Jump to Winners | Jump to Methodology

It has been a trying time for advisors across the United States, with geopolitical uncertainty, low interest rates, and a fractious election all creating waves. The best advisors have had to reassure clients and devise ways to navigate through these waters.

Dave Goodsell, executive director at the Natixis Center for Investor Insight, underlines the difficulties in finer detail.

He says, “Investment assumptions are being tested by lower inflation, lower rates, and slowing growth; clients are demanding more specialized services while holding high expectations for investment performance; and portfolio construction is becoming more complex as advisors adopt a wide range of new products and look to incorporate private investments in their strategies.”

Performing in this environment showcases the skills of InvestmentNews’ Top Advisors 2025, who were nominated by industry insiders and then recognized for their AUM and client growth.

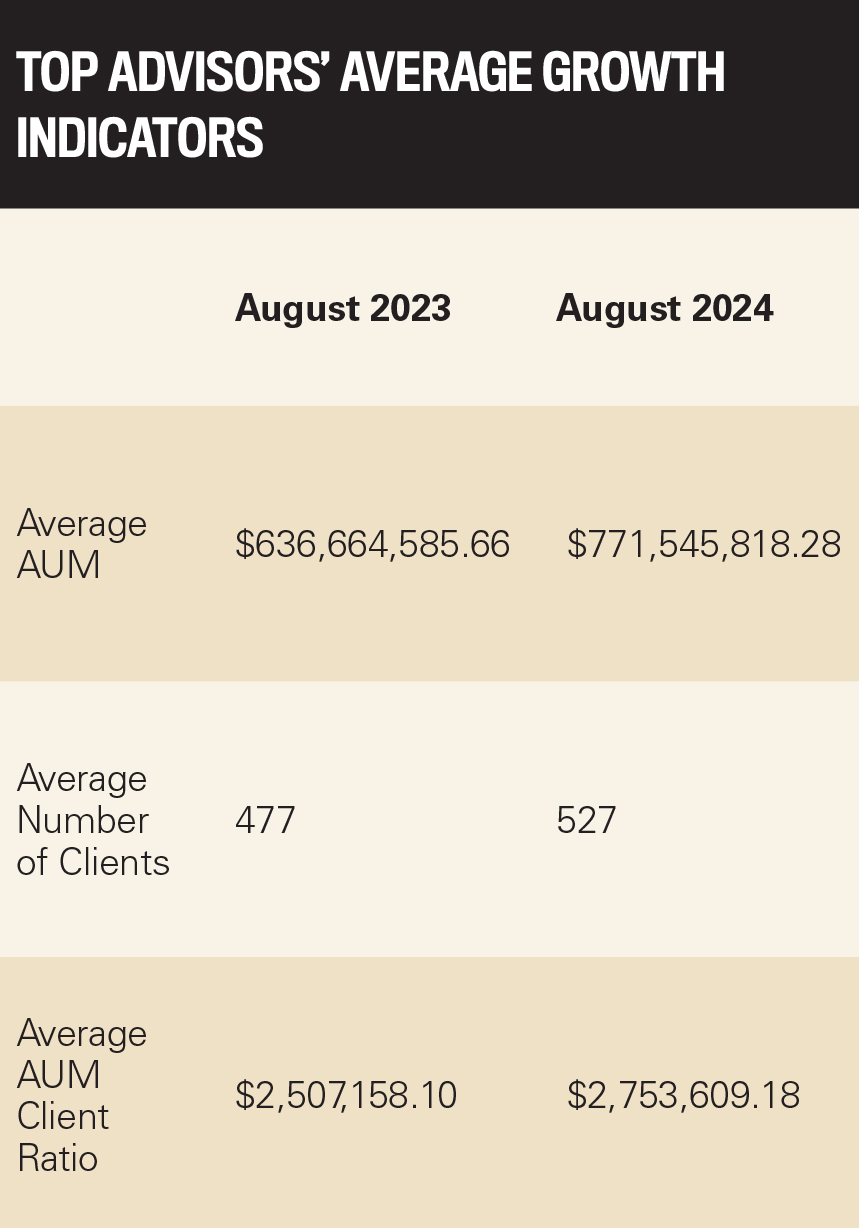

As a cohort, between August 2023 and August 2024, the Top Advisors have delivered a combined:

19 percent in AUM growth

10 percent in client growth

oversight of $77,154,581,827 AUM

The Top Advisors are quick to admit they have relied on their teams’ expertise and support to enable their outstanding performance. That team ethic, along with an appreciation and use of technology, is a commonality. What separates the best is their ability to master client communication and the emotional side of the business.

