The Bitcoin fever is starting to break as worries about a market bubble discourage investors from buying in.

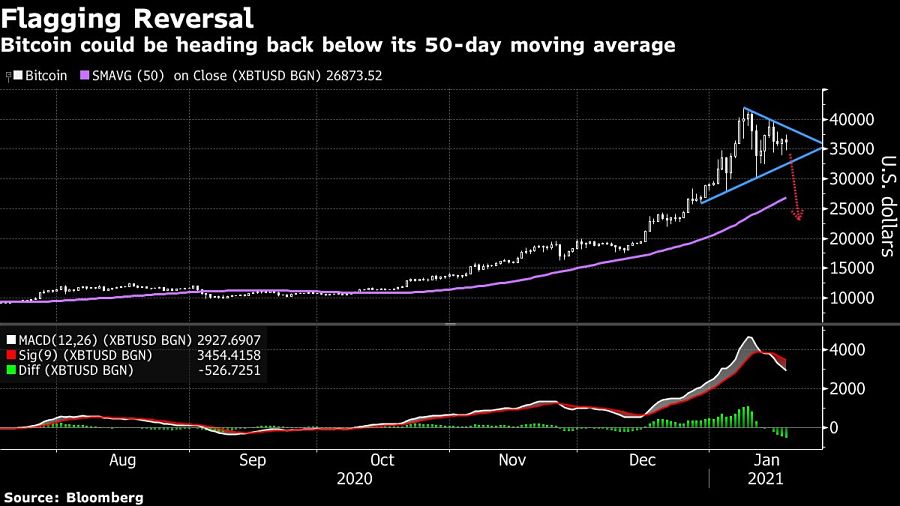

Prices for the largest cryptocurrency dipped as much as 6.8% on Wednesday and traded below $35,000. Ever since the market shot through all-time highs in early January, Bitcoin has been beset by volatility and skepticism that the run-up has been excessive.

Analysts have pointed to $40,000 as the key level that Bitcoin needs to surpass in order to draw fresh money from investors riding cryptocurrency momentum. They argue that recent gains could prove fleeting if the rally stalls and traders looking for quick returns shift their money elsewhere.

“Many cryptocurrency traders are diversifying into other coins in fear that Bitcoin could see another collapse if $41,500 is not reached sometime soon,” said Edward Moya, senior market analyst at Oanda Corp.

There are also concerns among Wall Street pros that Bitcoin’s 400% rally in the past year makes it too dangerous for them to jump in. In Bank of America Corp.’s monthly survey, fund managers called Bitcoin the world’s most crowded trade -- the first time it’s held that title since 2017.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.