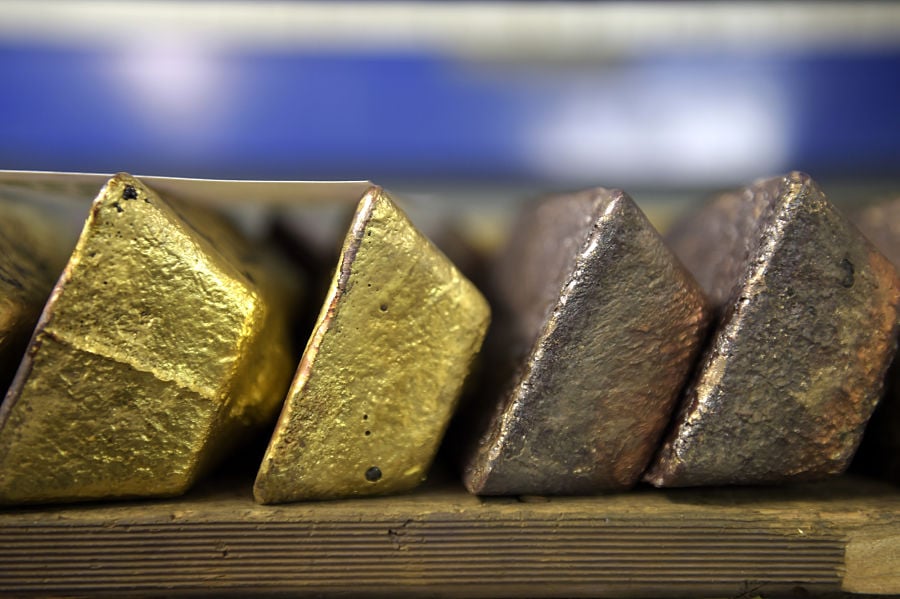

In a joint effort to fight the rise of precious metals fraud, particularly targeting those nearing or in retirement, major regulatory bodies have issued a stark warning. In a statement, the Commodity Futures Trading Commission said it is working with the Financial Industry Regulatory Authority Inc. and the North American Securities Administrators Association to highlight risks associated with investing in overpriced gold, silver, and other metals.

While dealers may talk these investments up as "safe," particularly as a haven against economic uncertainty, the three watchdogs warned they can entail hefty markups, commissions, and fees, eroding potential profits for the investor.

To empower investors, the CFTC and Finra have released an investor bulletin, 10 Things to Ask Before Buying Physical Gold, Silver, or Other Metals, which outlines critical questions prospective buyers should consider.

Another flyer by the CFTC, Lies Versus Facts: The Truth Behind Gold and Silver IRA Scams, takes aim at common falsehoods propagated by scam dealers.

According to the CFTC, the actors behind precious metal investment scams often sell the idea of retirement plan rollovers because for most people, those plans hold the largest chunk of their investing dollars. Older investors – given their larger retirement account balances and easier access to these funds – are particularly juicy targets.

To deceive the elderly, scam dealers may use affinity fraud techniques including infiltrating specific political or religious communities on social media, sending spam emails, making cold calls, and fabricating fake endorsements from well-known religious figures, pundits, and celebrities.

The CFTC also sounded the alarm on self-directed IRAs, which it says offer a wider range of investment options than regular IRAs but may enjoy only limited protections. It pointed to a joint warning, issued by the SEC, NASAA, and Finra, which said trustees or custodians overseeing SDIRAs typically don’t look into the background of the entity promoting an investment.

In its latest enforcement report, NASAA said cases involving SDIRAs have been on the rise. In 2022, it said state securities regulators reported 112 investigations of promoters using SDIRAs in schemes linked to sales of securities or investment advice, a 36 percent jump from 2021.

Some fraudsters may attempt to steal investors’ money by spoofing a self-directed custodian. A well-meant financial penalty for early withdrawals could also be harmful to self-directed IRA investors, the CFTC said, as it could give bad actors more time to run their schemes.

“These frauds can be particularly damaging to individuals near retirement and retirees who could lose much of their retirement savings and find themselves unable to return to work to support themselves,” said Melanie Devoe, director of the CFTC's Office of Customer Education and Outreach.

The CFTC highlighted its numerous efforts in recent years to crack down on precious metal fraud, including a 2020 joint civil enforcement action with 30 state authorities against two precious metals dealers who stole $185 million from elderly investors.

Over the past decade, the CFTC has pursued cases against a host of fraudulent dealers, who collectively sold over $500 million in overpriced metals to unsuspecting victims.

A Texas-based bank selects Raymond James for a $605 million program, while an OSJ with Osaic lures a storied institution in Ohio from LPL.

The Treasury Secretary's suggestion that Trump Savings Accounts could be used as a "backdoor" drew sharp criticisms from AARP and Democratic lawmakers.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.