Bitcoin’s rally shows little sign of abating yet after the token jumped past $51,000 for the first time.

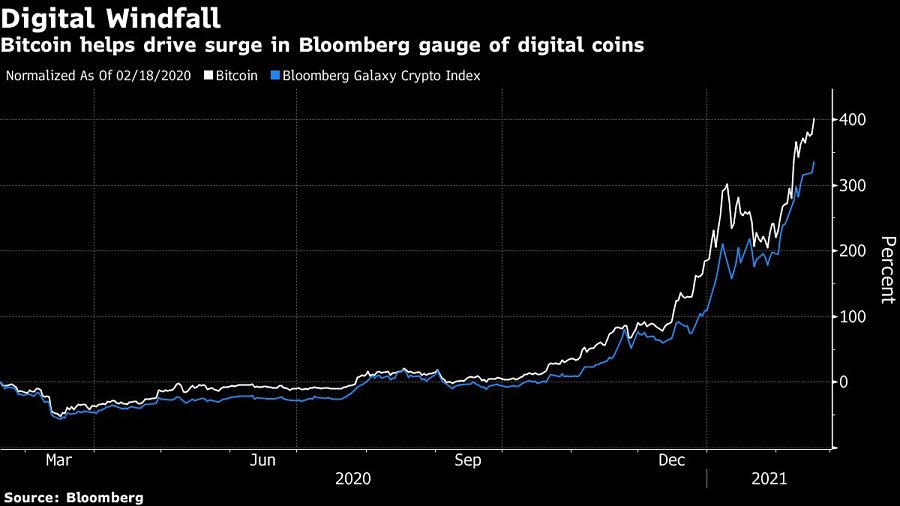

The largest cryptocurrency rose almost 6% Wednesday to about $51,431 after a fivefold surge in the past year, according to a composite of prices compiled by Bloomberg. The Bloomberg Galaxy Crypto Index reached a record.

Bitcoin’s rally for some is emblematic of speculative froth in financial markets awash with stimulus. The crypto faithful counter that the digital asset is grabbing more mainstream attention, especially after Tesla Inc.’s recent $1.5 billion purchase. On Tuesday, MicroStrategy Inc. said it would sell $600 million of convertible bonds and use the proceeds to buy more of the tokens.

MicroStrategy’s step is “a warning sign if there ever was one that things are getting out of hand in the crypto world,” Jeffrey Halley, a senior market analyst at Oanda Asia Pacific, wrote in emailed comments.

Others take a different view, contending that demand from institutional investors and companies is set to expand, driving further gains.

“There are a number of reasons why Bitcoin is soaring, but what stands out most is the trend that MicroStrategy started and Tesla popularised: moving institutional balance sheets into Bitcoin to hedge against inflation,” said Nicholas Pelecanos, head of trading at NEM.

Activity in Bitcoin futures suggests traders don’t see a sudden end to the crypto rally, with spreads continuing to widen between the active contract and March futures, according to data compiled by Bloomberg.

Shares of Asian crypto-linked companies are advancing too. Japan’s Monex Group Inc. jumped 11% to hit a 13-year high, while BC Technology Group Ltd. in Hong Kong closed at a record.

JPMorgan Chase & Co. strategists said Bitcoin’s volatility needs to ease to prevent its rally from fizzling. Other commentators see a mania likely to end in a bust akin to the implosion in 2017.

The digital coin’s 60-day realized volatility is around the highest since May last year, though still below the levels seen around the peak of its last boom some three years ago.

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

New report examines the impact that the initiative has had on philanthropy.

Few feel confident that they will meet their retirement goals.

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.