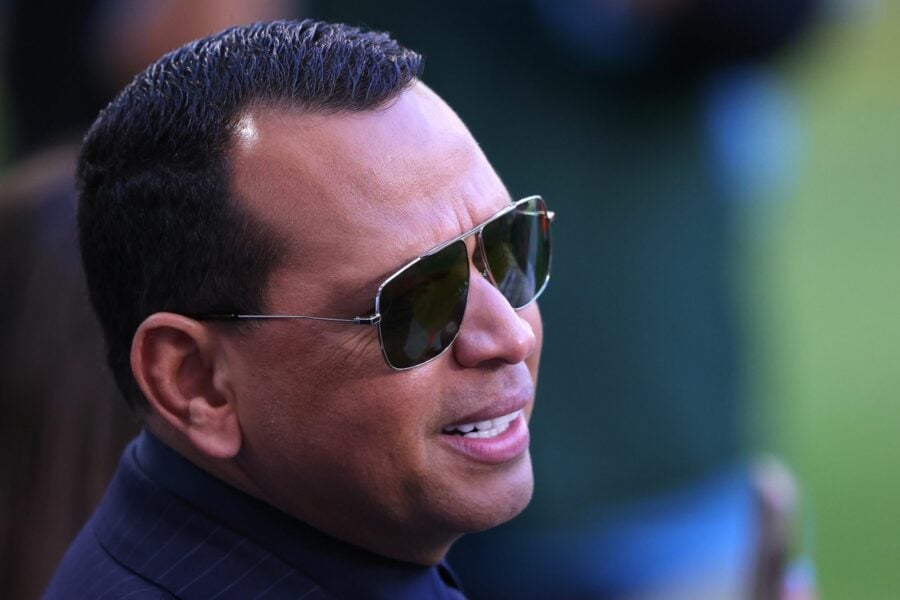

Online brokerage Nvstr announced Wednesday it has relaunched and rebranded as Tornado on the heels of a fresh funding round led by baseball legend Alex Rodriguez and billionaire serial entrepreneur Marc Lore.

Nvstr, founded in 2015, relaunched as Tornado with the debut of a new website, mobile app and technology features supported by the $10 million round of seed funding, according to the announcement. The round was led by Rodriguez, Chairman and CEO of A-Rod Corp., and Lore, who are co-founders of venture capital firm VCP, with participation from founder of Barstool Sports Dave Portnoy and New Enterprise Associates managing general partner Tony Florence.

Tornado enters a competitive but flourishing market for online brokerages. More than 10 million new brokerage accounts opened in 2020 as a surge of new retail investors entering the markets via online platforms skyrocketed during the pandemic, according the J.D. Power. Robinhood claimed 27% of all new do-it-yourself account openings, more than any other firm, according to the study.

Tornado, however, is advertising its app to users as a social platform that wants to provide them more community and education compared with competitors that focus on driving trading activity, according to the announcement.

Tornado follows a similar marketing campaign to social-media-driven upstart Public.com, a commission-free investing app for rookie investors that was founded in 2018 and was formerly known as Matador before rebranding. Public.com also has celebrity backing by actor Will Smith’s Dreamers VC and YouTube legend Phil DeFranco.

Online brokerages are racing to capture the attention of next-gen investors who are at the center of the $68.4 trillion in wealth projected to transfer into the hands of Gen Z and millennial investors over the course of the next 25 years, according to Cerulli Associates.

These Gen Z and millennial investors, largely influenced by social media platforms like Twitter and Reddit, drove the GameStop stock surge in January and February this year, and are still pouring investments into so-called meme stocks, an investment that sees a value increase primarily fueled by social media attention, and not company performance.

According to a study by Apex of Gen Z and millennial digital investor sentiment of the top 100 stocks during the second quarter, meme stock veteran AMC Entertainment was the No.1 investment, with GameStop remaining in the top 10.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.