Investing in sports is an increasingly popular conversation many financial advisors are having across their client base. While the opportunity to invest in sports isn’t novel, the industry has undergone transformational change over the past five years, and as a result, sports is emerging as one of the most in-demand asset classes for 2025 and beyond.

With a total addressable market size of more than $2 trillion,1 Ares believes sports and sports-related investing is currently one of the most attractive investment opportunities in private markets. It is important to note that in return for accessing this asset class, investors generally give up a level of liquidity and have less track record available. But how can advisors make sense of this asset class in the context of the total portfolio? In this edition of Private Markets Insights, Ares’ Financial Advisor Solutions Team shares our view to get you started.

For those that are less familiar, here are five key dynamics driving rising interest in sports assets:

The scarcity value of teams, paired with strong financial characteristics driven by long-term and contracted revenues from media rights deals, has some key professional franchises claiming top-dollar sticker prices.

Many sports teams and leagues have expanded their income sources beyond game-day revenue and ticket sales to include media rights, corporate sponsorships, premium seating and advertising partnerships.

Innovations in how fans engage with their favorite teams over social platforms and the in-person stadium experiences have the potential to boost profitability.

Major North American leagues like MLB, NBA, NHL and NFL started allowing private capital solutions to provide much-needed liquidity within the undercapitalized market.

Historically, sports have provided long-term growth irrespective of broader market conditions, making these assets great tools to consider when seeking ways to dampen overall portfolio volatility and create durable growth.

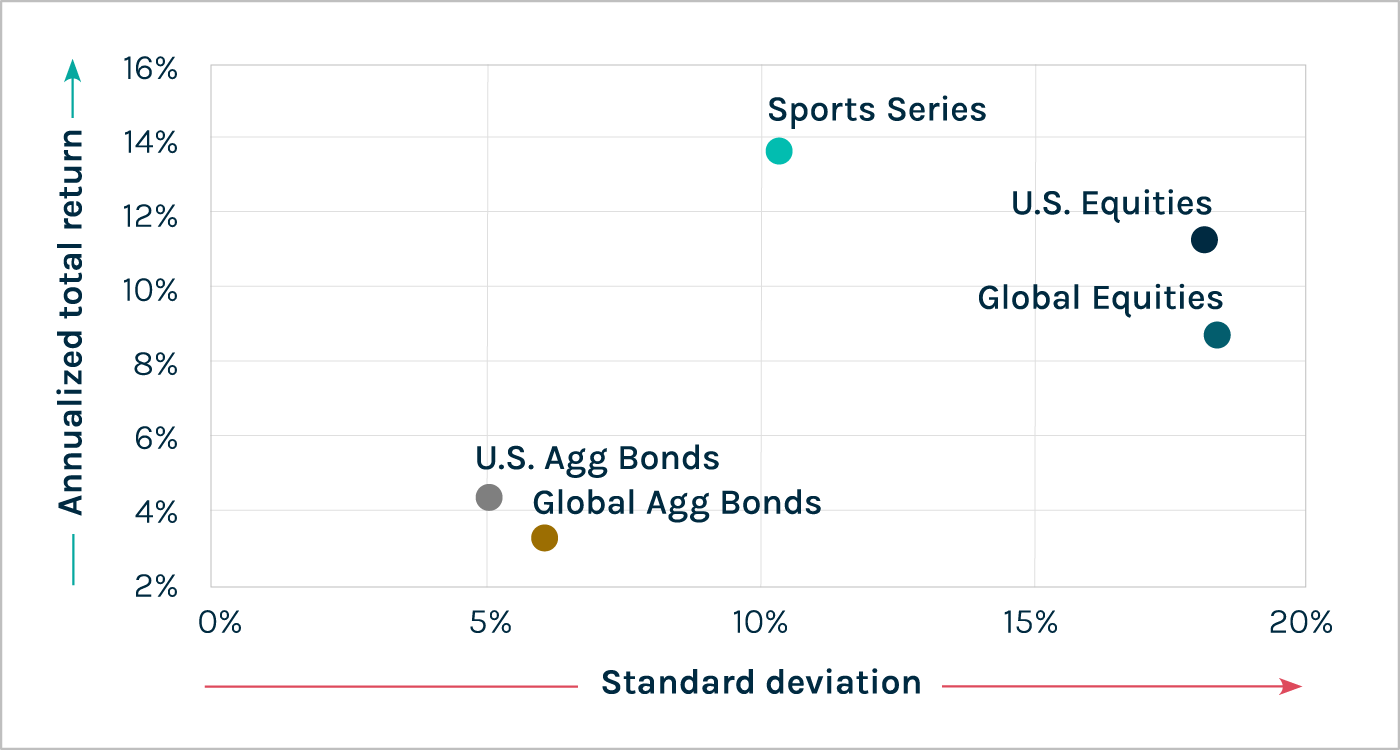

Sports investments exhibit distinct characteristics compared to traditional asset classes. The U.S. Sports Equal Weight Median Enterprise Value Return Series2 (“Sports Series”) has demonstrated cycle-tested, consistent growth over the past decade, at times outperforming indices like the MSCI World. A risk- return analysis shows that the sports asset class has delivered higher annualized total returns (~13%) than key benchmarks such as the MSCI World, the S&P 500 and the Bloomberg Global Aggregate Bond Index, with moderate volatility levels.

