Jump to Winners | Jump to Methodology

With a potent cocktail of macroeconomic volatility, regulatory headwinds, and paradigm-shifting technology happening, the most successful investment managers in 2025 are not just weathering disruption – they are reshaping their value propositions, retooling portfolios, and rethinking client engagement from the ground up.

As the traditional foundations of asset management undergo seismic shifts, the investment teams that evolve and remain ahead of the curve are thriving.

InvestmentNews selected the Fastest-Growing Investment Managers 2025 based on data reported to the Securities Exchange Commission, with the criteria that each had to derive the majority of business (>75 percent) from managing financial instruments and assets on behalf of other financial institutions.

What defines the Fastest-Growing Investment Managers in 2025?

Today’s standout investment firms share a common DNA, no matter where they are in the US. They are agile, tech-forward, and laser-focused on client outcomes. Importantly, they are not resting on past strategies; they are formulating new ones.

Firms on the growth fast track are:

Clear in their identity: They know who they serve and how they deliver differentiated value.

Scalable in their personalization: They leverage technology to offer individualized planning without sacrificing efficiency.

Holistic in their approach: They view wealth not just as capital to be managed, but as a vehicle for legacy, security, and purpose.

Lean in their cost structures: Streamlining structures by outsourcing non-core functions, leveraging generative AI to automate workflows, and minimizing redundant expenses, particularly those tied to staffing.

In a world of persistent complexity, it’s about staying relevant, responsive, and resilient. The best firms are rising to the challenge – not by chasing trends, but by anticipating needs, embracing innovation, and delivering with conviction.

