This article is one in a series of midyear outlooks for 2022 by the InvestmentNews team.

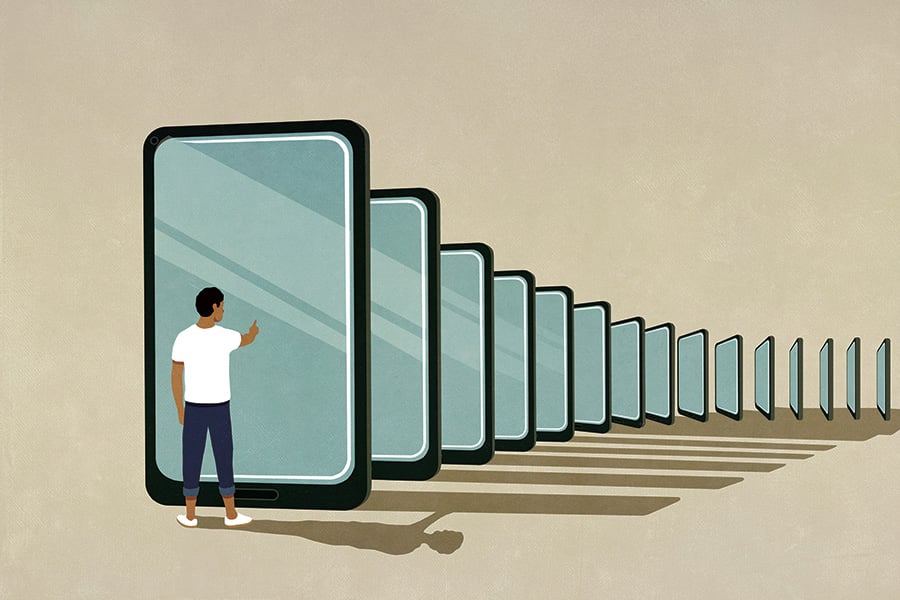

During a decade of historic market returns, fintech promised to help financial advisers be more efficient and build deeper relationships with clients. Those claims may soon be put to the test.

Most of the tools advisers now rely on have not faced the prolonged market volatility, inflation and threat of recession that many believe will loom over the rest of 2022. Firms across the industry are going to keep a close eye on the tools they’ve adopted, how advisers use them and how clients respond, said Susan Glover, president of consultancy firm Susan Glover & Associates.

“Each of the technologies that a firm is focusing on, they will all be tested.”

Susan Glover, president, Susan Glover & Associates

For example, those who embraced financial planning tools as a cornerstone of their practice will soon find out how good they are at handling client expectations of progress towards goals, Glover said. Firms that emphasize investment performance will monitor how modern portfolio reporting tools help communicate potentially bad news to clients.

“I think each of the technologies that a firm is focusing on, they will all be tested,” Glover said.

Advisers will also be making sure risk assessment tools accurately measure clients’ risk capacity and tolerance in relation to behavioral responses, said Daniel Crosby, chief behavioral officer at Orion Advisor Solutions, which acquired risk analytic company HiddenLevers in 2021. The adviser fintech world is going to revolve around how to help advisers keep investors calm, focused and thinking about the long term, he said.

“Not all clients are worriers, but advisers need to be able to discern who is and isn’t impacted by periods of market volatility so that they can tailor their outreach efforts,” Crosby said. “Things like risk assessment, behaviorally informed planning, reporting, goal optimization and client discovery tools are likely to take center stage for the next few years.”

DATA INVESTMENT LOOMS

A serious downturn could lead advisers to reevaluate the tools they currently have and how they are used throughout the firm, according to Jeff McMillan, head of data, analytics and innovation at Morgan Stanley Wealth Management. Successfully navigating the bear market will require a platform that integrates goals-based planning, investment risk analytics and client engagement across digital channels, he said.

“The tools and the technologies that people have been investing in more broadly were based on the assumption that markets will go up forever,” McMillan said. “I don’t think a lot of firms have really made a deep investment in [investment] risk types of tech. They are really expensive and when the market is going gangbusters you can make the argument that you don’t need them as much. Same with goals-based investing.”

Advisers may also get more focused on how they adopt technology and standardize its uses across the firm, said Riskalyze CEO Aaron Klein, who added that volatility can be an opportunity for fintechs to prove their value to advisers — if the company’s balance sheet is prepared for a recession. Several fintechs have already made significant cuts to prepare for a difficult economy.

“What we can see is that our business grows really nicely in good markets and our phones ring off the hook in bad markets because advisers need a better way to talk about risk,” Klein said.

More articles in this series:

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.