The most powerful financial motivator you’ve never heard of

A client's mental time horizon — how far into the future they think about their finances — can affect how much they save and their overall financial health.

In the world of financial planning, we often think about decades-long investment time horizons. In doing so, many of us have unconsciously trained ourselves to think long term because, well, that’s the nature of the job. This long-term planning mindset is something we can take for granted, but most people don’t think this way, and that matters … a lot.

WHAT IS MENTAL TIME HORIZON?

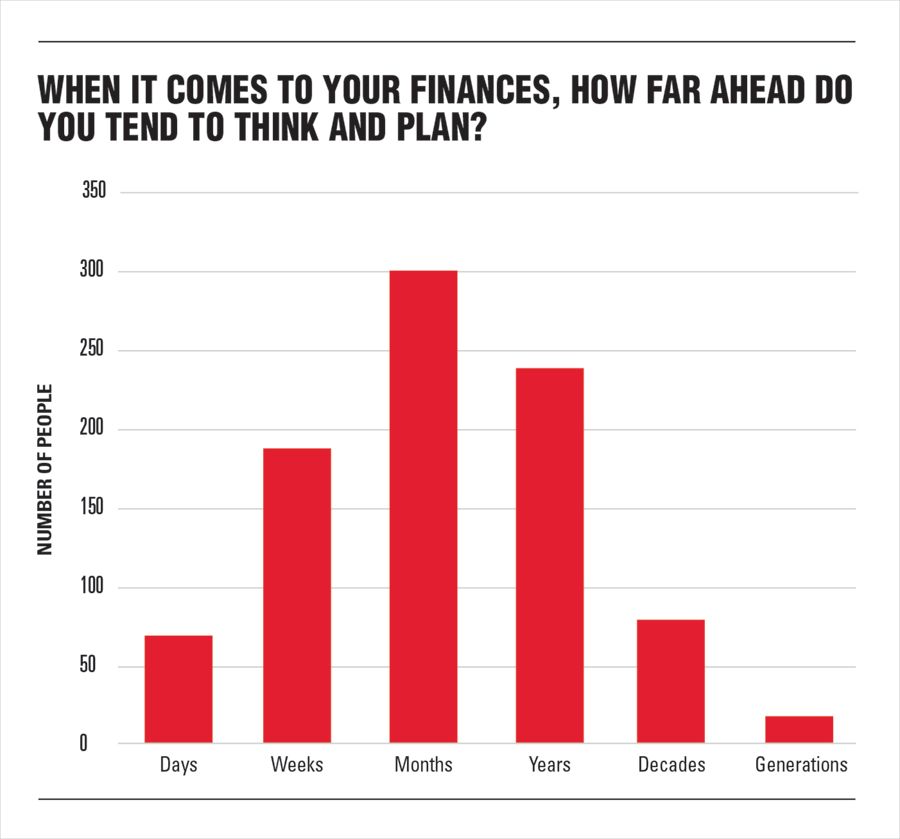

In a recent study for Morningstar, I asked a nationally representative study of more than 900 U.S. households the following question: “When you think about your finances, how far into the future do you tend to think and plan?”

I call this a person’s mental time horizon. It’s the point at which their mental picture of the future becomes fuzzy or unformed. Some can see only a few days ahead. Others look far off into the next generation. Innovators and entrepreneurs are often thinking in terms of generations or even millennia. The typical man-on-the street, though, tends to think in the short term, as the results of our survey show.

In our sample, most people, regardless of age, income or education, reported thinking several years ahead at most. This may help explain why so many people struggle to save, invest and adequately prepare for their future. If you’re not even thinking about it, why would you plan for it?

WHY DOES IT MATTER?

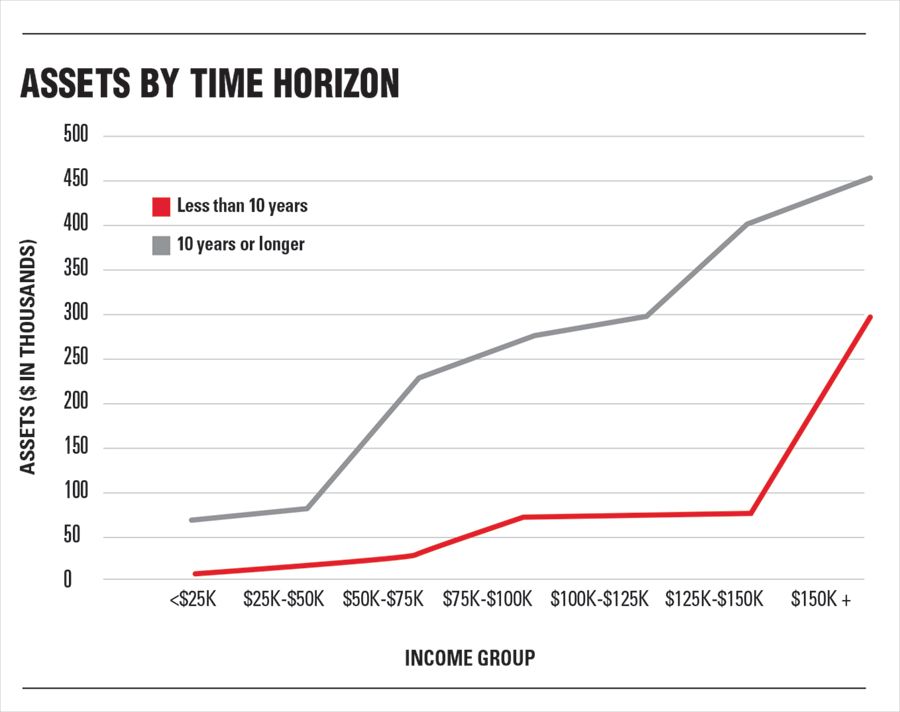

In fact, we saw that, in every income group, people who think at least 10 years ahead had saved significantly more than their peers who had a shorter mental time horizon.

