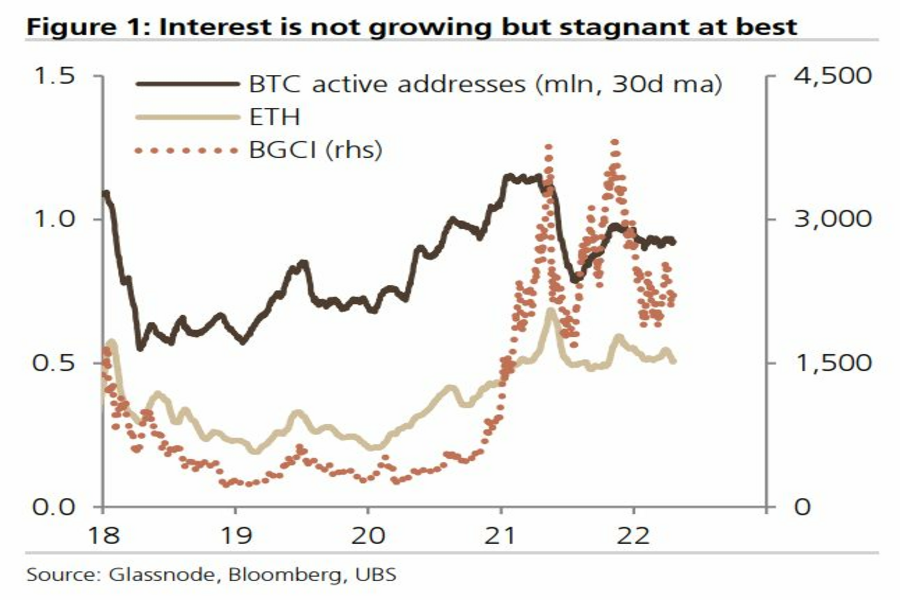

Bitcoin seems to be stuck in a rut: Prices are flagging, online searches for the largest cryptocurrency and other digital assets have fallen off, fewer and fewer coins are changing hands, and crypto-related funds are seeing massive outflows.

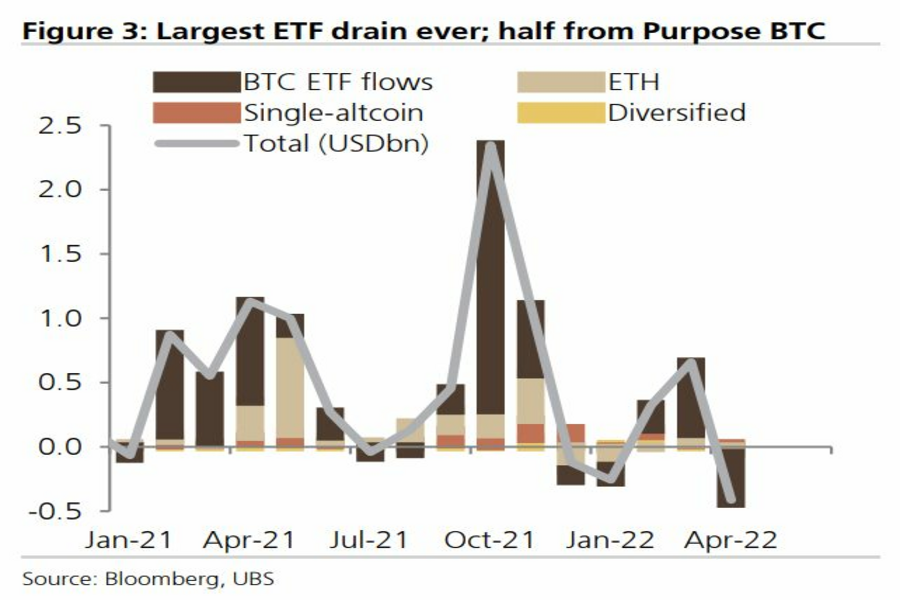

In fact, a UBS analysis of around 160 products shows April is set to see the largest crypto-ETF outflows on record, with investors having pulled more than $417 million so far this month. A Bitcoin product from Purpose alone has seen more than $220 million come out since the end of March.

