network, the idea of charging by the hour has become synonymous with the 57-year-old founder.

Ms. Garrett found her way to financial planning via the commission-based brokerage business. She recalls being at IDS, a precursor to Ameriprise Financial, in the mid-80s, where she was handed a phone book and told to make 100 cold calls per day.

In 1998, she started her own RIA, Garrett Financial Planning. In 2000, she launched the Garrett Planning Network to support and educate advisers on hourly-planning services.

Ms. Garrett stopped working with individual clients in 2005 to spend more time on the network. Last year, she stepped down as chief executive and chief compliance officer of Garrett Investment Advisors, an RIA she co-founded in 2011.

But the future is anything but static for the Eureka Springs, Ark.-based Ms. Garrett. Earlier this year, she helped launch a women’s financial advisory network in India.

Ms. Garrett’s other blossoming passion is financial literacy, an area which she is promoting for students in pre-K to early adulthood.

— Jeff Benjamin

Jonathan Guyton is generally credited with popularizing the concept of dynamic income withdrawals and showing financial planners how easy they can be to implement.

In two research papers he’s written, “Decision Rules and Portfolio Management for Retirees: Is the ‘Safe’ Initial Withdrawal Rate Too Safe?” in 2004, and “Decision Rules and Maximum Initial Withdrawal Rates,” which he co-authored with William J. Klinger in 2006, Mr. Guyton argued that giving retired clients a more aggressive withdrawal rate during good markets, and guardrails to cut spending when markets are bad, is a better strategy than a fixed withdrawal rate.

Mr. Guyton’s idea was inspired by his experience working with clients who often made small adjustments to spending during stressful markets. Some advisers balked at the idea of telling clients to reduce spending, but Mr. Guyton argued that the reduction wasn’t perceived as dramatic since cuts came from discretionary expenses, and retired clients live primarily off of Social Security benefits and portfolio withdrawals.

Today, many academics teach the strategy in class. Mr. Guyton’s theory has proven equally successful in practice, helping clients ride through the downturn in 2008 with their retirement income intact.

— Ryan W. Neal

Lynn Hopewell’s ideas helped pioneer the development of retirement planning software, but his contributions to the financial industry were just one piece of an eclectic life.

As a football player in Portsmouth, Va., Mr. Hopewell was an all-state defensive end and scored the winning touchdown for his high school in the state championship game. Mr. Hopewell earned a degree in physics in 1961 and spent the next eight years as a communications engineer with the Central Intelligence Agency. He earned an MBA from Harvard Business School in 1968 and spent the 1970s working in computing and communications.

Mr. Hopewell became a financial adviser in 1980, first with Hopewell Rembert Advisors, before launching his own firm, The Monitor Group. In a series of articles for Financial Planning Magazine, Mr. Hopewell laid out his ideas for retirement planning modeling, which formed the basis for retirement planning software.

Mr. Hopewell served as the editor of the Journal of Financial Planning, and in 1994 was elected to the Certified Financial Planner Board of Standards’ board of governors.

The Financial Planning Association awarded him a Lifetime Achievement Award in 2005 for his contributions to financial planning over 20 years. He died in 2006 at the age of 68.

— Ryan W. Neal

Lewis G. Kearns was the visionary who shaped the financial planning profession as practitioners know it today.

Mr. Kearns, a senior vice president at Wellington Management Co. in the 1960s, was known for what was then a rare approach of training staff members, instructing them to help clients holistically rather than simply selling clients a mutual fund.

Mr. Kearns was one of 13 participants at a meeting in December 1969 who laid the groundwork for what became the College for Financial Planning, the certified financial planner certification and the Financial Planning Association. Mr. Kearns, who acted as chairman of that meeting in a Chicago hotel, is credited as the driving force behind its accomplishments.

“He was like the foreman of the jury,” Marvin Tuttle, former CEO of the Financial Planning Association, had previously told InvestmentNews. “They looked to him on how to get this thing going and for the long-term perspective.”

Mr. Kearns was subsequently put in charge of the movement’s education component. He created the syllabus for the College for Financial Planning, then known as the International College for Financial Counseling. Mr. Kearns died in 2010 at age 96.

— Greg Iacurci

George Kinder is widely viewed as the father of the life-planning movement, heralding an era in which financial advisers intertwine ideas of human emotion with financial decision-making.

Mr. Kinder vastly changed the way planners delivered financial advice to clients beginning in the 1990s, via the notion that financial planning should help clients follow their dreams.

Mr. Kinder, founder of the Kinder Institute of LIFE Planning, is perhaps best-known for what he dubbed the Three Questions, which form the framework of life planning:

• If you had all the money you needed for the rest of your life, what would you do with that money? Would you change anything?

• If you had five to 10 years left to live, what would you do with that remaining time?

• If you had only 24 hours left, what dreams would be left unfulfilled? What did you not get to do, and who did you not get to be?

