Jump to Winners | Jump to Methodology

In the continued absence of the mythical crystal ball, the nation’s financial advisors rely on data. The standout operators in providing this valuable stream of information are recognized in InvestmentNews’ 5-Star Research Platforms of 2024.

The winners were voted on by industry professionals against the following criteria:

visualization and reporting

screening tools

customer service

integration with other software

documentation

The choice of which investment research platform to sign up to is a multifaceted decision, but ultimately relies on ensuring the advisor can access accurate data in a timely manner.

Scott Ward, director of relationship management services at Alabama-based firm Johnson Sterling, says, “We’re looking at things such as, will they help us serve our clients more effectively? Will they help us be more efficient with our time? Will they help us deliver on the things that our clients are asking for?”

And while they are a key part of the investment process, there is too much competition for any platform to fail to innovate. Hence, the 5-Star winners remain ahead of the pack.

Steve O. Oniya, CFP and president of OM Investments, highlights how information has never been more available, so the successful research platforms are correct to be wary of complacency.

“The reality is that we’re in the information age, you can Google or do a Yahoo! search, [but] there’s no one point of access for information. Maybe you can’t get it exactly the way a particular platform is presenting it, but it’s still the same information. Some of the names in this space are well established, they have brand name recognition, but you can’t get too comfortable. A new entrant could come in and take some of their pie,” he says.

Even though the leading platforms have cutting-edge tech and tools embedded, that will never be enough.

IN spoke to several industry sources who emphasize the need for synergy between the advisors and the platforms to work through any issues and to feel that support is available if they need it.

Ward explains what makes the difference between subscribing to one platform over another.

“It really comes down to whether the application’s relationship manager has an active dialogue with the planning team. Is the relationship manager curious about what’s working well for our clients, what’s working well for the planning team, and where we see opportunities for improvement? An effective relationship manager can help us resolve any issues,” he says.

“When there’s no relationship manager, no one connecting with us and asking if there are any questions about the software, then we sometimes look at alternatives.”

This is echoed by Oniya, who highlights how time spent changing settings and working out how to operate a platform is far from optimal.

“Responsiveness is very important, such as getting back to someone in at most 48 hours, but I would also say, as far as customer service, it goes into the visualization piece. For example, providing executive summaries at the beginning of research, that to me is good customer service because people in my position are busy. We’re trying to assess a lot of information, so if they find a way that makes things efficient and user-friendly, that makes a big difference,” he says.

What is clear is there is a need for customer service to be:

proactive

time-sensitive

able to offer clear solutions

The unique feature of the market’s leading investment research platforms is that advisors and investors use them continuously.

While this builds loyalty and dependence, it means that any credibility gaps will quickly be exposed.

Overpromising is something advisors coast to coast are wary of.

“If they’re saying that we will provide this and if you do XYZ, we will give you ABC, and then they don’t do that, that hurts trust,” says Oniya.

Due to the range of options, a credibility issue could be fatal for a platform.

“Sometimes I will say I don’t agree with that or that doesn’t look accurate. At the same time, I’m aware that I will give this platform a shot, but I will keep that thought in the back of my mind. It’s like the saying, ‘fool me once, shame on you, fool me twice, shame on me,’” he adds.

Alongside a belief in the functionality, the other edge to credibility is the integrity and accuracy of the data.

This is something Ward is mindful of.

“I want to make sure that the things that it’s measuring are reasonable, and really can help my client get the kind of information he or she might need in order to make an informed decision.”

An example of this is some platforms enabling the use of projected rather than historical figures.

“I love the fact that some platforms allow us to use projected estimated capital market assumptions as opposed to historical, and the difference is that historical numbers are typically higher,” Ward says.

“Take, for example, a balanced allocation of roughly 60 percent in equities and 40 percent in bonds. The average return for this allocation may have been 8 percent over time. But if the future estimate for a balanced allocation is closer to 6 percent now, then that information is highly useful for a client who needs to fund priorities throughout a long retirement. You have to make sure you're setting up realistic expectations for your clients.”

All of the leading research platforms have a multitude of features.

For example, data can be displayed in charts and graphs, and a variety of filters can be applied.

The key is that advisors do not want to spend time mastering complex tools and techniques. They need the platforms to be proactive to show them the most efficient methods.

“One of the worst scenarios that you can have is presenting to a client something that maybe is not addressing the question that he or she wants answered. The credibility of that conversation is critical and so for me, that’s where we get back to having a relationship with that technology provider through a person to say, ‘You know, here’s how I’m using it. Are these the most effective ways to use this tool? What am I missing?’” explains Ward. “I want to be aware of every feature or best practice that can help a client.”

And for Oniya, this is connected to how intuitive the platform is.

“Just throwing all the details out to somebody to find out the results and having to snoop around, that’s a very inefficient use of time.”