Key trends and insights on IN’s Fastest-Growing Investment Managers 2025

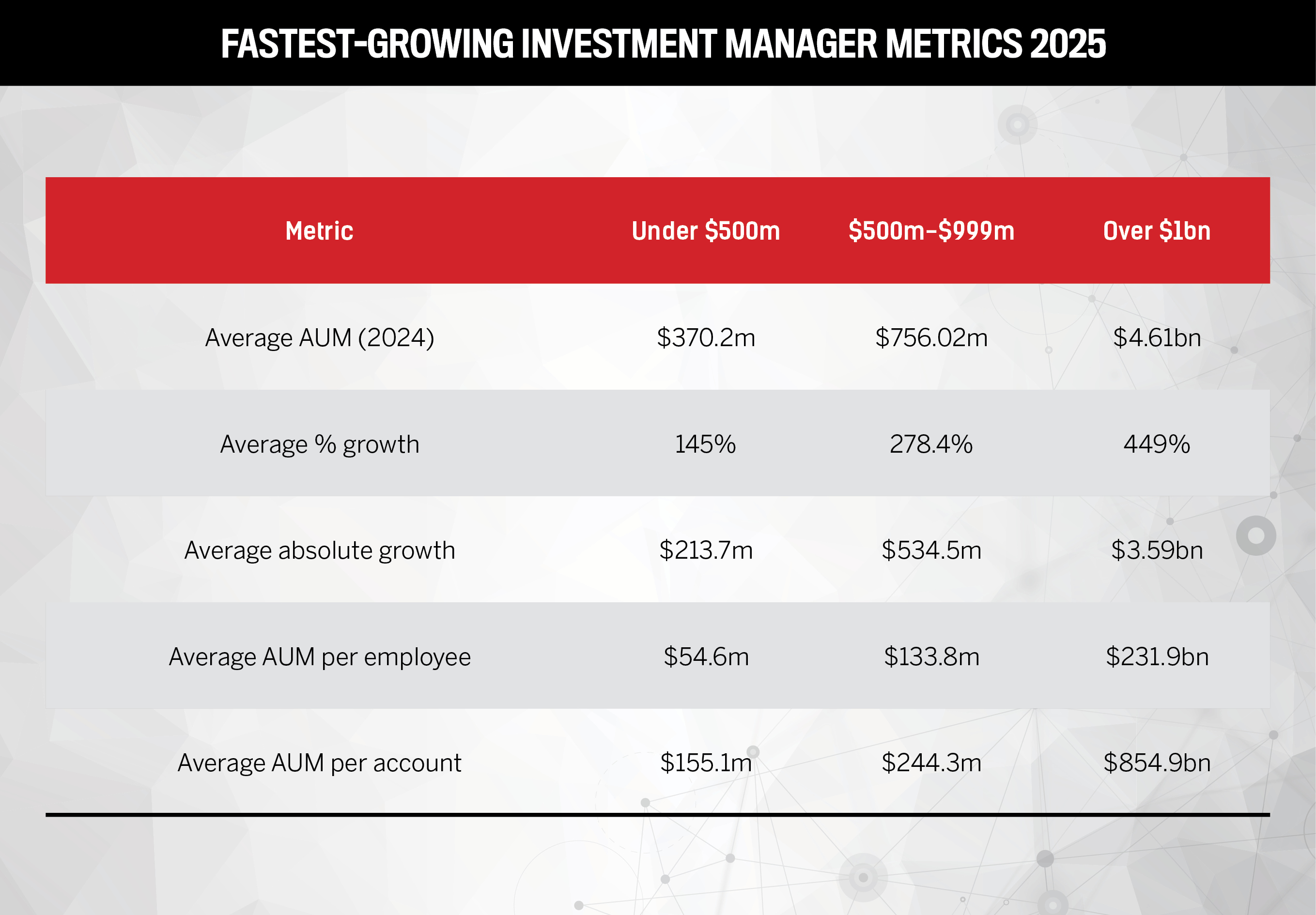

1. Growth accelerates with scale

Larger firms are not just bigger; they are growing faster:

Under $500 million AUM: 145 percent growth

Over $1 billion AUM: 449 percent growth

This indicates strong institutional capital inflow and trust in larger players.

2. Efficiency scales with size

AUM per employee increases significantly with AUM:

From $54.6 million (small firms) to $231.9 million (large firms)

Larger firms appear to leverage technology, outsourcing, or streamlined operations better.

3. Client concentration strategy

AUM per account is a powerful differentiator:

Small firms: $155 million/account

Large firms: $855 million/account

Suggests that larger firms are focused on institutional and ultra-high-net-worth clients, while smaller firms may serve more diversified or retail bases.

Strategic conclusions about IN’s 2025 winners

Large firms dominate growth and client economics, likely benefiting from economies of scale, brand trust, and market access.

Smaller firms may differentiate through specialization, boutique service, or niche strategies but face scalability challenges.

Mid-sized firms sit in transition – strong growth but may need structural evolution to reach large-firm efficiencies.

Redefining the role: From picker to partner

In today’s complex environment, the archetype of a “top-performing” manager has changed. It’s about offering comprehensive, tailored guidance that drives better outcomes with less volatility.

Brad Jung, head of North America advisor and intermediary solutions at Russell Investments, says, “Ultimately, a leading investment manager in today’s environment is more than a stock picker – they are a disciplined strategist, educator, and partner who empowers clients to make informed, confident decisions in pursuit of their financial goals.”

Their role in behavioral coaching – helping clients stay invested during periods of turbulence – has been critical. With many self-directed investors hoarding excess cash amid uncertainty, skilled advisors are guiding clients toward opportunity-rich allocations in international equities, emerging markets, real assets, and select alternatives.

Diversification – across geographies, asset classes, and structures – is being reframed not as a defensive strategy but as an engine of resilience and innovation.

“They ensure portfolios are positioned to capture a broader range of market opportunities aligned with each client’s unique risk tolerance,” adds Jung.

It has become particularly important for smaller asset managers to carve a niche as the trend of fewer firms managing far more assets continues, illustrated by the largest 20 firms accounting for 85 percent of AUM in the US.

