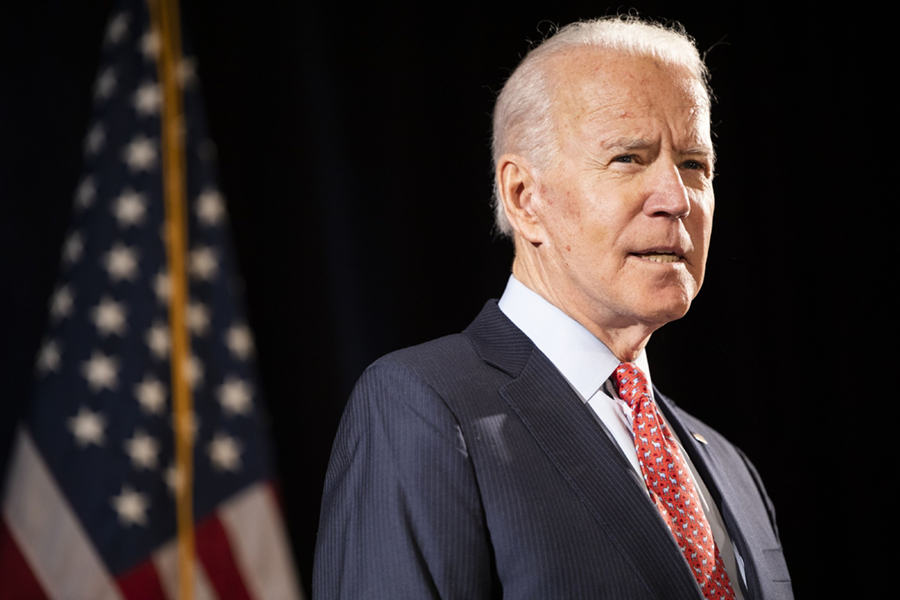

President Joe Biden is ordering his administration to create a strategy to quantify the risks that climate change poses to both public and private financial assets.

In a four-page executive order that he signed Thursday, the president is asking Treasury Secretary Janet Yellen, in her role as head of the Financial Stability Oversight Council, to recommend steps to reduce climate risks to financial stability, according to the administration. That assessment, which would be provided within six months, would also detail plans financial regulators have for bolstering disclosures.

A separate government-wide strategy for identifying and disclosing climate risk to government programs, assets and liabilities is set to be developed within 120 days. It will be drafted by Brian Deese, the director of the National Economic Council, and Gina McCarthy, the national climate adviser, in coordination with Yellen and the Office of Management and Budget. The Labor Department will be directed to analyze how to protect pensions from climate change risk.

“Our modern financial system was built on the assumption that the climate was stable, and that assumption has largely dominated existing financial models, and it’s underpinned the way that we invest capital, the way that we have built society, and the way that we have forecasted for the long term,” Deese said in a call with reporters Thursday. “Today it’s clear that we no longer live in such a world.”

Governments, regulators and business leaders on Wall Street have been debating how the financial industry should brace for environmental threats and whether companies should provide more information to investors about those risks.

“The intensifying impacts of climate change present physical risk to assets, publicly traded securities, private investments, and companies,” Biden said in the order. “At the same time, this global shift presents generational opportunities to enhance U.S. competitiveness and economic growth, while also creating well-paying job opportunities for workers.”

The executive order represents an early step in the new administration’s efforts to reduce the risks to financial stability posed by climate change, and to meet its longer-term goal of reducing U.S. greenhouse gas emissions.

Under Biden’s order, the OMB director, in consultation with other agencies, will identify the primary drivers of federal climate-risk exposure and develop ways to quantify climate risk for the president’s long-term budget projections. OMB and the Council of Economic Advisers will also develop and publish an assessment of the government’s climate risk exposure.

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Following a similar move by Robinhood, the online investing platform said it will also offer 24/5 trading initially with a menu of 100 US-listed stocks and ETFs.

The private equity giant will support the advisor tech marketing firm in boosting its AI capabilities and scaling its enterprise relationships.

The privately backed RIA's newest partner firm brings $850 million in assets while giving it a new foothold in the Salt Lake City region.

The latest preliminary data show $117 billion in second-quarter sales, but hints of a slowdown are emerging.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.