Despite all appearances, Dynasty Financial founder Shirl Penney doesn’t see the wirehouses as the biggest rival to the independent advisory movement.

No – in his view, the biggest challenge is inertia, and he believes it’s his mission to help advisors overcome it. Considering his background, there are few people better qualified for the job.

Prior to founding Dynasty, Penney worked for almost a decade at Citi Smith Barney in various leadership roles, including director of private wealth management and head of executive financial services. It was there that he learned what motivated advisors (other than money, that is) and what they needed (once again, other than money) to propel them to venture out on their own.

“I spent a lot of time with advisors and their top clients, and, as a result, I heard firsthand how ultra-wealthy clients thought about how they wanted to receive their wealth advisory model,” Penney said. “Many had a family office that provided advice separate from safe custody, and separate again from where products were manufactured and sold.”

Back when Dynasty was getting started, in 2010, Penney says his early-stage thinking was to follow this model of separating advice, custody, and products, capturing it in a user-friendly, scalable platform that would enable advisors to make the jump to self-employment.

And jump they did. Currently, Dynasty’s network includes 55 firms representing 330 advisors, and the firm maintains more than $87 billion in assets on its core technology platform. In fact, Dynasty grew more in 2023 than in any year since its founding.

“I remember at the time feeling more excitement than pressure because I felt that once the flywheel got moving, it would inspire both breakaway advisors and breakaway clients, and over time it would provide positive change to a nearly 200-year-old industry,” Penney said.

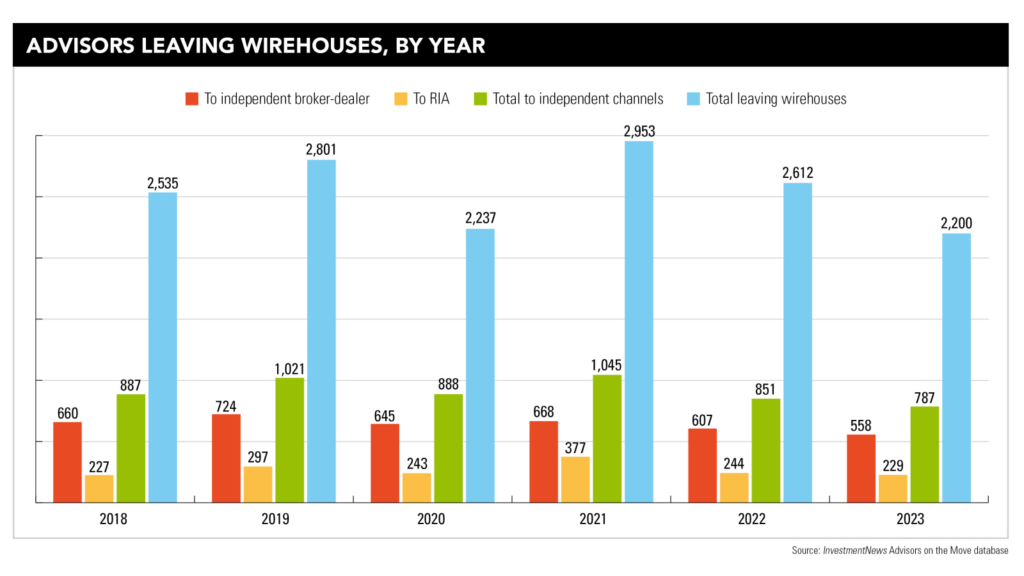

In 2023, a total of 2,200 advisors left wirehouses, with 787 of them going to independent channels, according to InvestmentNews’ Advisors on the Move database. That marked the sixth straight year in which more than 2,000 wirehouse advisors switched channels – and inertia was on the defensive.

Penney predicts the wirehouses will look and feel more like private banks over time as the exodus continues. He also wouldn’t be surprised to see some of them try to buy registered investment advisors as a way to increase their rosters of clients that are more captive to the firm.

Speaking of M&A, Dynasty isn’t immune to the arms race building up in the RIA space. As private equity-backed players gobble up advisory teams coast to coast, Penney says Dynasty is in the catbird seat as one of the few full-service investment banks providing advisory services, valuation, and capital programs to the RIA ecosystem.

“We see no slowing down this year for M&A, but buyers are being a bit more selective and want to see growth, healthy margins, and strong leadership, and are paying premiums for more professionalized businesses,” he said, adding that Dynasty often partners with PE firms to “provide a better outcome for both the advisor and the investors.”

While Dynasty’s pipeline may be bursting with advisors looking to go independent in 2024, its own attempt at independence in the form of an IPO has been put on hold, according to Penney.

In January 2022, Dynasty filed with the SEC to raise $100 million through an initial public stock offering. All systems were go at the time, with the stock set to list on the Nasdaq under the ticker symbol DSTY.

Seven months later, however, an S-1 filing threw cold water on Penney’s attempt to take Dynasty public. At the time of the filing, Dynasty was profitable, generating $7 million in net income in the first half of 2022, compared to $6.9 million in the same period a year earlier.

Penney said at the time he shelved the IPO idea in response to rough market conditions, deciding to sell minority ownership stakes to Charles Schwab and private equity investor Abry Partners instead. And on the shelf is where it currently remains.

“We kept the filing open for a number of quarters, but the window didn’t reopen,” he said. “It’s expensive and distracting for a business to keep a filing open so we pulled it and took investments from our amazing group of legacy investors, our employees, and brought on a new financial sponsor partner in Abry and a new strategic investor in Schwab.”

For the record, Penney said, “We are focused on taking care of our clients and growing the business, and will look at public markets again when the environment is more advantageous.”

Penney was born, raised, and schooled in Maine, which tends to be chilly, if not downright cold, most of the year. He situated Dynasty in the much more accommodating climate of St. Petersburg, Florida, where he and his wife are active in various charitable causes, with a focus on education, poverty, ALS, and veteran services.

As long as the market environment for Dynasty’s services remains equally warm and accommodating among wirehouse advisors on the move, Penney intends to make hay while the sun shines.

“We feel we are still very much in the early innings of the independent wealth movement,” he said.

Put simply, independence is what it’s all about for Penney – being one’s own boss. He stresses the fact that that Dynasty’s technology was built for “a business owner who happens to be an advisor.

“One of the beautiful things about the alignment in our business model is we get to live our American dream by empowering others to live theirs,” Penney said.

While entrepreneurs like Penney tend to see the bright side of any issue, he says he’s not blind to the challenges advisors face in making that big jump to independence. Such moves always affect friends and loved ones, and Penney says he’s not immune to the pressures placed on him by his employees and loved ones either.

“It is particularly hard to drive change when it involves team members, clients, or long-standing resource partners,” he said. “Many times, as a leader, you need to play the long game and do what is best for the business over time and hope that people understand.”

As for his long-term goal, Penney says it is to live up to his company’s name.

“To me, Dynasty means winning over a long period of time – sustained excellence,” he said. “As a founder and CEO, a big part of my job to make sure we do!”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.