Junk-bond ETF sees almost $1 billion of inflows ahead of Fed

Risk assets of all stripes have been climbing amid optimism that the Fed will dial back the pace of its rate hikes after it announces what's expected to be its fourth 75-basis-point rate hike in a row this week.

Exchange-traded fund investors are diving headfirst into high-yield debt just days before the Federal Reserve’s interest-rate decision.

Risk assets of all stripes have been climbing as optimism builds around the Fed dialing back the pace of rate hikes after it delivers an expected fourth 75-basis-point rate increase in a row Wednesday. The renewed appetite for risk has boosted equities and sent billions into credit ETFs despite lackluster corporate earnings.

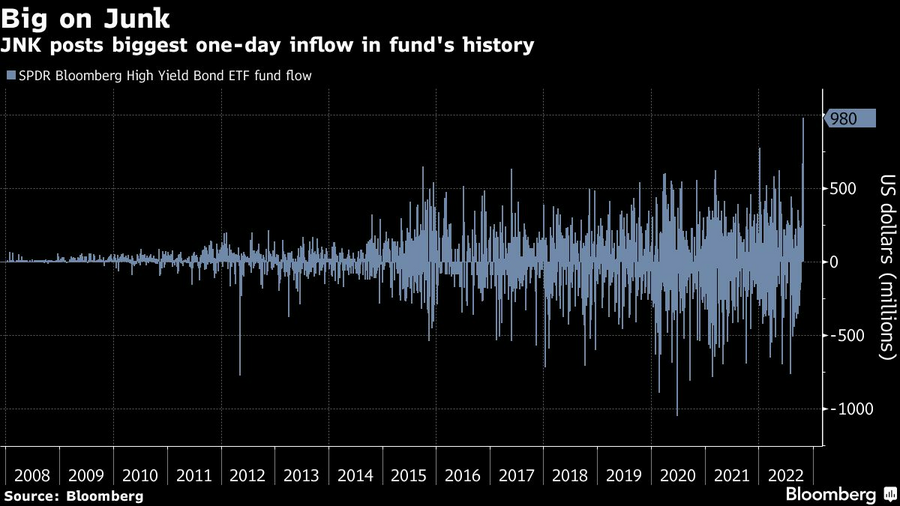

Traders poured roughly $980 million into the $8.5 billion SPDR Bloomberg High Yield Bond ETF (JNK) Friday in the fund’s biggest one-day inflow since 2007, Bloomberg data show. The influx follows JNK’s strongest two-week rally since May.

But this week’s Fed meeting may deliver a reality check to the bulls, according to Independent Advisor Alliance’s Chris Zaccarelli.

“We believe this will ultimately be a head fake as any risk-on rallies will run out of steam once investors realize the Fed is serious about raising rates and keeping them higher for longer,” said Zaccarelli, the firm’s chief investment officer. “From a fundamental point of view it is a risky time to be buying risk assets, although from a technical point of view it makes sense short term.”

Momentum cooled Monday, with JNK dropping 1% alongside U.S. stocks. The worst inflation in a generation and the Fed’s campaign to cool it have dragged JNK more than 12% lower on a total-return basis this year, Bloomberg data show.

DataTrek Research’s Nicholas Colas sees Monday’s price action as a blip. Junk bond spreads over Treasuries have narrowed in recent weeks, suggesting that there’s little concern about corporate America’s ability to cover interest costs or refinancing expenses.

“The highest risk parts of the U.S. corporate bond market are signaling similar confidence to that of American equity markets just now,” DataTrek co-founder Colas wrote in a note Monday. “We are looking for HY spreads over Treasuries to continue to narrow as a confirmation that the current equity market rally has further room to run.”

Learn more about reprints and licensing for this article.