He adds, “I shouldn’t have to customize too much to make it user-friendly, they should already have done that. We’re talking about a research company here, so they should have already researched what is it this type of user would like to see.”

Even though research is a high-tech industry, the old-fashioned recommendation is still a powerful calling card.

Ward comments on how a word-of-mouth referral means more than a sales call.

“Reaching out to certified financial planners, that’s been a very effective approach for us and of course, we reciprocate as well. My favorite question to ask a peer CFP professional who is already using a technology application we are considering is, ‘If you could go back in time, would you select this same application today?’”

And, of course, the best advisors do their research even on their research.

“I look at research that tells me what advisors are using, how they are rated, which one has the most market share and things like that,” admits Oniya.

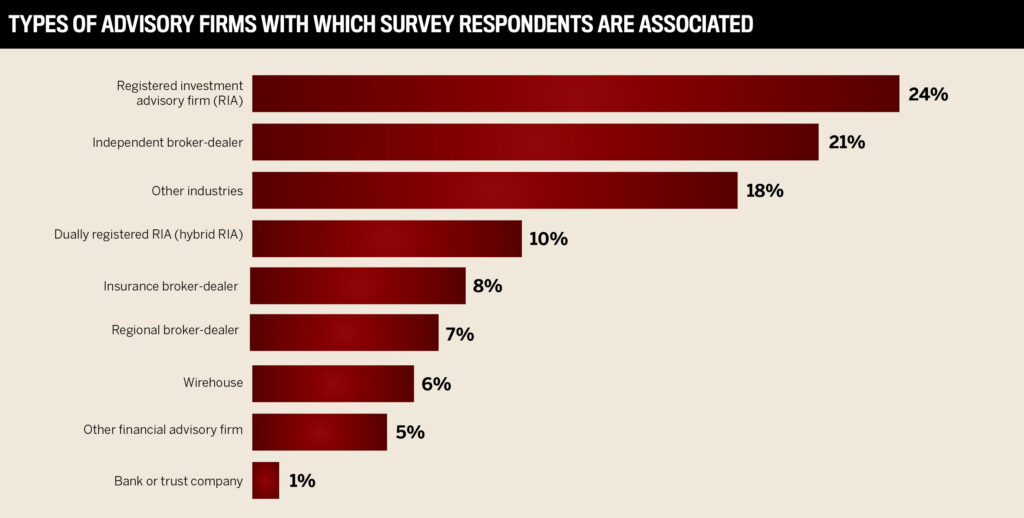

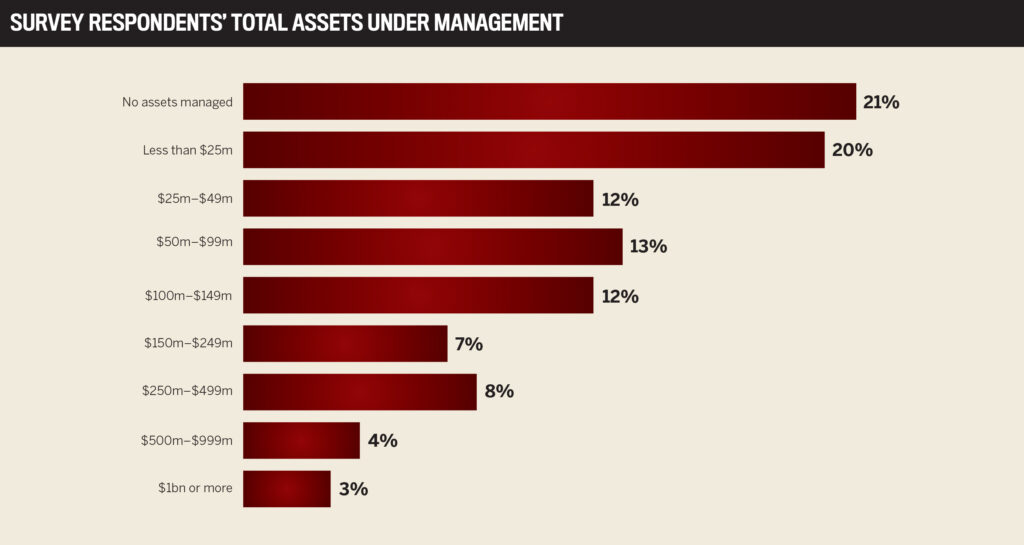

InvestmentNews surveyed its full readership of financial advisors and related professionals between November 20 and December 12, 2023 on 15 of the most commonly used research platforms. Self-identified users of the platforms rated them on a one-to-five scale on the following dimensions: visualization and reporting, screening tools, customer service, integration with other software, and documentation.

The 5-Star Research Platforms were identified as those ranking in the top third based on composite average and servicing at least 8 percent of the survey respondents.