We saw a generally positive relationship between income and assets, but in every income group, the average asset balance was significantly higher among those with longer mental time horizons than those who reported thinking less than 10 years ahead.

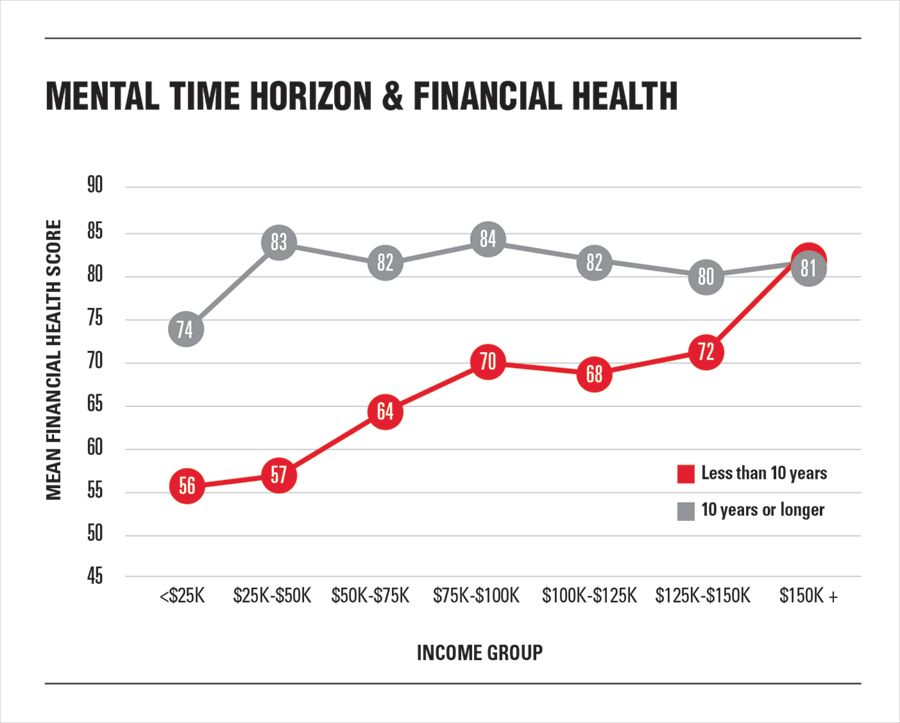

The study also asked participants to complete a financial health survey created and validated by the Financial Health Network. (See the full FHN survey and methodology here.) Using regression analysis, we found that answers to this one question explained a full 27% of the variation in financial health scores (for comparison, income accounted for only 8% of the variance in financial health scores). We also noted that in every income group, people who said they think at least 10 years ahead also had significantly higher financial health scores than their peers with shorter mental time horizons.

All of this data points to one important fact: The simple act of thinking ahead may be one of the most important things you can do for your financial health.

WHAT CAN YOU DO ABOUT IT?

The relationship between mental time horizon and financial health is good news for advisers who want to differentiate themselves through coaching. If mental time horizon plays a large role in asset accumulation and overall financial health, then coaching clients to think further ahead could have long-term positive benefits for their bottom line.

It’s much easier to change a mental habit than to change one’s income, education, age or other factors we typically associate with financial health. By coaching clients to have a longer mental time horizon, they may naturally be motivated to save and invest more as their mindset changes. So how do you encourage a longer time horizon?

1. One step at a time. If a client currently thinks in terms of weeks, it’s not realistic to ask them to suddenly plan for generations. Focus first on moving their mental time horizon out to months. Perhaps set a six-month goal for them to aim for, and regroup or check in monthly to remind them of the task. Training a new mindset is similar to training physical habits. It takes reminders and repetition before it becomes automatic.

2. Fill the picture with details. If you’re asking a short-term thinker to picture their life in one year (or five, or 20), they will likely have only a vague idea of that future. Helping fill in details with vivid and specific imagery can help solidify the vision into something that feels more tangible and realistic. That can often help give the imagination something to anchor itself upon in the long term. For example, if you want to encourage a young person to save more in their retirement account, and they struggle to think more than a year or so ahead, then asking them to picture retirement clearly may be too difficult and abstract. On the other hand, setting a specific goal to reach a balance of their first $100,000 in four years may be far more realistic and motivating. It extends their mental time horizon past what they are used to, and anchors on a specific, achievable goal that they can picture with clarity.

3. Build up to the big picture. Once a client has had some practice pushing the limits of their mental time horizon, you can work on extending their thinking to decades and even generations.

Over time, as you coach them with questions and help them fill their mental picture with details, they will be practicing the fine art of long-term thinking. As it slowly becomes a habit of mind, they may naturally become more inclined to save, invest and plan for their future. Eventually, they’ll be thinking in terms of decades and generations, just like a financial professional. With that mindset, long-term plans are much easier to accept and put into action.

[More: Emotions are information]

Sarah Newcomb is a behavioral economist at Morningstar Inc.

Learn more about reprints and licensing for this article.