Some of those honored by IN reveal what makes them stand out among a competitive and crowded advisor market.

The managing partner of the firm’s private wealth management business line puts his success down to ensuring clients are comprehensively catered for.

“It’s not taking the easy or quick answer, but really digging in with our client families, getting to know the ins and outs of the totality of their financial world, so that we can make the right recommendations to them from a broader context. We want the right answer, not the quick and easy one, so that our clients have the best chance of success possible,” says DeHaan.

While stationed in Afghanistan’s Helmand Province, Lauzen flew 127 combat missions as a light attack helicopter pilot for the US marines. This is the mindset he brings to the table with his clients today.

He says, “One of the things I loved in that role was being able to bring stability, show up on the battlefield, and build confidence in the folks that they were going to get out safely. There is a similar value set with being in the trenches with folks on the private wealth management side. We’re always in the boat with our clients and it’s incredibly important for folks to have trusted, hardworking, and smart advisors in the tough times.”

McCormick’s difference marker is working with a team and studying how they can refine their operations.

“I’ve got two associates who are integral parts of my team. One thing that sets us apart and helps our growth is that we spend a lot of time thinking about processes and how we can make things more efficient,” he says.

“I have always viewed the competence of an advisor and access to investments to be table stakes. Everybody’s got letters after their name, everybody’s got some investment strategy. But we constantly ask, what’s the extra that we can provide? We do a tremendous amount thinking outside the box and around the corners for the things that clients haven’t seen or thought of.”

Growing up in a farming family business shaped his outlook and values, which are the bedrock of his success.

He says, “I grew up working alongside people in a manufacturing and agriculture type of environment. I always felt that starting out working side by side with real people who work hard for a living every day, since the time I was about 12 years old, instilled a little bit of compassion for people who work hard every day, and I have translated that over to managing their money.”

Guenther, a broad-based financial planner with a special emphasis on comprehensive financial and retirement planning, admits his family and friends think he’s “a nerd and workaholic.” Caddying at a golf country club exposed him to finance and formulated his approach.

“I just love to educate people and help them do better in life. It’s my goal to help clients achieve financial comfort and freedom through strategy and planning. I want to bring common sense financial advice that can be implemented into my client’s daily lives,” he says.

Early to spot opportunities, McCormick brought on another partner last year after realizing that he and his other advisors were reaching capacity.

“In order to continue our level of service, we needed to bring on a really good third partner and it took nine months of looking and interviewing,” he says.

Around 75 percent of the firm’s clientele are nearing retirement, with the remainder being young professionals. Taking on a new client is as carefully thought out for McCormick as hiring new staff members.

This considered approach enables him to keep delivering and boosting his reputation.

“I measure potential clients not necessarily by their assets. They might not be a good fit if they’re looking for a service that we don’t offer, or I just don’t think it’s going to be a good personality match. I’m a big believer in clients for life. We don’t lose clients unless they pass away,” McCormick says.

“I tell clients upfront, ‘I expect to be working with you for years, if not decades, to come.’ I want to make sure it is a good fit and sometimes it isn’t, so we shake hands and part as friends.”

DiSette is clear with all clients that his firm is a cash-flow-based financial planning operation that looks holistically at every aspect of its situation, including estate planning, charitable planning, investments, insurance, and whether they have a business. While that remains stable, he has been able to grow by engaging external consultants.

“When you feel like you’re hitting that ceiling of complexity, whether it be with a financial planning process and you need to evaluate some new technology, or from a marketing process, you need to get a second opinion,” he says.

The most recent review, which has driven recent growth, helped DiSette’s firm refine workflows and its onboarding process for new clients.

He says, “I don’t work with other financial planning firms. There’s a lot of great firms, but I don’t know how they do it. But an external consultant can give you a great perspective, see your blind spots, and teach you how to overcome those.”

The cornerstone of Lauzen’s growth has been a focus on a high, responsive service. He says, “It is taking care of people spectacularly well and far exceeding expectations on a day in and day out basis, which continues to build the long-term trajectory.”

Part of this has been adding new advisors who can offer Lauzen support and bring efficiencies. But he admits it has been challenging to find smart, hardworking candidates who enjoy the process of diving in and tackling problems.

