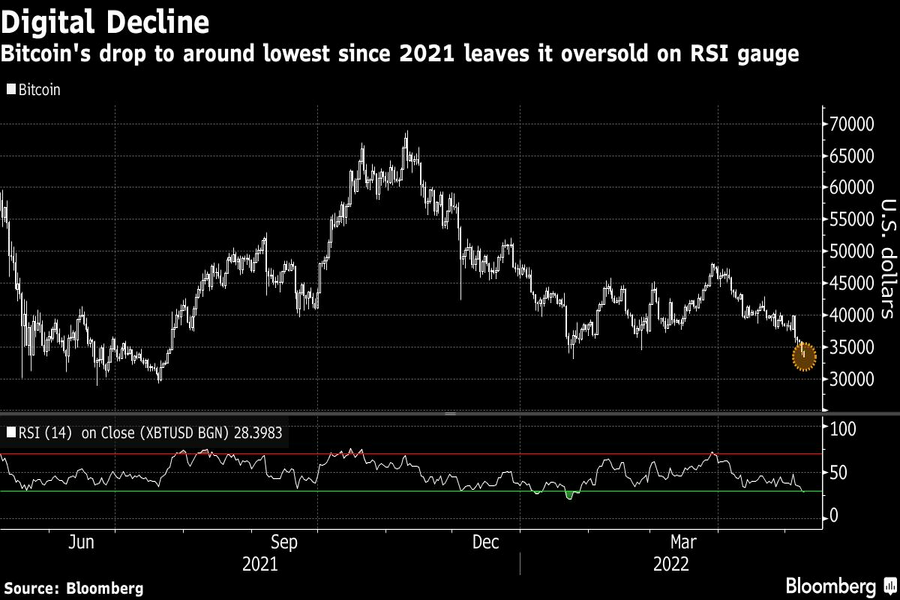

Bitcoin slumped to a level last seen in July 2021, part of a wider retreat in cryptocurrencies triggered by a global flight from riskier investments.

The world’s largest digital token fell as much as 4.6% on Monday and traded at around $32,800 at 7:07 a.m. in New York. Most major virtual coins were under pressure over the weekend and the downbeat mood carried over into Monday. Equities in Asia and Europe also dropped, with the Nikkei gauge down 2.5% and the Stoxx Europe 600 Index falling 2%. U.S. equity futures were also in the red.

Tightening monetary policy to combat runaway inflation and ebbing liquidity are turning investors away from speculative assets across global markets. Adding to the caution around digital assets, the value of TerraUSD or UST, an algorithmic stablecoin that aims to maintain a one-to-one peg to the dollar, slid below $1 over the weekend before recovering.

“In light of fears of rising inflation, most investors have taken a risk-off approach — selling stocks and cryptos alike in order to cut down risk,” said Darshan Bathija, chief executive of Singapore-based crypto exchange Vauld.

Monday’s selloff was widespread across the cryptocurrency universe, with Cardano falling 8.4% and Polkadot down 6.7%, data compiled by Bloomberg show.

Rising interest rates are giving individual and institutional investors pause for thought about the crypto market outlook, according to Edul Patel, chief executive officer of Mudrex, an algorithm-based crypto investment platform. Bitcoin’s 29% decline in 2022 compares with a retreat of more than 10% in global bonds and shares, and a 2.5% advance in gold.

“The downward trend is likely to continue for the next few days,” he said, adding Bitcoin could test the $30,000 level.

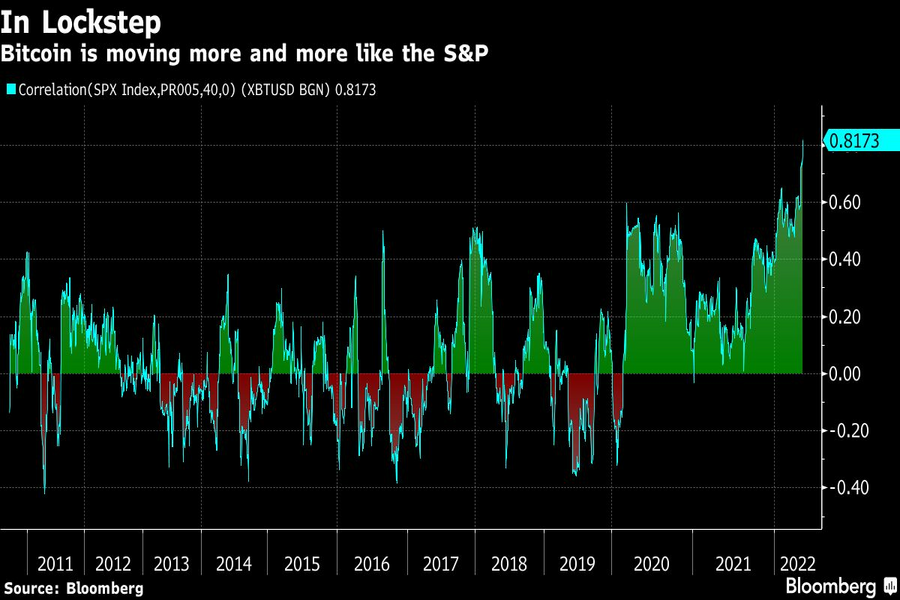

Bitcoin’s recent decline puts it at risk of firmly dropping out of the range where it’s been trading in 2022, completely reversing the most recent bull run that drove the token to a record of almost $69,000 in November. With its 40-day correlation with the S&P 500 stock benchmark at a record 0.82, according to data compiled by Bloomberg, any further hit to equities sentiment would risk dragging Bitcoin down as well.

A correlation of 1 means two assets move in perfect lockstep; a reading of -1 means they move in opposite directions.

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.