The world’s largest exchange-traded fund issuer is taking another step into cryptocurrencies with the filing of a new metaverse product, just months after launching a digital-assets fund that has so far failed to interest investors.

BlackRock Inc. is aiming to track companies that have exposure to the metaverse via the iShares Future Metaverse Tech and Communications ETF, according to a Thursday filing. The fund, for which fees and a ticker weren’t yet listed, might include firms that have products or services tied to virtual platforms, social media, gaming, digital assets, augmented reality and more.

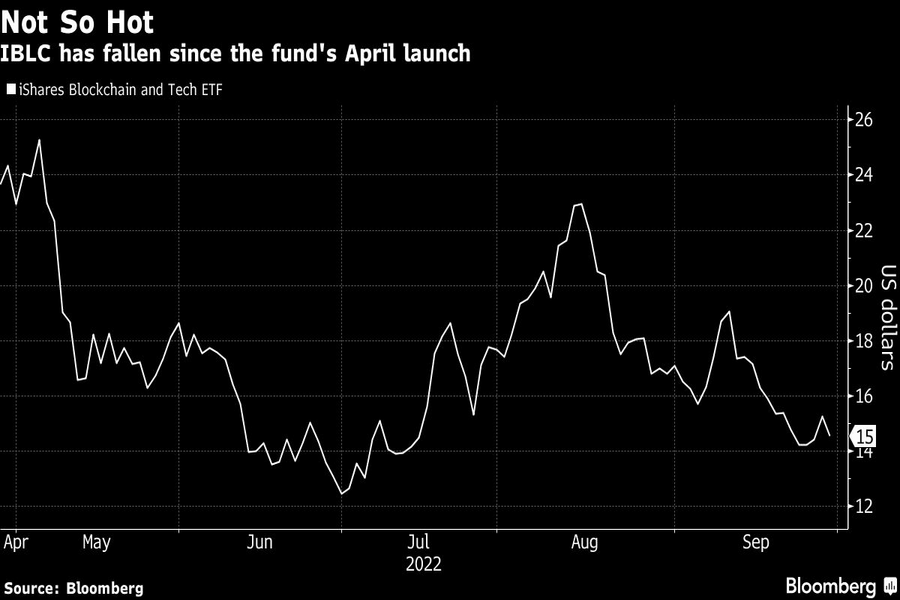

The parent company is making inroads into digital assets, launching in April its blockchain and tech fund (IBLC), which has inflows totaling about $6 million. BlackRock recently partnered with crypto exchange Coinbase Global Inc. to make it easier for institutional investors to manage and trade Bitcoin, making waves in the crypto market.

Yet interest in the digital-assets ecosystem has plunged this year as prices for just about every crypto token have tanked. Bitcoin, the largest by market value, has plummeted about 60% in 2022 and Ether has declined as well. Google searches for cryptocurrencies have also diminished amid the so-called crypto winter.

“You can tell from other metaverse, blockchain funds that interest has waned,” said Todd Sohn, ETF strategist at Strategas Securities. “I get the long-term idea, but now there’s a ton of competition in the space too.”

BlackRock’s metaverse ETF wouldn’t be the first. A handful of funds are already trading, including the Roundhill Ball Metaverse ETF, and there are also products from Subversive and Fidelity.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.