The questions allow advisers to drill down to a client’s real wants and inspirations, rather than simply focus on the traditional planning tools like risk-tolerance or investment preferences.

“I wanted to make sure the whole financial planning piece was aimed directly at who the client wants to be,” Mr. Kinder told InvestmentNews in 2013.

— Greg Iacurci

Michael Kitces says his career in financial services began “somewhat randomly” with a job as a life insurance agent after earning a bachelor’s degree in psychology with a minor in theater. Though Mr. Kitces says he was a terrible salesman, the job introduced him to the world of financial planning.

He soon joined an advisory firm while studying financial planning part-time. After earning CFP, CLU and ChFC designations alongside a master’s degree, Mr. Kitces accepted a role as director of financial planning at Pinnacle Advisory Group at age 25. He still works with Pinnacle as partner and director.

Today, Mr. Kitces is a man with many titles.

Mr. Kitces is the founder of XY Planning Network, a group of fee-only advisers and financial planners focusing on younger investors, and AdvicePay, a software to help planners collect fees.

From 2012 to 2015, he served as practitioner editor of the Journal of Financial Planning. He also publishes Nerd’s Eye View, a blog that provides in-depth commentary on trends, research and best practices for financial advisers. The blog reaches 200,000 unique readers every month.

— Ryan W. Neal

Tim Kochis has earned a reputation for spreading the gospel of financial planning on a global scale.

He founded Kochis Fitz Tracy Fitzhugh & Gott in San Francisco in 1991, and through a series of mergers became the chief executive of Aspiriant, which now manages nearly $12 billion as one of the country’s largest registered investment advisers.

Before starting his own advisory firm, Mr. Kochis was national director of personal financial planning at Deloitte & Touche.

He stepped away from Aspiriant in 2012 to launch Kochis Global, an international consulting business to help RIAs expand and improve their businesses.

Mr. Kochis acknowledges having a special interest in the developing world, particularly in China and other fast-growing parts of Asia.

In 2004, he helped financially back the Financial Planning Standards Board, the international administrator of the Certified Financial Planner designation. Mr. Kochis served two terms on the FPSB board of directors, chaired the board of governors of The Foundation for Financial Planning, chaired the international CFP Council, chaired the CFP Board’s board of examiners, and served as president of the CFP Board of Standards.

— Jeff Benjamin

Joe Duran has accomplished what two decades ago was practically unthinkable: He’s brought the big-time financial engine of Wall Street, or firms that chased huge fees from underwriting IPOs, to the financial advisers of Main Street, a much steadier and less glamorous business.

Already a successful businessman, in 2005 he launched United Capital Financial Advisors, one of the first of the registered investment adviser “roll-ups” that have transformed the RIA industry.

Backed by private equity or venture capital funds, the RIA roll-up strategy was to aggressively build a network of firms through acquisitions and become a regional or national player.

And Mr. Duran did just that.

United Capital spent the next 14 years acquiring RIAs and also building a suite of unique, interactive financial planning products and made money and emotions a focus.

The end result? Goldman Sachs bought United Capital in May for $750 million in cash. Mr. Duran at the time said his portion would be at least $75 million.

When the deal was announced, United Capital had more than 220 advisers and $25 billion in assets under management.

“We want to be the dominant player in financial advice business,” Mr. Duran said at the time.

— Bruce Kelly

Financial adviser Carolyn McClanahan has been perhaps the most vocal proponent in the industry on the importance of considering health and aging in relation to financial planning, helping to bring focus to an area that advisers had traditionally shunned.

Unlike other advisers, Ms. McClanahan has the rare background of having been a practicing physician for a decade before becoming a financial adviser and founding Life Planning Partners, in Jacksonville, Fla., in 2004.

She’s explained the high cost of aging to financial advisers, and through social media and industry event presentations has helped them understand all the things they need to plan for and how to get at a number that makes sense for their particular clients.

In 2017, seeing that financial advisers were inadequately broaching health care planning with clients, she co-founded Whealthcare Planning, a software company that helps advisers create a financial plan by incorporating age-related financial risks.

“There’s so much good I can do with my medical knowledge,” she previously told InvestmentNews. “Especially with understanding aging issues and how to deal with them.”

— Greg Iacurci

Fielding Miller is the co-founder and chief executive of Raleigh, N.C.-based Captrust, the largest retirement plan adviser aggregator focused on the retirement market. Captrust is responsible for more than $300 billion in retirement plan assets.

A former stockbroker at Interstate/Johnson Lane, Mr. Miller transitioned into fee-based consulting in 1988, helping companies set up employee retirement plans.

A key ingredient of the firm’s early success was the “no golf ball rule,” which was designed to ensure no conflicts could arise when advising clients by enforcing a strict rule against accepting any complimentary gifts (not even a golf ball).

The retirement plan adviser business model got a boost by the Sarbanes-Oxley Act of 2002 that increased financial disclosure requirements on corporations. By 2007, Captrust had $19 billion under administration.

