A growing number of financial advisors have been leaving their broker-dealer (BD) firms to start or join a registered investment advisor (RIA), an annual industry analysis has found. The study noted that among the biggest factors driving the trend is the RIA model’s client-centric approach to wealth management.

In this article, we will delve deeper into the key differences between a broker-dealer and an RIA. We will discuss how the two roles differ and what compliance challenges those transitioning need to navigate. An industry expert also shared advice on how BDs can ensure compliance as they make the shift.

This guide can prove handy for BDs who may be wondering whether transitioning to an RIA is the best move. Keep reading as we dig deeper into the different layers of BD vs. RIA.

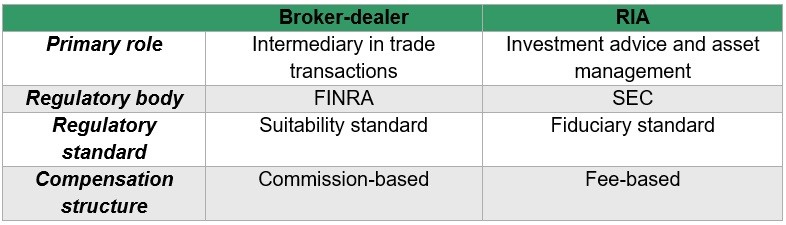

Broker-dealers and RIAs are key figures in the financial advising space. Both play an important role in helping investors shape their investment strategies. However, they differ in several aspects, including how they operate, the regulations they need to meet, and their payment structures. Here’s a more detailed comparison of BD vs. RIA.

BD: Broker-dealers act as intermediaries in the purchase and sale of securities. As the name suggests, they serve dual functions. As a broker, they facilitate investment transactions by connecting buyers and sellers. They may also work with advisors to help clients decide which assets to buy or sell. As a dealer, BDs trade securities from their inventory, acting as the principal of the deal.

RIA: RIAs provide clients with financial advice and manage assets on their behalf. Compared to a BD, an RIA can offer a broader range of services. These can include retirement, estate, and tax planning. Some RIAs target a particular client base, such as retirees or high-net-worth (HNW) individuals. This holistic approach to their service makes them a good option for clients needing extensive financial guidance.

BD: The Financial Industry Regulatory Authority (FINRA) is the main regulatory body for broker-dealers. FINRA is regulated under the Securities and Exchange Act of 1934. BDs must meet specific rules involving trades and customer accounts. They are also subject to a suitability standard. This requires them to recommend only investments that suit their clients’ needs.

RIA: RIAs are regulated under the Investment Advisers Act of 1940. Depending on the firm’s size, they may need to register with the Securities and Exchange Commission (SEC) or their state’s securities commissions. Unlike BDs, RIAs are subject to a fiduciary standard. This requires them to always act in their clients’ best interests, ensuring the highest possible standard of care.

BD: Firms must have at least two general securities principals and a financial and operations principal (FINOP) to get a broker-dealer license. For sole proprietorships, only one general securities principal is required. Industry professionals must pass the Series 24 exam to qualify as a general securities principal. The Series 24 exam, however, has prerequisites, including the Securities Industry Essentials (SIE) and Series 7 exams.

RIA: Industry professionals must pass the Series 65 exam to qualify as an investment advisor representative (IAR) and work for an RIA firm. To progress in their careers, they will need additional qualifications, such as the Series 6 or Series 7 exam, and credentials, including the CFP or CFA designations.

BD: Broker-dealers often receive commissions for their services. This means that they earn income for each transaction they facilitate.

RIA: RIAs are paid through fees. These can be based on a percentage of assets under management (AUM), an hourly rate, or a flat fee.

Here’s a summary of the key differences between a BD and an RIA.

This guide provides more details on how to become a registered investment advisor.

An annual analysis of the investment advisor industry has revealed a notable trend that has emerged in the past few years – a growing number of financial advisors are leaving their FINRA-member firms and opting to start or join an RIA.

The latest industry snapshot from the Investment Adviser Association (IIA) identifies some of the factors driving the shift. These include:

FINRA-member broker-dealers have traditionally operated under a suitability standard. This makes it obligatory for BDs to ensure that any investments they recommend suit their clients’ needs. Suitability can be based on various factors, including the client’s risk tolerance, financial situation, and investment goals.

