Displaying 36 results

Employers falling short of workers’ benefits expectations

Two national surveys examining employer-provided plans point to gaps in retirement confidence and health benefits.

Empower unveils comprehensive retirement income suite

The DC plan provider is rolling out an expansive shelf of retirement solutions through multiple partnerships.

SEC orders TIAA to pay $2.2M for violating Reg BI

Disclosure failures at the organization’s broker-dealer arm led to nearly $1 million in unnecessary costs for retail customers in IRAs.

Congress takes another shot at federal auto IRA

Since the auto IRA was proposed 18 years ago, the only successful efforts have been in the states.

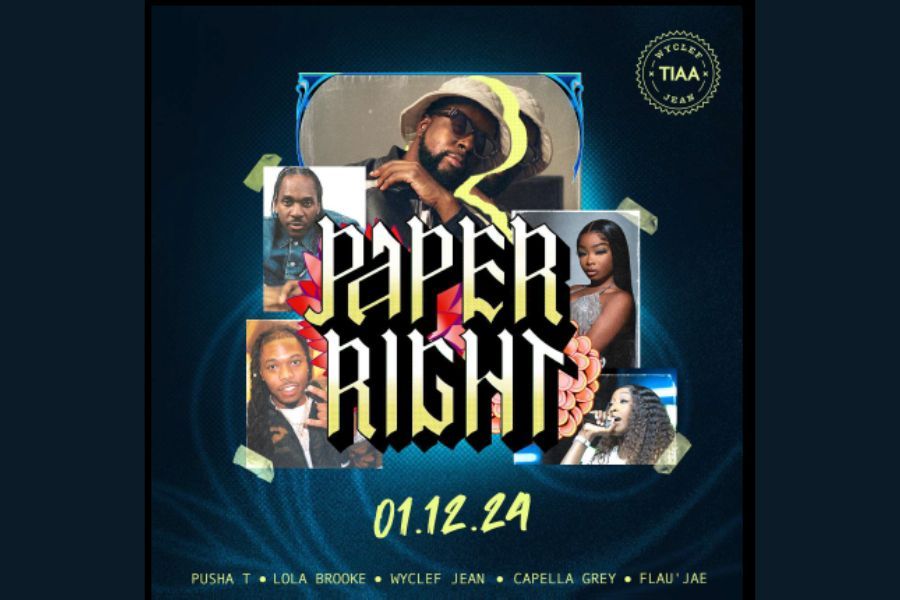

TIAA brings hip-hop artists together for sponsored track about retirement saving

The song, 'Paper Right,' is part of the company's Retire Inequality campaign.

TIAA hires six new leaders for wealth management team

The executives, all of whom are joining from other firms, will complement TIAA's current staff 'to help clients prepare for retirement and reach their financial goals,' an executive says.

Nuveen and TIAA roll out target-date series with annuity feature

Few 401(k) plans have such features, but product providers expect that to change.

Will adding annuities to 401(k) plans alleviate the retirement crisis?

Client feelings of certainty and happiness are main benefits of adding annuity option to retirement plans, says advisor.

Stocks can’t continue to ignore recession risk

Despite the recent surge in equities, most market watchers expect stocks to finish the year flat or down from current levels.

Nuveen gets new muni bond leader amid lawsuit settlement

As the firm announces a settlement of suits brought by Preston Hollow Community Capital, Nuveen announced that John Miller is retiring and will be replaced by Daniel Close.

TIAA joins retirement plan portability network

Approximately $92 billion in savings exits the US retirement system every year because Americans who change jobs cash out their workplace retirement accounts.

TIAA adds industry veterans to retirement solutions team

TIAA announced the hiring of Shamila Rajaratnam from the Vanguard Group and Jim Mullery from Prudential to round out its retirement solutions leadership team.

Most successful financial services football stadiums

See how the 11 NFL stadiums sponsored by financial services companies stack up in terms of their team’s postseason success.

How advisors can help the ‘unretired’ with their return to the workforce

The convergence of low bond prices, high inflation and market volatility has boosted the number of retirees being forced to go back to work.

Nuveen bulks up private equity and private credit business with deal for Arcmont

The deal combines North American and European businesses to create Nuveen Private Capital, a global debt platform with more than $60 billion in committed capital.

Duo from TIAA manages $600 million at Raymond James

Nicholas Troiano and Mathew Mattice join the firm's employee unit in Colorado.

Employers fret about retirement income

Just 66% say target-date funds do extremely well or very well when it comes to helping plan participants deal with their income needs during retirement.

Retirement savings legislation continues to percolate on Capitol Hill

Among the provisions of a draft bill are one that would improve fee disclosures in defined-contribution plans and another that would allow annuities as qualified investment default alternatives in plans.

TIAA offers annuity to corporate retirement plans

The deferred fixed annuity is designed to be used as an allocation within managed accounts or custom target-date model portfolios in 401(k)s.

Target-date fund sales back up after a dip in 2020

The products had net inflows of $23.9 billion, a significant increase from the $6.7 billion in outflows seen in 2020, according to a report from Morningstar.

- 1

- 2