Even without the fervor around the Travis Kelce-Taylor Swift love story, sports franchises are big businesses watched by billions. They also occupy a unique place in the world of private equity, something renowned investor Christopher Zook has capitalized on.

Owning sports teams is just one chapter in the Zook playbook, however. Based in Houston, Texas, he is founder, chairman, and chief investment officer of CAZ Investments, which has about $6 billion in assets under management in the private markets across the likes of energy, general partner stakes, private credit, real estate, and professional sports. He has also been hitting up the book circuit with Tony Robbins as co-author of The Holy Grail of Investing.

CAZ’s owners and shareholders – Robbins is a minority, passive shareholder - have more than $600 million of their own money invested in the company’s funds. But its blueprint meant creating a network where others could co-invest, “lock arms as a unified front,” and gain access to opportunities previously available only to large institutions. Its CAZ Network now stands at about 3,100 investors in 50 states and 13 countries.

“There’s a lot of big institutions that can write large checks,” Zook says. “And then there are a ton of people that can write fast checks. There are very few people that can write fast and large. In the last 12 months, we’ve invested a million dollars in an investment and a billion dollars in an investment. There are very, very few people and organizations that can flex like that.”

Since it was founded in 2001, CAZ has primarily focused on vehicles for qualified purchasers – those with $5 million in investments – but it has now opened the door fully to accredited investors with its new CAZ Strategic Opportunities Fund.

The firm’s founder is riding the crest of a wave and bullish in his outlook, believing that the Federal Reserve is “stuck in a box” and unwilling to risk cutting rates as quickly as people expect. This will serve as a boon to what CAZ offers, according to Zook, which is less correlation to the public markets.

However, the true essence of Zook’s philosophy was born years earlier after a knee injury forced him to give up playing football for Texas Tech University. To help pay for college, he started trading commodities. A course in agricultural economics had sown the seed and taught him how to hedge. If you’ve got a corn crop, for example, you’d better hedge it in case the price is bad when you harvest. Zook applied these principles to the financial markets and never looked back.

“I’m a very competitive person, and one of the things I love about trading in general markets is at the end of the day, you know whether you’ve won or lost,” he says.

“Candidly, and I've never really said this publicly, but I’m so much better as a private market investor because of being a commodities trader,” he adds. “If you do not have discipline about what you’re doing with the amount of leverage embedded in commodities, they will take you out on a stretcher.”

Zook got his start in the industry at PaineWebber & Co., which was acquired by UBS in 2000, before he was recruited to Lehman Brothers, where he worked in the executive services firm. Then, after a stint at Prudential, he moved to Oppenheimer. But in the background of all these jobs was a goal he set himself at 21 – to create CAZ Investments within 10 years. Nine years and nine months later, with the backing of some prominent families in Texas, he achieved his goal.

Zook puts CAZ’s subsequent success down to its “enormous respect for risk.” Over 23 years, in realized and unrealized investments in the private markets, he says CAZ has made money on 94 percent of them. “We spend almost all of our time focused on what can go wrong. What’s going to blow up in our face? What’s going to simply not work?”

The world of sports, then, with all its potential for heartbreak and unpredictability, doesn’t sound like a natural fit. But separating the on-field from the off-field activity is crucial, and CAZ’s portfolio of 30 sports franchises makes for eye-catching reading.

In the US alone, it includes Major League Baseball names like the San Diego Padres, San Francisco Giants, Los Angeles Dodgers, Chicago Cubs, Houston Astros, and Boston Red Sox. In the National Hockey League, it owns stakes in the Tampa Bay Lightning and Pittsburgh Penguins, while the National Basketball Association is represented by the likes of the Sacramento Kings, Golden State Warriors, and Philadelphia 76ers.