An aggressive acquirer, Captrust has made 34 acquisitions since 2006. The firm grew from $200 billion under advisement in 2016 to more than $300 billion today, all while shunning the increasing lure of private-equity backing.

Asked in 2017 about its preference to not sell to PE investors, Mr. Fielding said, “We want to be able to control the clock, and PE has a five-to-seven-year plan, then they’re out, or you’re looking at selling to another private-equity investor. Now your business is getting disrupted, and you’ve kind of created a new master to serve.”

— Jeff Benjamin

Daniel Moisand is perhaps best-known for his involvement in a landmark ruling against Wall Street’s big brokerage houses.

Mr. Moisand was president of the Financial Planning Association in 2005, when the group sued the Securities and Exchange Commission to overturn the so-called Merrill Lynch rule. That rule exempted brokers with fee-based brokerage accounts from being fiduciaries under the Investment Advisers Act of 1940.

Mr. Moisand, however, philosophically disagreed with the exemption. Brokers holding themselves out as advisers, Mr. Moisand argued, should be regulated as advisers, i.e., fiduciaries.

A federal appeals court tossed out the rule in 2007, forcing brokerage firms to convert fee-based brokerage accounts onto advisory platforms.

The FPA’s fight was a seminal moment for the financial advice industry, helping planners compete more directly with brokers.

“It showed we weren’t entirely powerless against the big-money forces of Wall Street,” said Mr. Moisand, principal of Moisand Fitzgerald Tamayo. “Being right can overcome being rich.”

Mr. Moisand wasn’t even aware of the financial planning profession when he graduated from Florida State University with a finance degree in 1989. He got his start selling life insurance, then spent a decade with large independent broker-dealers before becoming a fee-only financial planner in 2000.

— Greg Iacurci

Richard B. “Dick” Wagner pushed financial advisers to worry less about gathering assets and more about showing people how to use their money to live a richer life.

Among his many accomplishments in the industry, Mr. Wagner helped create the life planning movement almost 30 years ago, in which he introduced the idea of focusing on a client’s life rather than his or her investment needs. At the time, the financial planning and advice industry was still in its infancy and for the most part focused on asset allocation.

“The essence of financial planning is not finding a product to best fit the client’s needs,” he wrote in the January 1990 Journal of Financial Planning. “The essence is to provide answers and services within the context of the client’s own special situation.”

Mr. Wagner was 68 when he died in 2017. Survived by his wife, son, daughter and grandson, he was still working to advance the financial planning profession and had recently published a new book, “Financial Planning 3.0: Evolving Our Relationships With Money” (2016).

“Advisers who aren’t doing life planning are leaving a lot of stuff undone that people are interested in doing with their financial advisers,” he said in a 2013 interview with InvestmentNews.

— Bruce Kelly

As a financial adviser in the 1990s, Edmond Walters wanted a digital portal that could show clients all their accounts in one place. Such a tool didn’t exist, so Mr. Walters created his own. In 2000, he left his advisory practice to turn that software into a technology startup: eMoney Advisor.

Most financial planners at the turn of century still did everything by hand, and the few digital tools available only produced static, paper-bound reports. Mr. Walters’ vision for eMoney was a platform combining a digital document vault and account aggregation to support interactive, collaborative financial planning for advisers and clients.

The idea proved a hit with advisers. eMoney grew to a 300-person company before it was acquired by Fidelity Investments in 2015 for more than $250 million. The tool remains one of the most popular financial planning tools among advisers, with an estimated market share of 22.3%.

Mr. Walters left eMoney nine months after the Fidelity acquisition, but returned to the financial planning technology scene in 2019. His new company, Apprise Labs, is teaming up with Envestnet and MoneyGuide, eMoney’s rival, on a new tool addressing the more complex estate and tax planning needs of the ultra-wealthy.

— Ryan W. Neal

Based solely on their shared contribution and dedication to the financial planning industry, it might be easy to overlook the fact that David Yeske, 62, and his wife Elissa Buie, 59, also run a successful financial planning business, Yeske Buie.

Mr. Yeske merged his advisory business with Ms. Buie’s in 2008, two years after they got married. They continue to operate offices in San Francisco and Vienna, Va.

The two met in the late ’90s while serving on the board of the Institute of Certified Financial Planners, the predecessor to the Financial Planning Association, which they each chaired.

They are often cited for an academic paper they co-authored in 2006 in the Journal of Financial Planning on ‘policy-based planning.’

The premise of the paper was that advisers should establish explicit polices to help guide their planning with clients.

By creating such policies, the paper contends, both advisers and clients benefit from more precise decision-making in uncertain environments, which helps clients stick to their long-term financial plan regardless of the economic cycle or market conditions.

Financial advisers who followed the advice of Mr. Yeske and Ms. Buie at that time, just two years before the 2008 financial crisis, are likely still grateful for the tools they provided to help them navigate that volatile period in the financial markets.

— Jeff Benjamin

Learn more about reprints and licensing for this article.