Medicare premium increase and IRMAA surcharges announced for 2020

The base premium for Medicare Part B, which covers doctors’ fees and outpatient services, will increase to $144.60…

The base premium for Medicare Part B, which covers doctors’ fees and outpatient services, will increase to $144.60 per month in 2020, up from $135.50 this year, according to an official announcement by the Centers for Medicare and Medicaid Services.

The premium hike of $9.10 a month is slightly higher than previously forecast by the latest Medicare Trustees report.

The annual deductible for all Medicare Part B beneficiaries will also increase next year, rising from $185 in 2019 to $198 in 2020.

CMS attributed the increase in Medicare Part B premiums and deductibles to rising spending on physician-administered drugs.

“The law requires CMS to pay the average sales price for a drug and also pays physicians a percentage of a drug’s sales price,” the press release noted. “This incentivizes drug companies to set prices higher and for physicians to prescribe more expensive drugs because that lead to a higher Medicare payment.” Lowering drug prices has been a priority of the Trump administration.

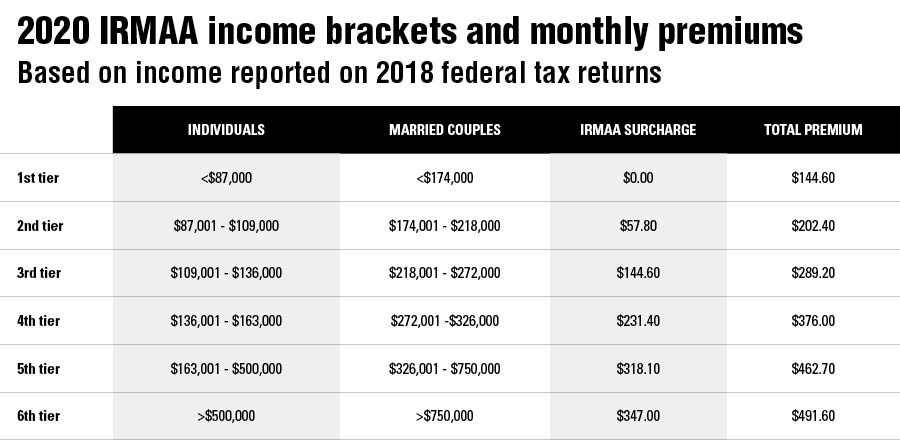

Higher-income Medicare beneficiaries will also pay more for Medicare Part B and Part D prescription drug premiums plans in 2020 as a result of income-based surcharges, officially known as income-related monthly adjustment amounts, or IRMAA.

For the first time in a decade, the income brackets used to determine those surcharges will be indexed to inflation starting Jan. 1. As a result, some high-income retirees may experience a reduction in their Medicare costs in 2020 compared to this year. Medicare premium surcharges for 2020 will be based on income reported on 2018 federal tax returns.

[Recommended video: Mary Beth Franklin: Good news on Medicare surcharges]

Currently, there are six income tiers that determine high-income surcharges for both Part B and Medicare D prescription drugs plans. The income thresholds that determine who pays the Medicare surcharges have been fixed at their current levels since 2011.

Individuals with modified adjusted gross income of $85,000 or less and married couples with joint MAGI of $170,000 or less are not subject to IRMAA surcharges in 2019. They pay the standard Medicare Part B premium of $135.50 per month. MAGI includes adjusted gross income plus any tax-exempt interest from municipal bonds.

In 2019, individuals with incomes above $85,000 and married couples with joint income above $170,000 pay combined Medicare premiums and surcharges ranging from $189.60 per month to $460.50 per month per person.

The initial thresholds for income brackets that will be used to determine surcharges will increase in 2020 for the first time in a decade. The initial income thresholds are higher than previously forecast by private health care costs analysts.

Next year the initial income threshold for IRMAA surcharges will increase to $87,000 for individuals, up $2,000 from this year, and to $174,000 for married couples filing jointly, up $4,000 from this year’s level. High-income beneficiaries who are married and lived with their spouse at any time during the taxable year but who file separate tax returns are subject to IRMAA surcharges in 2020 when their individual income exceeds $87,000.

Combined Medicare Part B premiums and IRMAA surcharges will range from $220.40 per month to $491.60 per month per person in 2020. High-income Medicare beneficiaries are also subject to monthly surcharges for their Medicare Part D prescription drug plans.

Income thresholds will be indexed to inflation in future years starting in 2021, except for the top-level income thresholds of $500,000 for individuals and $750,000 for married couples filing jointly, which were added in 2019. Those top tiers will be indexed to inflation starting in 2028.

“Medicare means-testing can threaten the retirement plans of millions of affluent Americans,” said David McClellan, head of wealth management solutions at Aivante, a firm that uses artificial intelligence to help financial advisers plan for retirement medical expenses.

“Smart financial planning can minimize the damage,” Mr. McClellan said. His new white paper details how using health savings accounts, Roth contributions and conversions, and locating assets in the appropriate accounts can minimize Medicare premiums over a person’s lifetime.

Learn more about reprints and licensing for this article.