Displaying 2691 results

IRS rethinks rules for savings accounts to care for young people with disabilities

States get additional guidance on how to administer 529 ABLE plans.

Social Security update for gay couples

Legalizing same-sex marriage nationwide opens the door for spousal, survivor, disability and Medicare benefits.

Social Security benefits for noncitizens

Foreign workers and dependents retiring abroad face complicated rules.

Republican tax plan would reduce brackets, slash investment taxes

House Republicans rolled out a tax-reform plan on Friday that would reduce the number of individual rates to three and eliminate many deductions.

Skeptical advisers should reexamine their attitudes toward reverse mortgages

Most of the loans' issues have been solved, or at least ameliorated.

A widow’s Social Security dilemma

Earnings test complicates choice between retirement and survivor benefits.

Social Security cost-of-living adjustment unlikely for 2017

High-income retirees could see net benefits decline next year if Medicare premiums rise.

Who’s keeping track of IRA basis?

IRA basis is required to be tracked on IRS Form 8606 “Nondeductible IRAs,” which is filed with a client's tax return.

Deadline for disclosure of foreign bank accounts approaches, grace period narrows

If your clients have any involvement in offshore holdings, now is the time to double check their status and make sure everything is filed before June 30.

401(k) savings options come with tax consequences

Choosing between a traditional and Roth 401(k) is essentially a bet on how your clients' future income tax rates will compare to their current rate.

Most recent retirees do not regret claiming Social Security early

Plus, one of the biggest shocks to current retirees is the cost of health care, according to a new survey.

Social Security, divorce and remarriage

Who gets which benefits when? It depends.

Hackers are targeting tax professionals as October deadline approaches, IRS warns

Incidents of online thieves taking control of tax preparers' computers and client information are rising.

Time to talk about financial wellness

Financial wellness is one of the hottest topics in the retirement industry today and at top of mind for many plan sponsors.

Permanent 100% exclusion of small business gains a long-term tax advantage

Exclusion for qualified stock will be a big draw for investors to reconsider C corps.

To pay income taxes now or later, that is the IRA question

Answers are related to an individual's current and expected future tax circumstances.

Retiree medical expenses could outpace Social Security benefits in 20 years

Your clients could be under saving for their real retirement income needs.

Retirees need 70% of their pre-retirement income but most live on less: Bankrate

Financial planners say that you need 70% of your pre-retirement income when you retire. And if that’s so,…

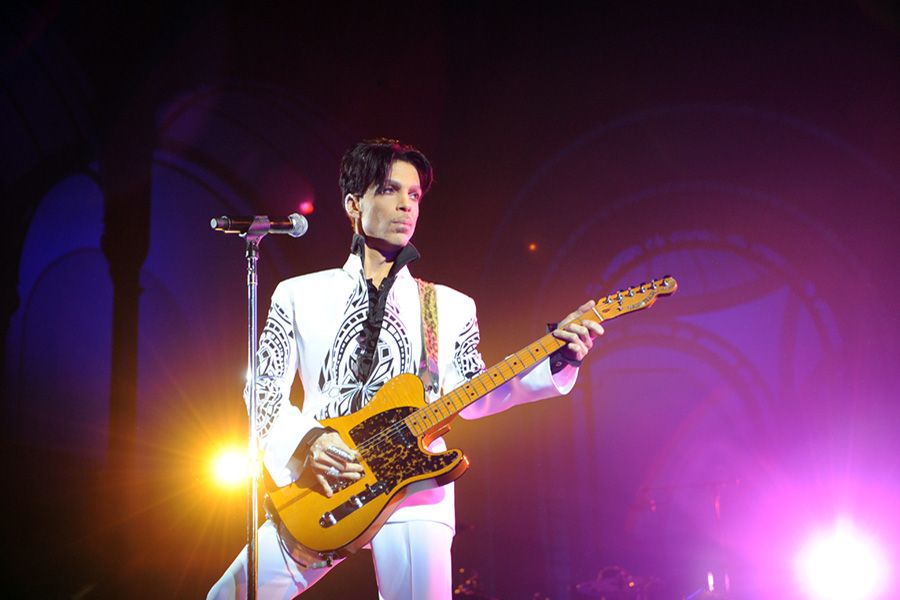

Prince’s death sets off estate planning quagmire

A complicated process to value the music icon's estate hinges on future royalties.

Michael Bloomberg: Public policy changes needed to address income inequality

Changing economy and job market stem from greater use of technology, he says.