Editor's note: This story has been revised to reflect updated data on moves for the quarter.

Fewer experienced advisors are set to change firms this year than at any time since the Great Recession, according to the latest data from the InvestmentNews Advisors on the Move database.

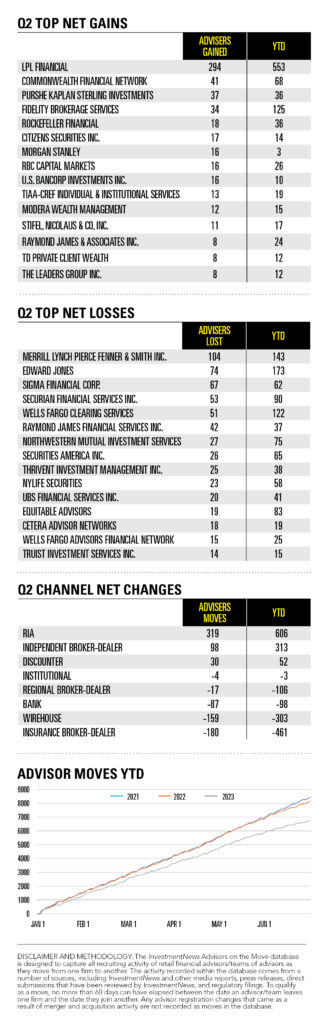

The total of 6,757 advisors tracked between advisory and brokerage firms over the first two quarters is 16.6% lower than the number in the comparable period last year and the lowest level of first-half activity observed in the data, which go back to 2009. According to government data, the size of the advisory profession has nearly doubled since then.

The data on advisor moves exclude moves resulting from mergers and acquisitions, as well as those between related firms.

The data in part reflect a longstanding pattern of advisors leaving wirehouses like Merrill Lynch, which lost 104 advisors net during the second quarter, for greater flexibility at firms like LPL Financial, which led the industry with a net gain of 294 advisors over the three months ending in June.

It is important to note that these numbers don’t reflect total head count at firms, and many firms have shifted their focus away from expensive recruitment efforts in recent years in favor of developing talent in-house.

Although RIAs and independent broker-dealers continued to add to their ranks on net, since relatively few advisors tend to leave these channels, recruitment activity was down across the board.

Broker-dealers recruited 4.4% fewer experienced advisors than over the first half of 2022. RIAs recruited 12.2% fewer experienced advisors, but that follows a post-pandemic surge of advisors entering the channel over the past two years.

It’s unclear whether the drop in recruitment signals a long-term shift in industry practice or a temporary lull amid heightened economic uncertainty. But slower activity is likely over the remainder of the year. As a result of summer vacations and the holiday season, the first half of the year tends to see slightly higher numbers than the latter half.

Other firms that saw a large number of departures during the second quarter included Edward Jones, with 74 net departures during the second quarter; Wells Fargo Clearing Services, which had a net loss of 51 advisors; and Northwestern Mutual Investment Services, with 27 net departures.

Firms that saw big gains in the second quarter, in addition to LPL, included Commonwealth Financial Network, with a net increase of 41 advisors; and Fidelity Brokerage Services, with a net gain of 34.

Over the first half of the year, Securian Financial Services saw a net loss of 90 advisors after the announcement in January that it would be acquired by Cetera Financial Group.

In May, Jacksonville, Florida-based Aegis Consulting, including principals Michael Cirino and Alexander Harrison and 11 advisors, joined Commonwealth Financial Network from Lincoln Financial Group. And in June, a group of 14 advisors, led by Scott Bishop, left Houston-based Avidian Wealth Solutions to form a new RIA, Presidio Wealth Partners, in partnership with Hightower Advisors.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.