“These aren’t knick-knacks being sold. These are the hard-earned assets of a lifetime, and often multigenerational lifetimes of effort. So, it’s a distinct privilege to be able to shepherd growth over time,” he says.

While growth is positive, it does open up another set of challenges.

“It’s one of the double-edged swords of success. I never want my clients to suffer because of the success I’ve had or because I’m good at what I do,” says DeHaan. “Managing growth is one of the hardest things that any business has to do and making sure that we can maintain the standard that we expect of ourselves, let alone what our clients expect.”

Outside of efficient processes and value-adding tech, DeHaan is meticulous in adding new advisors and is adamant that they need to appreciate the standards they should offer to clients.

He says, “There are two non-negotiables when we’re hiring; one is character. I have to be able to trust them and be comfortable that if I were the client and were passed to this new person, I would trust them to take care of my family. If not, then they’re not taking care of our client family. Character is huge for us, and then the other side of it is competency.”

Being relatable and connected with clients is also something Guenther draws on. He puts his growth down to a trifecta: organically from current clients and their family referrals, online branding and marketing, and building key relationships with centers of influence.

Guenther adds, “I implement a listen-first approach, which leads to asking thoughtful and insightful questions.”

DeHaan is quick to acknowledge how the last 12 to 18 months have been a trying time. He has made a concerted effort to support clients and enable them to block out the noise of political and social upheaval by reminding them that their financial plan is still being executed.

He says, “There’s a lot on people’s plates to digest. We’ve been feeling that with our client base of just having to do a little bit more hand holding, even though things are going really well from a market perspective.”

And he continues, “A lot of our clients are experiencing record years for their businesses and yet there’s still this overshadowing feel of negativity. It’s easy to miss those good things if you’re so focused on the bad things, but we’re there to tell them, ‘Here’s where we are, here’s where that means you need to get to, and here’s how we’re going to get there.’”

DiSette has opted to ensure client satisfaction by running a diverse and adaptable structure. He’s done this by ensuring part of his team is younger, including his two sons, and brings a fresh perspective.

“I think a majority of my clients would say that they almost prefer working with the younger people in our organization,” he says.

The key to the strategy is the firm rarely manages clients singularly.

“It means they really understand the approach that we take and there are multiple relationships in the organization with people with different skills,” explains DiSette.

In McCormick’s office, a weekly meeting is held on Tuesdays to discuss processes.

“Nothing is off the table, there’s no process that’s above scrutiny, and we have a clearly defined process to analyze our processes. In the meetings, we ask, ‘What’s going on in the markets? What are our forecasts? What’s going on with the election? What’s going on with the Fed? Are there any developments in the insurance world or estate planning?’ We make sure that we’re all speaking with a consistent message.”

While it may be time consuming to keep adjusting, it actually makes things run more smoothly.

McCormick says, “Those baseline processes allow us to not get mired in the weeds when a client has a very specific request or a specific need. We’ve got the bandwidth to be thinking about that ahead of time for them, because we’re not spending all of our time on the basics of running a financial services firm.”

Ensuring a consistent culture is also important for Lauzen, who embodies the firm’s values, which extend to competence, care, and people who are excited to work hard for others.

“It’s in the service to others that I think we really capture the intent of long-term finance of building for others,” he says.

This extends to leaning into situations where clients may have tricky problems or situations to unpick.

“At Grey Fox, we really talk about being the ones who love to take the responsibility for that hot potato and say, ‘Hey, I’m going to take this. I’ve got the skill and the enthusiasm to take responsibility for this and to get it done for the person.’”

Another arm of Lauzen’s vision is ensuring he shapes the firm into a refined and well-honed unit, delivering a consistent enterprise of business and value.

He says, “We continue to refine that process. It’s been neat to designate roles and to optimize the right people in those right seats.”

To compile the second annual Top Advisors list, InvestmentNews first solicited nominations from advisors, industry professionals, and clients. Only advisors nominated were eligible for the list. All information on the nominees had to be verified by their compliance team before it could be accepted.

The final list was determined based on each advisor’s weighted ranking in overall AUM, AUM growth, and client growth (between August 2023 and August 2024). The InvestmentNews team assigned a ranking to each advisor in each category and then calculated a combined score to determine the advisor’s final placement on the 2025 Top Advisors list.