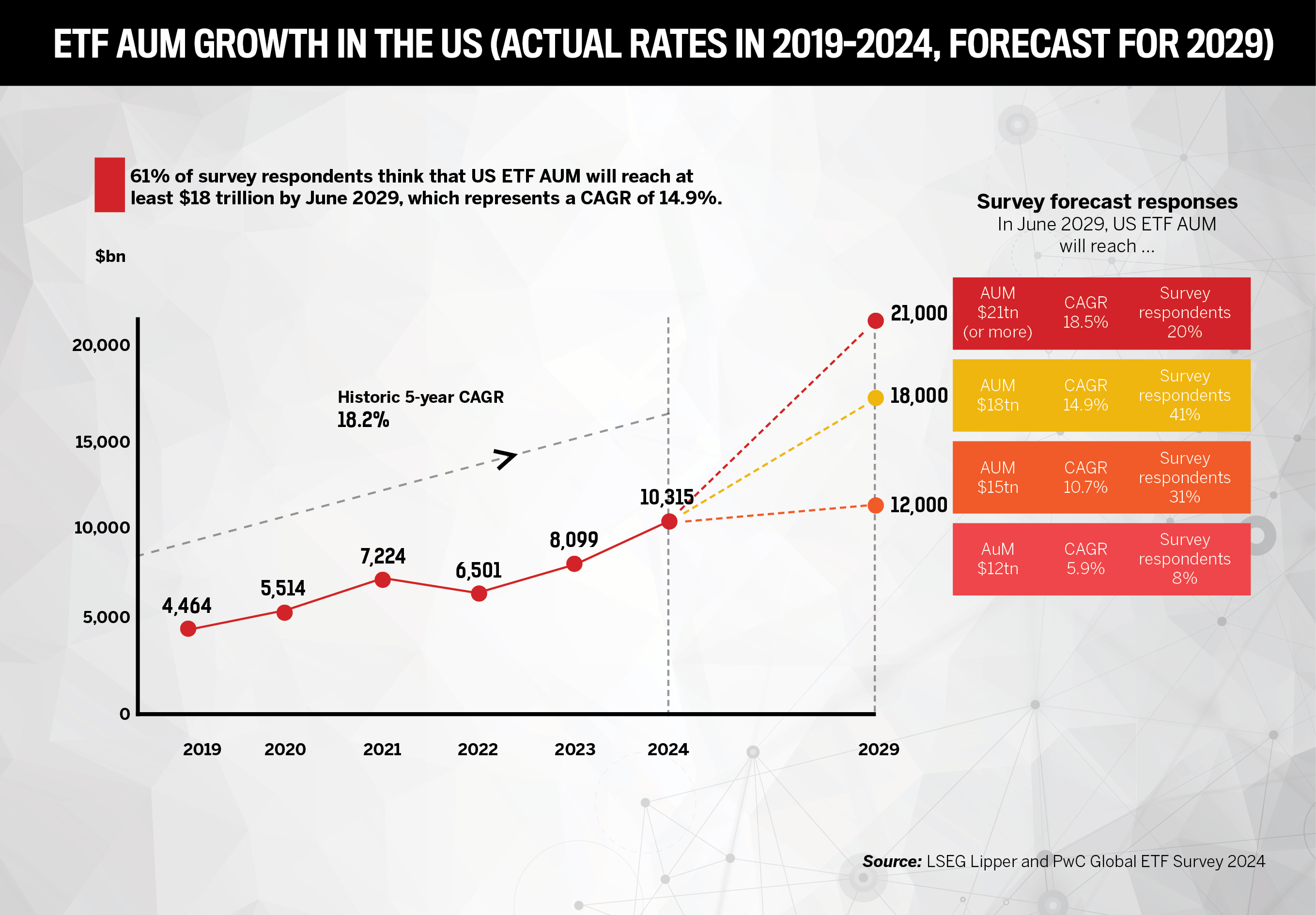

ETFs surge as mutual funds diminish

Coming into 2025 exchange-traded funds (ETFs) continued their ascent, as investment managers responded to investors’ demand for liquidity, transparency, and low-cost exposure. Over the past five years, ETFs have absorbed more than $3 trillion in net inflows in the US. Meanwhile, mutual funds – long the stalwarts of American retirement portfolios – have endured steady outflows.

PwC’s ETFs 2029 report states, “US ETF AUM grew by an impressive 27 percent to reach $10.3 trillion in 2024. The record US ETF inflows of $1.1 trillion tower above the $317 billion into US mutual funds.”

Index mutual funds, once the low-cost flagbearers of diversified investing, are now outpaced by even leaner ETF structures. In 2024, net inflows to index mutual funds were but a shadow of their 2017 peaks. Part of the erosion stems from an increasing cohort of investors who are laser-focused on fees. Across the investment landscape, growth-focused funds with lower expense ratios now command the lion’s share of total assets under management (AUM).

Collective investment trusts (CITs) have also emerged as serious contenders, particularly within retirement plan menus. With approximately $4.6 trillion in AUM as of 2022 – largely concentrated in target date funds – CITs are capturing share once monopolized by mutual funds, further fragmenting the investment ecosystem.

