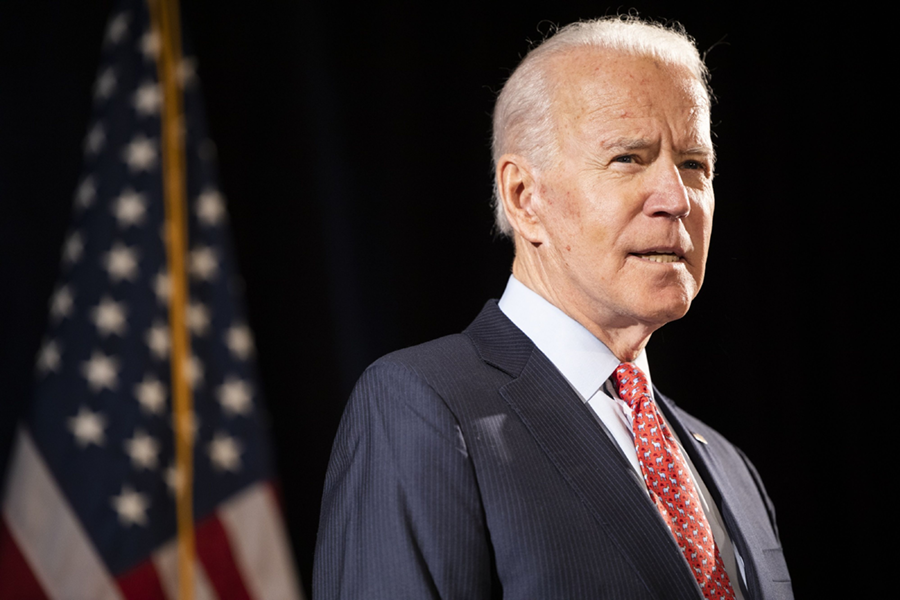

President Joe Biden on Wednesday plans to order government agencies to take a closer look at issues surrounding the fast-growing crypto market, from developing a potential digital dollar to combating illicit finance.

The White House executive order, which was outlined in a fact sheet, comes as the administration faces calls from the industry to take a leading role in setting policy for digital assets. It's the first attempt at coordinating the government’s strategy, though it falls short of providing a clear direction on regulation — something crypto firms have been clamoring for.

Instead, the order instructs agencies from Treasury to the Commerce Department to research a number of topics, including the pros and cons of a potential U.S. digital dollar. It also calls for studies and policy recommendations on issues ranging from protecting consumers to combating illicit finance. The goal is to take advantage of the potential benefits of digital assets while also addressing the risks, the White House said in the fact sheet.

Bitcoin traded above $42,000, up more than 9%, as of 6:45 a.m. in New York. Biden plans to sign the executive order later Wednesday.

“As we take on this important work, we’ll be guided by consumer and investor protection groups, market participants, and other leading experts,” Treasury Secretary Janet Yellen said in a statement.

The White House said the order will “reinforce U.S. leadership in the global financial system and safeguard the long-term efficacy of critical national security tools like sanctions and anti-money laundering frameworks,” in a statement attributed to both Brian Deese, director of the National Economic Council, and National Security Advisor Jake Sullivan.

The order “identifies the Administration’s policy priorities, both for cryptocurrencies and any future U.S. central bank digital currency, to help guide the evolution of the digital asset ecosystem in a way that is consistent with our values,” they said.

Agencies will have from 60 to 180 days to complete their reports, depending on the complexity of the issue, a senior administration official said late Tuesday on a call with reporters. Once the reports are finished, the administration plans to move quickly to carry out the recommendations, another official said, without giving a timeline.

Other topics agencies will be requested to research are:

• Maintaining financial stability.

• Promoting global competitiveness.

• Ensuring financial inclusion.

• Providing for “responsible” innovation.

“The United States must maintain technological leadership in this rapidly growing space, supporting innovation while mitigating the risks for consumers, businesses, the broader financial system, and the climate,” the fact sheet said.

The White House push to coordinate crypto regulation comes as countries from Singapore to the U.K. race to adopt standards for overseeing the industry, from licensing exchanges to curbing misleading advertising.

Congressional committees in the U.S. have stepped up hearings on cryptocurrency, which has ballooned into a nearly $2 trillion market, in recent months to examine some of the areas that might need to be addressed through legislation. Those topics include stablecoins, which are private tokens typically pegged to the U.S. dollar and other fiat currencies.

Another area is a central bank digital currency, or CBDC. The Federal Reserve said in a paper released in January that it doesn’t plan to move forward with a CBDC without clear support from Congress and the executive branch.

The White House is placing great urgency on research and development of a possible U.S. digital dollar, a senior administration official said on the call. The official rejected the notion that the U.S.’s relatively slow movement on a digital dollar would put it at disadvantage to rival nations like China, which is already piloting its own CBDC.

The dollar is underpinned by fundamental, long-held advantages, including the depth and liquidity of U.S. financial markets and the independence of the Federal Reserve System, the official said.

While the executive order puts the White House at the center of crypto policy, it’s unclear how much progress can be made given the looming November midterm elections and the possibility that Democrats might lose control of Congress. Although Republicans have acknowledged the need for regulation, they’ve often advocated a less strict approach than their Democratic counterparts.

The directive also comes at a time of renewed focus on crypto following Russia’s invasion of Ukraine — with digital assets hailed as a key vehicle for donations to the Ukrainian government while also being vilified as a potential avenue for Russian individuals and entities to evade sanctions.

A senior official told reporters that, in the case of Russia, the administration doesn’t view digital assets a viable workaround to the sweeping sanctions that have been imposed, in particular on the country’s central bank.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.