If you’re going independent, you might prefer to take a hands-on approach and do everything in-house when it comes to managing client assets. After all, that’s part of the reason why you went independent in the first place.

However, advisors can make better use of their time instead of doing the back-office tasks and other administrative work involved in asset management.

That’s where turnkey asset management platforms or TAMPs come in. With a variety of options to choose from, it can be difficult to nail down the right choice for the right value. That being said, there seems to be a few top dogs among the pack.

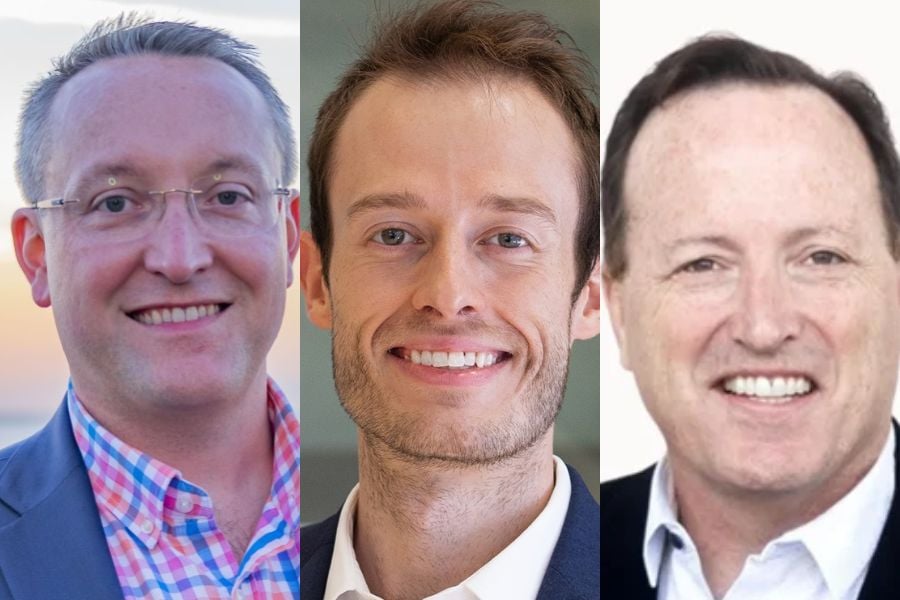

For Andrew Herzog, financial planner at The Watchman Group, he believes Envestnet's Tamarac platform to be one of the best. While he admits it’s not the cheapest option, it’s the one he’s been the most exposed to.

“They're trying to offer the full-blown package to help the advisor not just report and bill their clients on all the assets that are being managed, but also even offer the ability to do the trading for them,” he says. “That’s an additional fee, of course, but they're helping put more time back in your pocket."

Herzog adds that he finds the Tamarac interface simple and “very user-friendly”.

While having a TAMP like Tamarac allows advisors to get back to the day on phone calls, prospecting and doing financial planning, Andrew Evans, CEO of Rossby Financial admits that it’s not required.

“There's nothing wrong with not having a TAMP and I can't say that you need to have one,” he says. That said, Evans uses AssetMark for his firm, pointing to its “extremely robust practice management program” and their Leadership Advantage Program.

“AssetMark gives you so many tools, and they do these development programs that it's almost like getting an executive MBA within a year,” Evans said. “They're fantastic with that stuff. They’re really focused on the development of an advisor in their office and their practice.”

That's not to say that other TAMPs like Orion or SEI, who Evans considers strong contenders as asset managers, don't have such things. But the differentiator with AssetMark, he believes, is the effort and energy they put into their development programs for advisors.

Derieck Hodges, founder of Anchor Pointe Wealth Management, attests to AssetMark being one of the best options. “It’s been a fantastic experience working with them.”

“Their culture is massively important,” he added. “They're such a good fit because they are very client centric, like we are. They make every decision with us; they get that there's an end investor and financial planning client involved whose lives we’re affecting. They really bend over backwards to support us strongly.”

Reflecting on when he founded his firm, Hodges admits that while he initially walked away from using a TAMP, “it would have been wise to have started with one,” he says.

“When I talk to advisors, a lot of firms are struggling because of all the operational pressures and the regulatory pressures, so I do think a TAMP can help immensely with a lot of that.”

As for when new RIAs should consider implementing their TAMP, Herzog and Evans have differing opinions. Evans says they should start “right at the beginning.”

“A lot of the TAMPs will be able to give you guidance on whether you need outsource compliance or if you need certain software. If you're working with them, chances are you’ll get a discount on some things.”

Evans believes they can also provide advisors other services they otherwise didn’t realize they’d have to pay “top dollar” for, highlighting financial planning tools, marketing strategies and communication opportunities.

Herzog believes it’ll depend on a few things: the size of the firm, and whether the advisor wants to hand off the investment management and the trading. With The Watchman Group being a medium-sized firm with roughly 10 employees and over $500 million in AUM, he believes a TAMP is worth considering for other firms who are similar.

“If you're a sole proprietor RIA all by yourself and you can't afford a TAMP, you should probably stick with a simpler tool to do the reporting and the trading yourself until you start to get so many clients that you’re going to have to start outsourcing some more of that work so you can continue to grow.”

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.