Disruption and opportunity

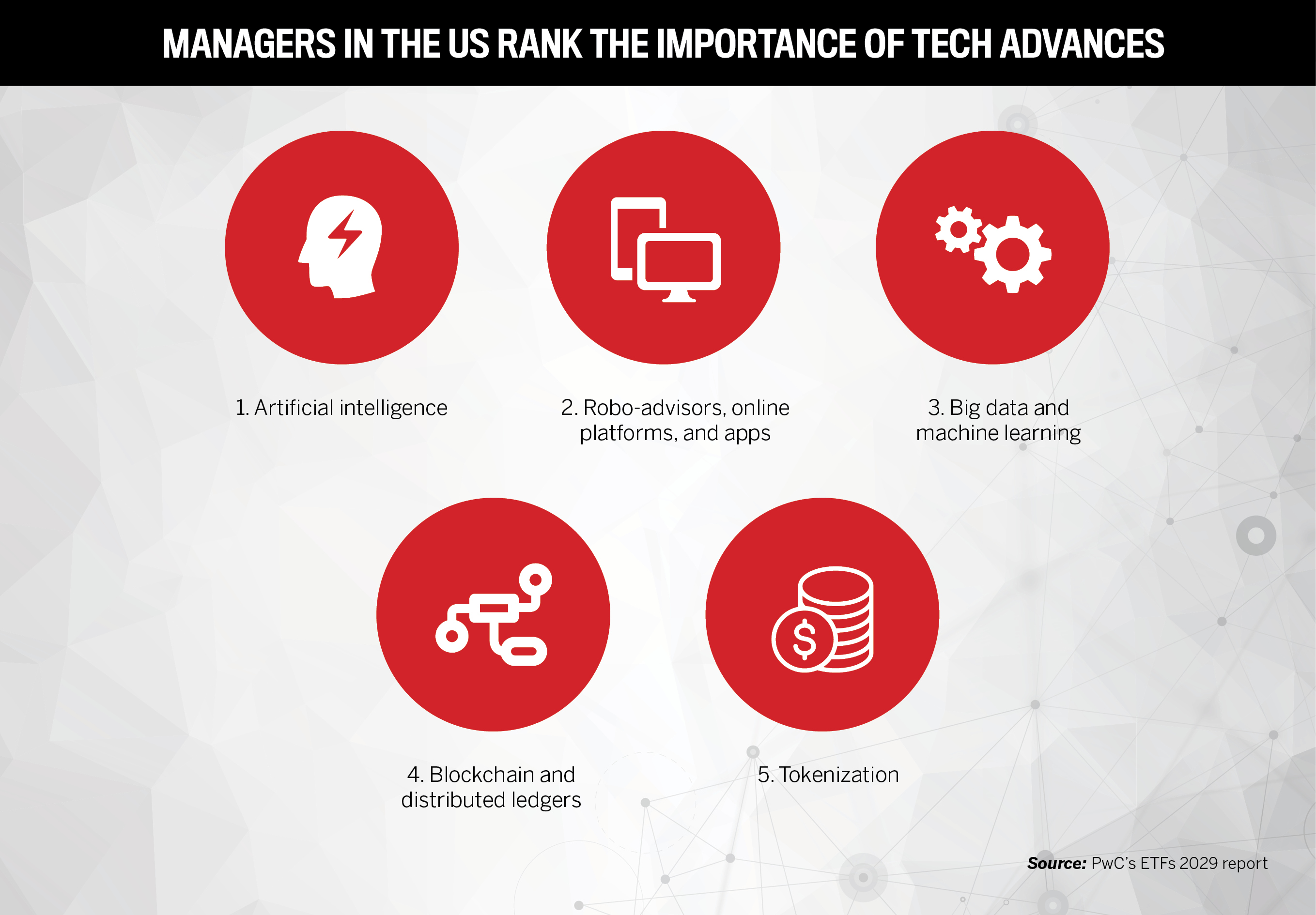

While AI has been discussed and trialed for the last few years, the fastest-growing investment managers are using it as a transformative force, tapping into its real-world impact, which has exceeded the most bullish projections.

Firms are racing to harness generative AI and machine learning for tasks ranging from portfolio construction and risk modeling to tax optimization and behavioral analysis. Yet, many asset managers are still grappling with implementation at scale. Unlike prior technological shifts, there is no roadmap for what widespread AI deployment should look like.