The recommendations, however, don’t need to be in the client’s best interests. This means that nothing is prohibiting BDs from recommending investments that may earn them a higher commission, as long as these meet the suitability standard.

RIAs, on the other hand, adhere to a fiduciary standard. This demands that they act in their clients’ best interests. RIAs are held to a higher standard of ethics and transparency, which resonates with advisors who want a more client-centric approach.

Registered representatives working for FINRA-member BDs work within a structured framework. This restricts their ability to choose investment products and strategies.

By contrast, RIAs hold more control over their business. They can personalize their offerings to meet a client’s unique needs. They can also provide a wider range of investment options, allowing them to capitalize on emerging opportunities in a rapidly changing market. The independence and flexibility that come with the RIA model make it an appealing option for many financial advisors.

RIAs are legally required to act in their clients’ best interests. This allows them to build a relationship based on trust and transparency. This can be a major selling point for financial advisors who want to differentiate themselves in a highly competitive market.

This chart reveals a strong growth in the number of IARs in the three-year period ending in 2022, according to the report.

The rising number of investors seeing the value of the fiduciary advice provided by RIA firms and representatives was the main factor driving the shift, the industry report adds.

But despite the uptrend, the transition from a BD to an RIA firm is far from straightforward, with compliance potentially turning into a major stumbling block.

“Transitioning from a broker-dealer (BD) to a registered investment advisor (RIA) firm is a shift that goes beyond simply changing business cards,” said Alisha P. Dowell, fractional chief compliance officer at Knight's Shield Compliance Consulting. “It requires changes in mindset, compliance, and client interactions.

Read more: What does a CCO do?

“Unlike BDs under FINRA's ‘suitability’ standard, RIAs operate under a fiduciary duty, prioritizing clients' best interests and focusing on transparency. This involves disclosing conflicts, communicating openly, and documenting interactions to maintain compliance.”

Dowell highlighted some compliance requirements that advisors transitioning to an RIA firm must meet.

“On the compliance side, RIAs regulated by the SEC or state agencies must file Form ADV and create a tailored compliance program,” she said. “The SEC’s updated marketing rule also allows more flexibility in advertising – hello, honest client testimonials! But be prepared for strict guidelines on truthfulness and disclosures. Organized recordkeeping of client communications and other documentation is also essential.”

In this section, we will provide a brief overview of the different compliance requirements for both BD and RIA firms.

FINRA requires broker-dealers to meet a stringent set of regulations involving customer accounts, trade execution, and asset protection. Here are some of the essential compliance requirements BDs must meet:

Non-compliance with FINRA regulations can lead to disciplinary actions. Penalties can include fines and suspensions. Serious violations can result in revocation of licenses or even bans.

RIAs with at least $110 million in AUM are required to register with the SEC, unless they are granted an exemption. Smaller RIA firms may register with the SEC or their state regulatory commissions, depending on their AUM.

The Investment Advisers Act requires RIAs to meet compliance obligations. This provision is meant to ensure that they uphold their fiduciary responsibilities. Here are some of the most important rules that RIAs must comply with:

Read more: What is RIA compliance software?

Compliance requirements are set out to protect investors and mitigate the risk of fraudulent activities. That’s why it is crucial for every firm to develop a solid compliance plan. It is also important that the plan is reviewed regularly to ensure that all areas of the business remain compliant.

“If joining an existing RIA, familiarize yourself with its compliance policies on client communication, conflicts, and documentation,” Dowell said. “The compliance team, whether in-house or outsourced, will be key as you adjust to this client-first model.

“Despite new responsibilities, your core mission – helping clients achieve their financial goals – remains. Whether in a BD or RIA, guiding clients with strategies aligned to their best interests is at the heart of the work.”

Visit our goRIA section for the latest updates on compliance regulations. Don’t forget to bookmark this page for easy access to breaking news and the latest industry developments.

The up-and-coming Los Angeles-based RIA is looking to tap Merchant's resources to strengthen its alts distribution, advisor recruitment, and family office services.

US wealth advisory business will get international footprint boost with new tie-ups.

New research shows physicians start their careers at least $200K in debt.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.