Historical risk and return

Past performance is no guarantee of future results.

Correlation analysis further highlights the potential diversification benefits of sports investments.

Historical data from 2007 to 2024 indicates a near-zero correlation (-0.01) between the Sports Series and Global Equities, as well as a modest negative correlation with fixed-income indices like Global Agg Bonds (-0.49) ] and U.S. Agg Bonds (-0.45). This suggests that sports investments often move independently from traditional equity markets and reinforces the role that sports investments may play in portfolio risk reduction.3

We believe the low correlation between sports investments and traditional asset classes may help to manage total portfolio volatility and increase risk- adjusted returns. While some of the lower correlation is due to less frequent valuations, we believe much can be attributed to the unique revenue streams associated with sports investments, such as media rights and sponsorships, which have tended to exhibit less sensitivity to broader market fluctuations.

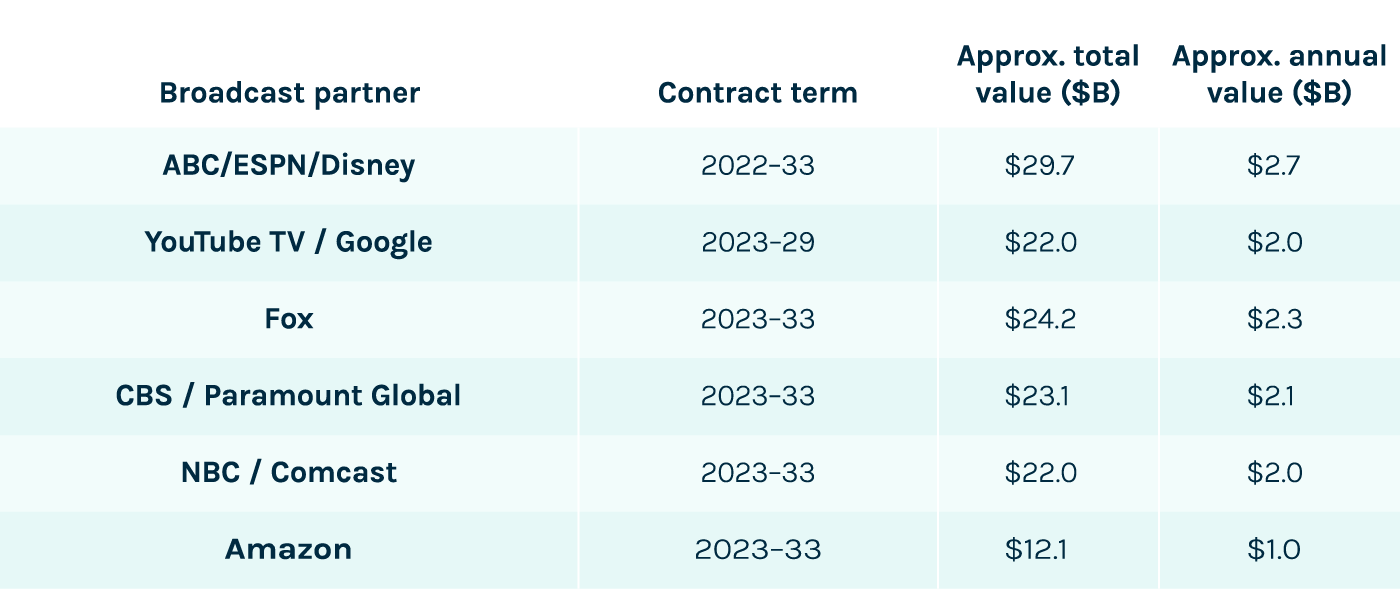

We attribute much of the moderate volatility and near- zero correlation to public equity to the structure of long-tailed sponsorships and sports media contracts, as well as sticky customers, which we believe function similarly to long-term infrastructure agreements. For example, national revenues account for 65–75% of NFL team revenues, with the vast majority coming from long-term media contracts.4

Sports media contracts

Source: List of sports media rights deals - Sports Media Watch (July 2024).

We believe sports investments offer a compelling opportunity for portfolio diversification, enhanced risk-adjusted returns and reduced volatility. With its low correlation to traditional stocks and bonds, as well as traditional private markets, we find that even a modest allocation can enhance portfolio performance.

Just as a winning baseball team relies on deep bullpen, ready to step in and stabilize the game when needed, we believe a well-diversified portfolio can benefit from a unique differentiator like sports investing in its portfolio allocation.

