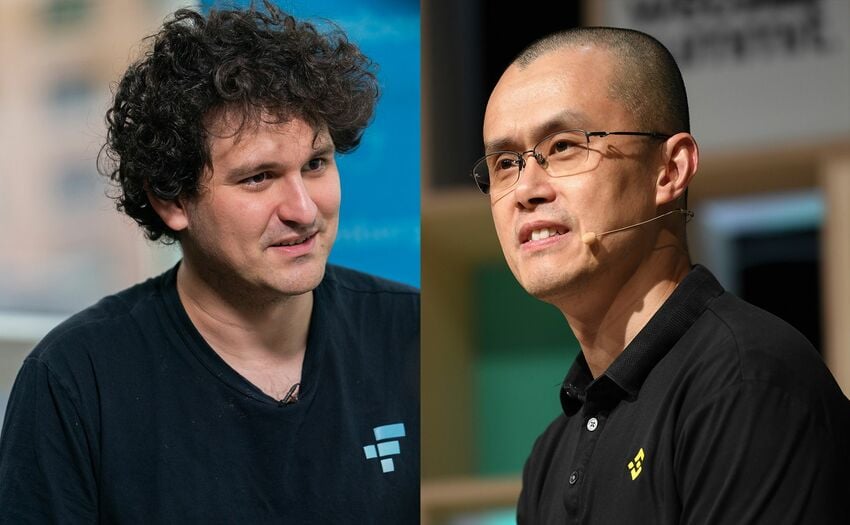

A 48-hour crypto drama ended in shock Tuesday as Binance Holdings Ltd. agreed to acquire its most formidable rival, FTX.com, after helping whip up an investor exodus from billionaire Sam Bankman-Fried’s three-year-old exchange.

The sharp turn of events will reshape the more than $1 trillion industry amid a possibly prolonged market downturn. The two founders made the announcement on Twitter concurrently. “To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch,” Changpeng Zhao, CEO of Binance, said in a tweet. Terms weren’t disclosed.

“A huge thank you to CZ, Binance, and all of our supporters,” said Bankman-Fried, CEO of FTX.com, on Twitter. “Our teams are working on clearing out the withdrawal backlog as is. This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in.”

Bitcoin pared an earlier loss, reaching $20,488 as of 11:52 a.m. EST in New York. BNB, the native token of the Binance blockchain, jumped 15%, erasing an earlier loss of as much as 7.4%.

The tension between Bankman-Fried and Zhao has been brewing almost since the start. Back in 2019, Binance invested into FTX, then a derivatives exchange. The next year, Binance launched its own crypto derivatives, quickly becoming the leader in this space.

Tensions rose as the two companies increasingly had been seen as different by regulators. Bankman-Fried was testifying in Congress, while Binance was said to be facing regulatory probes around the world and emphasized that it’s not headquartered anywhere.

The two companies have also been competing for assets, with both bidding for assets of Voyager Digital. FTX won the auction of Voyager.

The drama reached fever pitch on Sunday, when Zhao announced he would sell all of his FTT holdings, the native token of FTX exchange, worth $529 million at the time due to “recent revelations that came to light.” The tweet followed a story from CoinDesk saying that Alameda Research, a trading house owned by Bankman-Fried, had a lot of its assets in FTT token. FTT pared an earlier loss of more than 35% to around 19%, and was recently trading at around $18, according to prices on CoinMarketCap.

Binance is the largest crypto exchange by far, with trading volume of about $31 billion so far today. FTX is second in spot trading, with volume of about $3.7 billion, according to CoinMarketCap data. CoinMarketCap is owned by Binance.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.