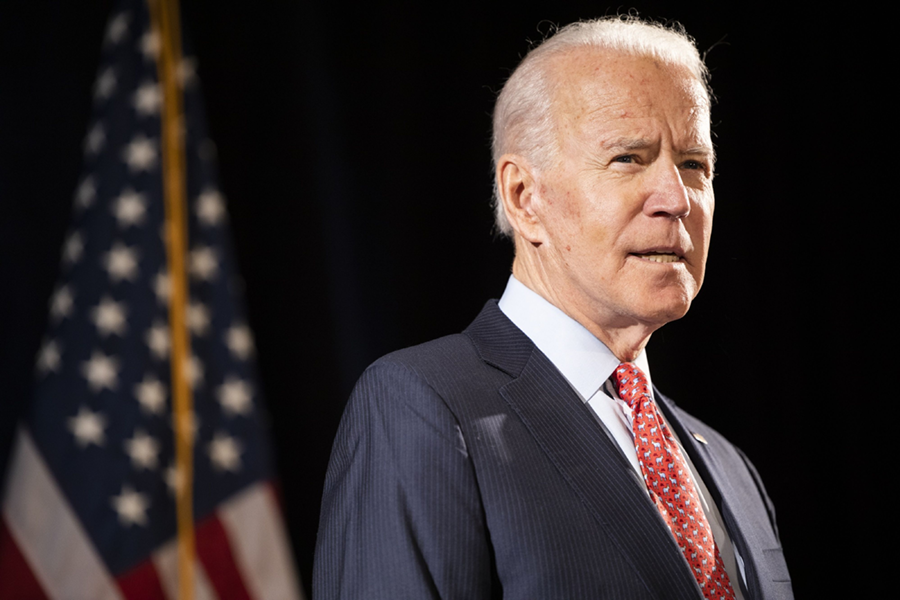

Former Vice President Joe Biden would raise capital gains rates and make other changes to the tax code to ensure that wealthy Americans and corporations pay more for government investments in infrastructure, health care, education and other programs — ideas that draw mixed reviews from financial advisers.

Last week, the presumptive Democratic presidential nominee released a 110-page framework crafted with a former competitor for the party’s nod, Sen. Bernie Sanders, I-Vermont. Biden also announced what he called the Build Back Better program for pandemic recovery and economic growth.

“He will pay for the ongoing costs of the plan by reversing some of [President Donald Trump’s] tax cuts for corporations and imposing common-sense tax reforms that finally make sure the wealthiest Americans pay their fair share,” an overview of the Build Back Better plan states.

Under Biden’s plans, capital gains would be taxed at ordinary rates, rising from 15% or 20% for investments held for more than a year up to 39.6% for taxpayers in the highest bracket. He also would end the so-called stepped-up basis for inherited stocks, requiring that capital gains be paid before the investments are passed to the next generation.

Biden would raise payroll taxes on the highest earners to increase Social Security benefits, the framework states. He would raise estate and corporate taxes. He would use taxes to “address extreme concentrations of income and wealth inequality” and would limit “unequal and unproductive tax expenditures” to make the code more progressive and fund productivity improvements.

The Biden approach to tax policy concerns Michael Caligiuri, chief executive of Caliguiri Financial in New Albany, Ohio.

“What that will do is it will disincentivize people to invest,” Caligiuri said. “They’re more concerned about punishing certain people and not punishing other people. It’s not about raising everybody up. It’s about bringing wealthy people down.”

But John Bovard, owner of Incline Wealth Advisors in Cincinnati, said a targeted approach to raising some taxes on higher-income Americans — such as ending the so-called stepped-up basis for inherited investments — is a good idea.

“There are some pockets of wealth that should be paying higher taxes,” Bovard said. “If [Biden] can navigate it and be strategic, it could be a good thing. It eliminates the cycle of the rich staying rich.”

Generating higher government revenue is necessary to cleaning up the environment, said Dejan Ilijevski, president of Sabela Capital Markets in Munster, Indiana.

“In my opinion, climate change is the most important thing facing us right now,” Ilijevski said. “I’m happy to see [Biden has] included it prominently in his plan. To take on climate change, you probably need to raise taxes on the wealthy in some way.”

Some Biden recommendations give Bovard pause, such as higher corporate taxes. In that area, he favors the lower-tax policies that President Trump has pursued.

“I like parts of both because there’s work to be done in order to stop the deficit from ballooning,” Bovard said.

The Biden plan does not include a wealth tax that was popular among other Democratic presidential primary candidates, including Sanders.

Overall, Biden is proposing a $4 trillion tax increase, according to an analysis by Americans for Tax Fairness. That compares to tax plans from other Democratic candidates that ranged from the $5 trillion proposed by former New York Mayor Michael Bloomberg to $11.4 trillion offered by Sanders.

“It’s a moderate proposal,” said Frank Clemente, director of Americans for Tax Fairness. “He’s very modest on rates. He’s not really going after taxing accumulated wealth.”

But Capitol Hill Republicans are warning Biden’s tax proposal would do further damage to an economy struggle to cope with the coronavirus pandemic.

An analysis released on Tuesday by the GOP side of the House Ways and Means Committee characterizes Biden’s plan as “job-killing tax hikes that punish workers.”

Although he’s been pummeled in polls for his handling of the pandemic, Trump still gets positive ratings on his ability to manage the economy. The election may come down to whether enough voters will stick with him in that area, which could increase the importance of Biden’s proposals.

“I still think, at the end of the day, the number one topic determining who people will vote for will be economic policy,” Bovard said.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.