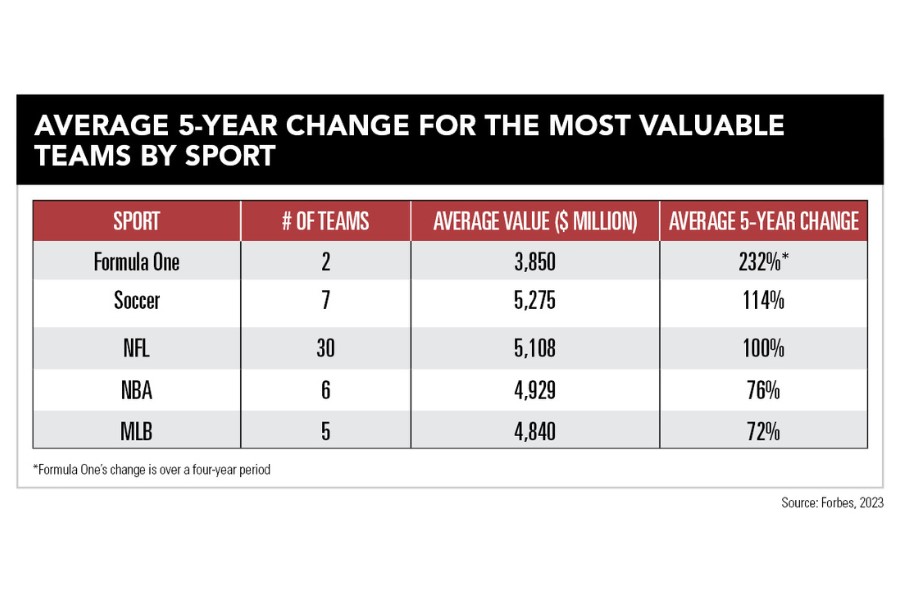

Major League Soccer clubs also feature but beyond North America, CAZ also owns a piece of Premier League team Liverpool, French club Paris Saint-Germain, and Formula One team Aston Martin, and it recently bought into the PGA Tour.

There’s no doubt this is a fun area of investing for many, but Zook says the thesis for buying sports teams is actually about capturing the change in consumer behavior. With the rise in streaming, the demand for live content among advertisers is “going through the roof.”

“It’s an irrefutable trend,” he says. “So, how do you take advantage of that? Well, I can’t buy a piece of the Eagles, the music group, and I can't go out and buy a piece of the Oscars. But I can buy professional sports teams. Four years ago [the rules changes], starting with Major League Baseball in the United States, we now have the ability to own qualified institutional investor [minority] stakes in multiple teams.”

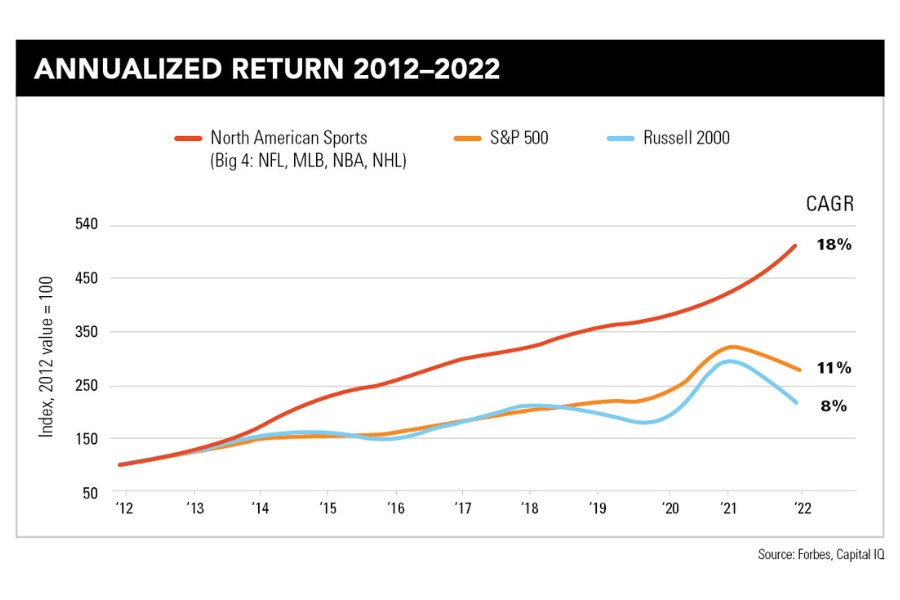

Generally, owning sports teams is a capital gains vehicle rather than a cash revenue generator. And while European sports is a different animal given its promotion-relegation model, US sports teams benefit from having a legal monopoly in their cities, gaining a guaranteed pro rata share of profits, season ticket sales, media rights, sponsorship deals, and often ownership of surrounding real estate. It’s why professional sports teams in North America have outperformed the S&P 500 by a factor of two over the last 25 years compounded, Zook adds, because it’s a very predictable business model.

CAZ also owns a plethora of different private asset management names like Silver Lake, Platinum Equity, and Monroe Capital – all stellar operations that have helped propel CAZ’s success. It also loves general partner stakes and is fully behind the artificial intelligence boom, owning a piece of OpenAI. But the power of sports is a universal calling card Zook is happy to provide to advisors.

“We take great pride in helping investment advisors grow their businesses because they cannot get what we do,” he says. “It’s unique when we’re able to go out and tell somebody, ‘Oh, by the way, would you like to own a piece of the Houston Astros? Well, there’s only one place in the world you can buy the Astros.’ That’s a differentiator for the advisor and the ultimate door opener.”

The new regional leader brings nearly 25 years of experience as the firm seeks to tap a complex and evolving market.

The latest updates to its recordkeeping platform, including a solution originally developed for one large 20,000-advisor client, take aim at the small to medium-sized business space.

Crypto investor argues the federal agency's probe, upheld by a federal appeals court, would "strip millions of Americans of meaningful privacy protections."

Meanwhile in Chicago, the wirehouse also lost another $454 million team as a group of defectors moved to Wells Fargo.

The broker-dealer giant's latest acquisition agreement extends its push towards offering enhanced financial planning and investment management.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.