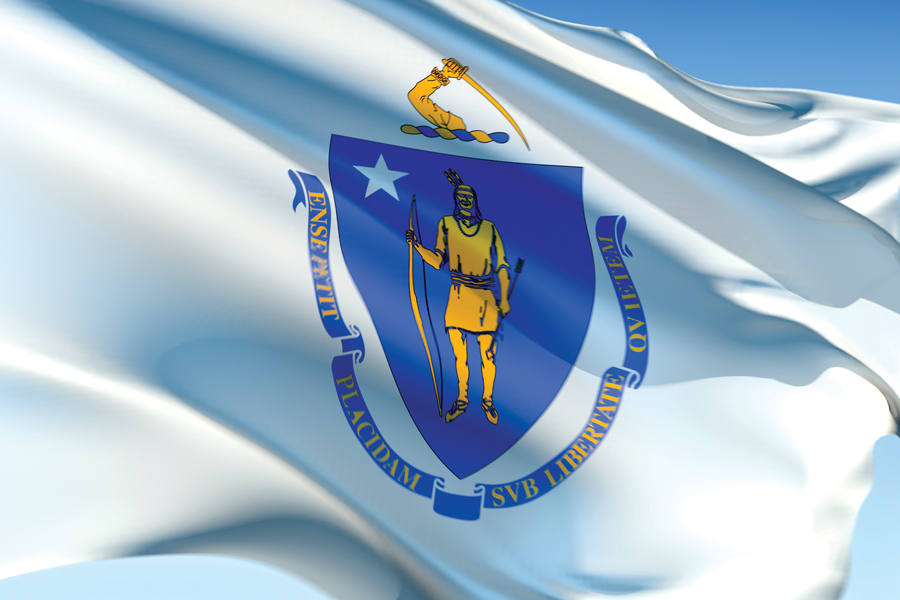

Massachusetts state securities regulators have fined U.S. Data Mining Group Inc. $1 million over charges that the company, incorporated in Nevada with offices in Florida and New York, sold fraudulent and unregistered securities to Massachusetts investors.

William Galvin, Massachusetts secretary of the commonwealth, described the case as a warning for individuals who were thinking of investing in Bitcoin mining or cryptocurrencies.

In a consent order, the state’s securities division accused the company of selling nearly $4 million in unregistered securities to Massachusetts investors, while also failing to appropriately disclose the involvement of several people who had previously been charged by the Securities and Exchange Commission with conspiring to commit securities fraud by operating a “pump-and-dump” scheme. Two of the individuals who formed U.S. Data Mining Group are considered “bad actors” under securities laws as a result of their prior involvement in a series of schemes, Massachusetts securities officials said in a release.

According to the securities division, Massachusetts investors weren't properly warned or advised of the involvement of these men and others when they purchased shares of the company in 2021. In addition to the $1 million fine to be paid to the Commonwealth of Massachusetts, the consent order also requires the company to make offers of rescission to Massachusetts investors, and to refund the total amount of investors’ stock with interest, if investors so choose.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.