Jung comments on the tech that he feels is moving the needle: “Advanced analytics that help fuel personalization at scale, including tools for direct indexing, tax-loss harvesting, and tax overlays.”

This shift toward targeted, data-driven allocation is reshaping the notion of what it means to be an active manager. In many respects, the future of asset management may lie not in beating the market in aggregate, but in curating exposure to precise themes, sectors, and tax-aware strategies at scale.

Rethinking portfolio construction in an uncertain macro climate

A leading strategy for the fastest-growing investment managers has been to upend long-held assumptions about diversification and asset allocation. The post-pandemic market environment – marked by persistently high interest rates, firm inflation, and robust consumption – has distorted traditional relationships between asset classes.

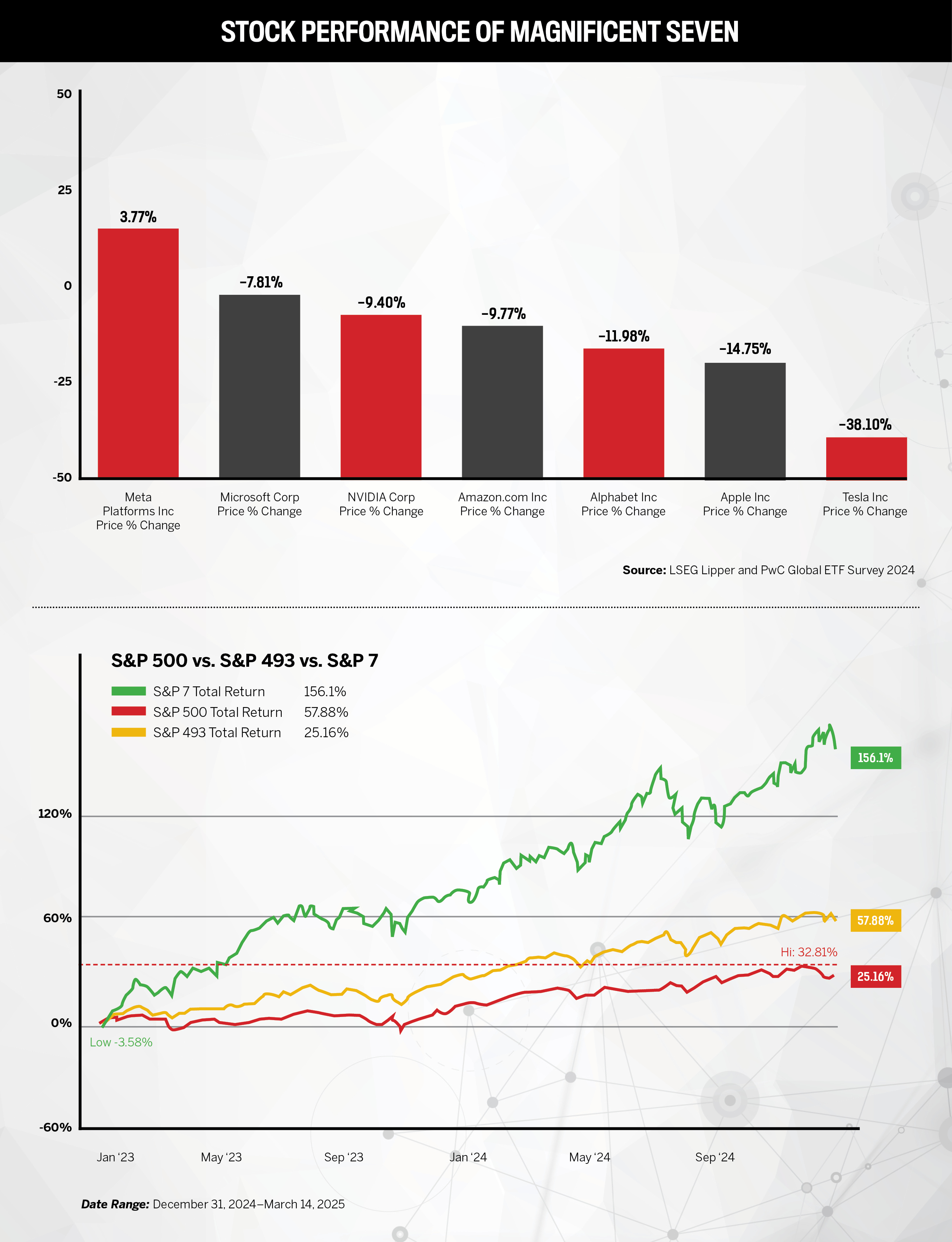

The US equity market, once driven to record highs by the Magnificent Seven – Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla – has faltered in the first part of 2025, considering those stocks accounted for more than 50 percent of the S&P 500’s return in both 2023 and 2024. The stumble prompted a reassessment of portfolio construction frameworks.