In other words, the latest bout of crypto fever seems to be breaking, much as it did after the boom and bust of 2017 and 2018. The space is also no longer notching the huge influx of new investors that it had seen in the past two years.

“The vast majority of the population seem to have little interest in crypto because it’s too complicated, too volatile, too strange,” James Malcolm, head of foreign exchange and crypto research at UBS, said by phone. “So, in a sense, we’re stuck at the moment.”

Cryptocurrencies, just like other assets considered to be riskier or more volatile, have sold off this year as central banks around the world raise interest rates to fight persistently hot inflation. Bitcoin peaked near $69,000 in November before a selloff commenced, and it hasn’t been able to recover. It’s down roughly 40% since reaching that record.

Aggregated trading volumes across crypto exchanges like Coinbase and Kraken have also fallen off as interest remains muted and the flow of new investors dries up. Meanwhile, Google searches for the word “Bitcoin” have also declined, and social-media activity via the Crypto Subreddit — as measured by things like comments and posts per day — is down from mid-2021 levels.

So, what needs to happen for interest to perk up again? UBS’ Malcolm says industry participants want greater regulatory clarity, something that might still be a long way off. If prices started to rally again, investors could return.

“It either needs new people or it needs existing players to dedicate an increasingly large slice of resources to the industry,” he said.

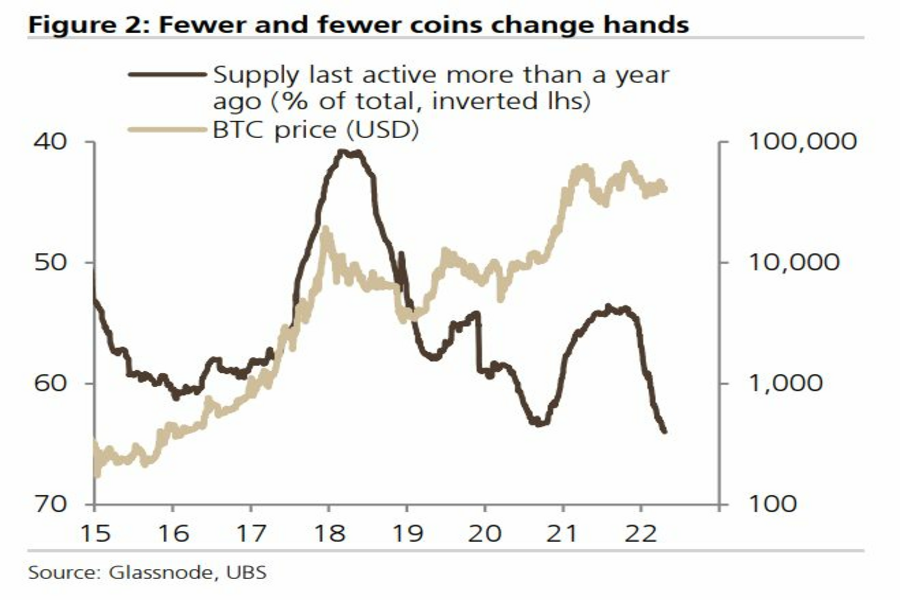

One reason Bitcoin’s been stuck in a rut is that a lot of the coin’s supply has been moving into long-term-holder accounts. Analysts at Blockforce Capital, who used Glassnode data, cite the “massive amount” of the coin that’s been coming off exchanges recently — that gets taken “offline” and put into cold storage, meaning it’s not likely to be traded. The number of illiquid coins is not just growing, but the rate at which it’s doing so is accelerating too.

But the data could be hiding a silver lining. “We have only seen this level of outflow from exchanges four previous times since the start of 2018,” the analysts wrote in a note. “Three of those instances correlated with a sharp upward movement in price not too long after.”

US wealth advisory business will get international footprint boost with new tie-ups.

New research shows physicians start their careers at least $200K in debt.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.