FOOTNOTES

1. Ares Management Corporation, Annual Letter, Q4 2024

2. The U.S. Sports Equal-Weighted Median Enterprise Value Return Series is designed to track the annual percentage change of the median enterprise values for U.S. professional sports teams in the NBA, MLB, NFL and NHL for the period of December 31, 2007 through December 31, 2024. Data is derived from Forbes and calculated by Ares. The median enterprise values include all teams within each of the four leagues, NBA, MLB, NFL & NHL, (e.g., 30 teams in the NBA; 30 teams in the MLB; 32 teams in the NFL; and 32 teams in the NHL) as of 2024. The Forbes dataset provides the team valuations for the teams in each of the four leagues. Ares then takes the median growth value of each league and equal-weights to get to the U.S. Equal-Weighted Median Sports Enterprise Value Return Series.

3. It is important to note that sports as an investment remains a relatively new concept, resulting in limited available data. For instance, the U.S. Sports Equal Weight Median Enterprise Value Index tracks annual returns for the NBA, NHL, NFL and MLB since 2007. However, investor experience in this asset class reinforces its infrastructure-like characteristics, given the prevalence of the long-term contracted revenues.

4. Sportico, February 2024.

DISCLOSURES

Investing involves risk including the loss of principal. An investment in the sports, media and entertainment asset class entails a significant degree of risk, and, therefore, should be undertaken only by investors capable of evaluating the risks of that investment and bearing the risks it presents. General risks include, but are not limited to, a lack of liquidity; a high degree of regulation within the sports leagues, teams and related companies; additional authority of certain regulatory bodies in respect to operations; personal investments or ownership interests from senior management; success of sports teams; cancellation and disruption of events; portfolio concentration and lack of industry diversification; use of leverage; need to deploy capital quickly; no market for units and restrictions on transfers; potential effects of the repurchase program; potential difference in valuations of underlying assets; errors in NAV and that the strategy(ies) have a limited operating history. These are not the only risks and potential investors are encouraged to refer to the private placement memorandum of the corresponding strategy prior to investing.

There are inherent differences between public and private equity. On the whole, public equity is more liquid, represents direct ownership in a company, has more stringent reporting, and has historically had higher volatility and lower fees. Private equity has historically had lower volatility relative to public equity, but operates under less stringent reporting requirements, is generally more illiquid and designed for more sophisticated investors with a longer time horizon. Indexes designed to track the public markets are different from private equity in that data is derived from trade data and reporting requirements. Indexes are not available for direct investment, do not include the fees, expenses or reinvestment of any investments.

AccessAres articles are for educational purposes only. The views contained in these articles may change and should not be relied upon as, nor are they intended to be used as, investment advice or a recommendation to buy, sell, or hold any security, investment strategy, or market sector. AccessAres undertakes no obligation to update the materials contained on this website.

AccessAres is the thought-leadership and educational division of Ares Wealth Management Solutions. The materials distributed by AccessAres are for informational purposes only and do not constitute investment advice or a recommendation to buy, sell or hold any security, investment strategy or market sector. Ares Wealth Management Solutions is a global brand of Ares Management Corporation.

Past performance is not an indicator of future results.

This information is for informational purposes only and is neither an offer to sell nor a solicitation to purchase any related securities. Investing in private markets investments involves a high degree of risk including, but not limited to, risk of substantial loss of principal. Direct investments in private companies and investments involve a high degree of business and financial risk that can result in substantial losses.

Financial advisors must carefully consider the risks and other suitability details in determining appropriate investments for their individual clients’ portfolios.

In Canada, this document (this “document”) is directed only to Canadian residents that are “accredited investors” as defined under section 1.1 of National Instrument 45-106 Prospectus Exemptions and “permitted clients” as defined under section 1.1 of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. This document is not, and under no circumstance is to be construed as an offering memorandum, an advertisement or a public offering of any securities in any province or territory of Canada (each, a “Canadian Jurisdiction”). Under no circumstances is this document to be construed as an offer to sell securities or the provision of advice in relation to any securities. Any offer or sale of any securities described in this document will be made pursuant to the definitive private placement documents for the securities, which do not include this document. In addition, any offer or sale of, or advice related to, any securities described in this document will be made only by a dealer or adviser registered or relying on an exemption from registration in the applicable Canadian Jurisdiction. No Canadian securities regulatory authority has reviewed or in any way passed upon the information contained in this document or the merits of any securities described in this document, and any representation to the contrary is an offence.

To learn more about Ares Wealth Management Solutions, visit https://areswms.com. Ares Wealth Management Solutions is a global brand of Ares Management Corporation.

©2025 Ares Management Corporation REF: AM-04110

Since Vis Raghavan took over the reins last year, several have jumped ship.

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership's 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning