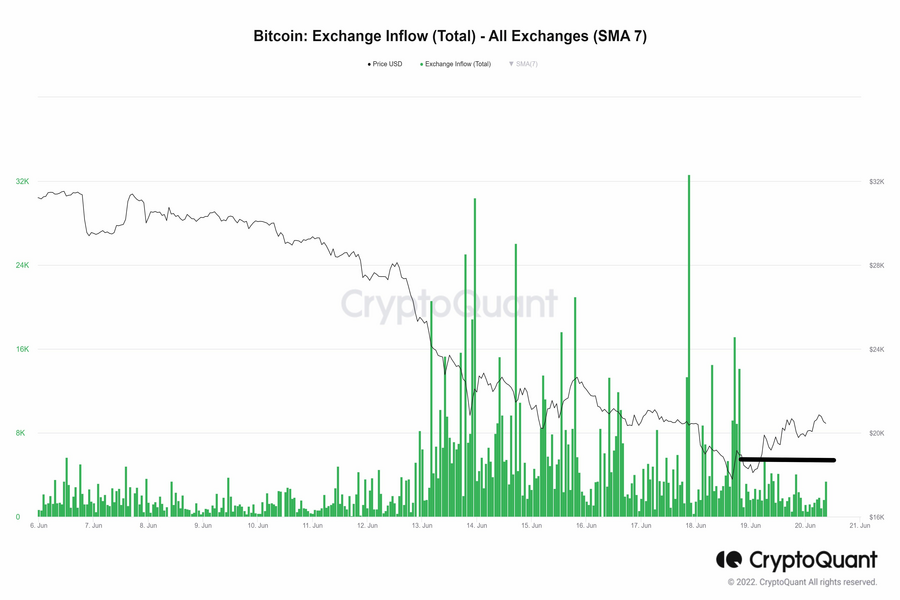

One notable source of selling pressure on Bitcoin is ebbing, buttressing arguments that the token is due at least a temporary reprieve.

Fewer Bitcoins are being moved to exchanges from so-called cold wallets — offline stores of the digital asset — for potential sale, according to data from analytics firm CryptoQuant.

The seven-day average of such flows dropped to 92,470 tokens Tuesday from a weekend peak of 137,326. The latter was one of a string of elevated readings for much of last week that accompanied a slump in Bitcoin to $17,600 on Saturday, the lowest since November 2020.

When the exchange inflow metric was spiking, the “selling pressure” on the world’s largest cryptocurrency was as intense as in May — the month that saw the unraveling of the TerraUSD stablecoin, said Burak Tamac, senior researcher at CryptoQuant.

“If another wave of capitulation occurs, we probably see this metric spike up again,” Tamac said in an interview.

Cryptocurrencies are stabilizing following last week’s rout, part of a nascent improvement in investor sentiment in global markets. Bitcoin climbed as much as 4.9% on Tuesday and was trading at $21,366 as of 10:09 a.m. in London. Tokens ranging from Ether to Solana and Polygon also rallied. Dogecoin gained after Elon Musk reiterated his support for the coin, which was created as a joke in 2013.

Just how long this bout of calm can last is anyone’s guess. A global wave of monetary tightening is sucking liquidity from financial markets, leaving them vulnerable to setbacks. Bitcoin is down 54% this year, global stocks have shed almost 22% and world bonds are nursing losses of nearly 15%.

Katie Stockton, founder and managing partner of Fairlead Strategies, an independent research firm focused on technical analysis, flagged the $18,300 to $19,500 range that Bitcoin loitered in over Saturday and Sunday.

“It’s a very natural place to see some stabilization, a kind of relief rally,” Stockton said in an interview on Bloomberg Television. “We do think that relief rally would be muted, however, just given the downside momentum really across the board.”

A Texas-based bank selects Raymond James for a $605 million program, while an OSJ with Osaic lures a storied institution in Ohio from LPL.

The Treasury Secretary's suggestion that Trump Savings Accounts could be used as a "backdoor" drew sharp criticisms from AARP and Democratic lawmakers.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.