Adding to the complexity is a global political environment in flux. With a contentious US election in the rearview and potential policy shifts on the horizon, interest rate expectations remain fluid. This caused heightened volatility across both fixed income and equity markets.

Fixed income, once left for dead during a decade of near-zero rates, is again an area of strategic focus. Intermediate-duration bonds are seeing inflows, though many portfolios remain underweight duration compared to the Bloomberg US Aggregate Index. With higher yields, fixed income is being re-evaluated as a recession hedge – and as a legitimate source of income rather than just ballast.

“While some investors may have been tempted to sit in cash or chase short-term trends, those working with skilled advisors were more likely to stay invested, diversified, and disciplined,” says Jung. “The most successful advisors helped clients reframe market noise, revisit long-term goals, and implement strategies that balanced opportunity with risk.”

On the credit side, a benign macro backdrop supports overweight allocations. But managers are cautious, mindful that any uptick in recession risk would necessitate a shift toward higher-quality credit and shorter durations.

Another catalyst is the sustained momentum behind sustainable investing, with Environmental, Social and Governance (ESG) considerations moving steadily from the periphery to the core of portfolio construction. Amid heightened public awareness of climate risk, social inequality, and corporate governance standards, investors are demonstrating a marked preference for strategies that align with long-term ethical and environmental objectives. In response, investment managers seeking to grow are expanding their suite of ESG-aligned products, ranging from actively managed mutual funds and exchange-traded funds to bespoke private equity vehicles.

Private credit and unlikely partnerships

Amid the search for yield and differentiated return streams, private credit has taken center stage. What’s new in 2025 is the profile of its backers. Traditional asset managers are forging deals with institutions previously viewed as unlikely collaborators.

Wells Fargo’s partnership with Centerbridge Partners and Barclays’ alliance with AGL Credit Management exemplify this trend. These tie-ups allow banks to extend capital access to clients while asset managers gain entrée into proprietary deal flows – a mutually beneficial relationship that redefines the old boundaries of financial intermediation.

Such relationships are not only expanding the toolkit of investment managers but also providing clients with access to unique private market opportunities at a time when traditional public markets face performance headwinds.

Growth through personalization and tax-smart strategies

For asset managers with growth ambitions, 2025’s playbook is clear. Success hinges on three pillars: delivering a compelling value proposition, personalizing client experience at scale, and offering holistic financial solutions.

A growing number of firms are deploying advanced analytics to support direct indexing, tax-loss harvesting, and tax overlay strategies. Direct indexing, in particular, has seen explosive growth, empowering advisors to construct hyper-personalized portfolios that align with investor values, tax considerations, and financial goals.

Tax-aware management is also increasingly seen as a differentiator. Advisors are scrutinizing 1099-DIV forms to uncover and mitigate high-cost income streams, helping clients retain more of what they earn.

“The standard is no longer just performance,” says Jung. “Fast-growing firms provide holistic wealth management, including estate planning, tax-aware strategies, and generational wealth planning.”

Takeaways and conclusions

IN’s winning firms in 2025 are not defined by size alone, but by adaptability, clarity of purpose, and operational leverage.

Efficiency is the new alpha. Firms are winning by doing more with less, at scale.

Personalization, AI, and tax strategy are the next battlegrounds for growth.

The most successful investment managers are already transitioning from managers of money to partners in long-term client outcomes.

InvestmentNews selected the Fastest-Growing Investment Managers based on data reported to the Securities Exchange Commission on form ADV.

To qualify, firms must have met the following criteria: (1) the latest ADV filing date is either on or after January 1, 2024, (2) total AUM is at least $100 million, and (3) the firm derives the majority of its business (>75 percent) from managing financial instruments and assets on behalf of other financial institutions.

To be considered for the list of Fastest-Growing Investment Managers, firms must meet these criteria for both 2023 and 2024 (ending December). In cases where a firm filed more than one annual update to their ADV, the latest filing for the year was used.